US: Core CPI print to be 0.3% MoM

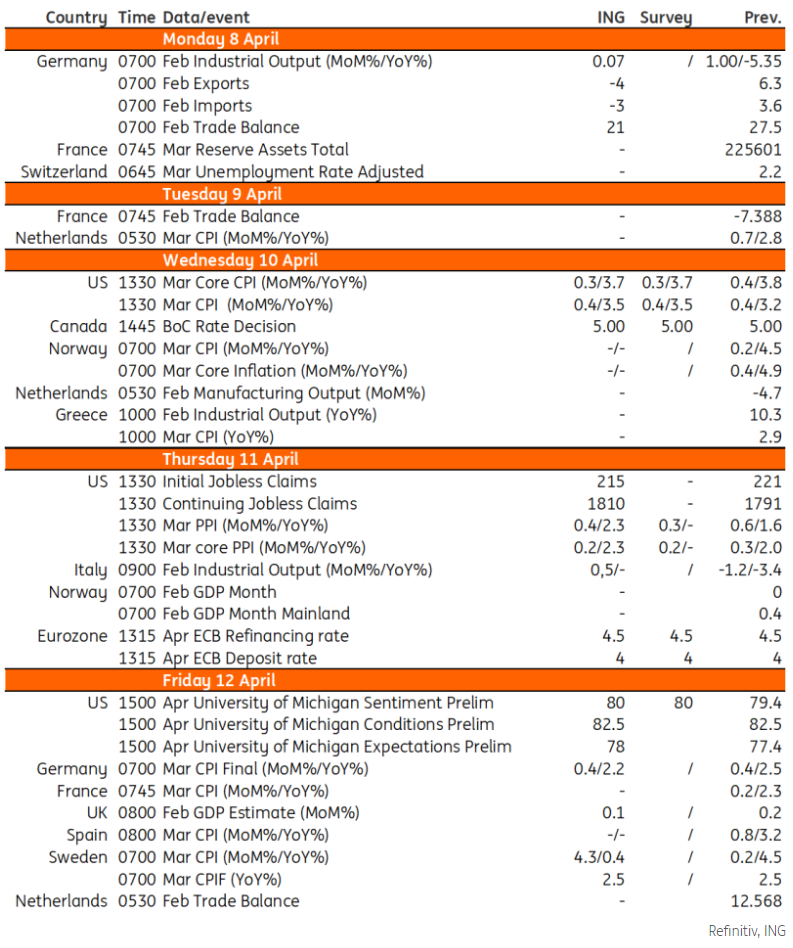

The highlight over the week ahead in the US will be March consumer price inflation data. This has been running consistently hot in recent months, with housing components remaining particularly sticky while sharply higher insurance costs and portfolio management fees have been contributing to elevated supercore readings. We expect the core CPI print to be 0.3% month-on-month versus 0.4% in February – but this is still around double the 0.17% MoM rate that would, over 12 months, bring the YoY rate down to the 2% target.

There still remains a lot of uncertainty, though. The ISM prices paid, the NFIB prices charged and the employment cost index all suggest that price pressures will soften meaningfully through the year. Still, the Fed is worried about “residual seasonality” in some components – such as one-off annual insurance price hikes continuing to boost inflation. Uncertainty surrounding the all-important housing rent components is further clouding the outlook. In January, the BLS reweighted the components, so single-family homes are now more significant, and rent for these is running faster than for apartments. Due to the construct of the index and the methodology used, it could take another couple of months before we see the 0.2% MoM readings that the Fed wants to see. As such, the prospect of a June Federal Reserve cut will remain in the balance.

UK: February UK GDP figures to point to first quarter rebound

The UK economy entered a technical recession at the end of last year, albeit a shallow one. But a rebound in monthly GDP in January is likely to be followed by a small 0.1% gain in February, and that suggests we’re heading for positive overall first quarter growth. These figures have admittedly been fairly volatile recently, but we do expect a gradual recovery in UK output this year. We think the majority of the mortgage squeeze is behind us in terms of the macro impact, while positive real wage growth should help consumer spending.

For the Bank of England though, this isn’t what will determine the timing of the first rate. Instead, that’ll be down to services inflation and wage growth, both due later this month. It’s a close call between a June and August rate cut – though for now, we’re narrowly sticking with the latter.