US: Existing home sales and leading index the highlights of next week

Federal Reserve interest rate cut expectations have been significantly scaled back in the wake of strong GDP, jobs and consumer price inflation. At the start of the year, the market was looking for 175bp of cuts this year starting in March, today the pricing is for a mere 100bp of cuts starting in June. The upcoming data is unlikely to have that much impact though with next week’s calendar looking light. Existing home sales and the leading index will be the highlights in terms of the data, but we will at least have several Fed speeches to digest and the minutes of the 31 January FOMC meeting.

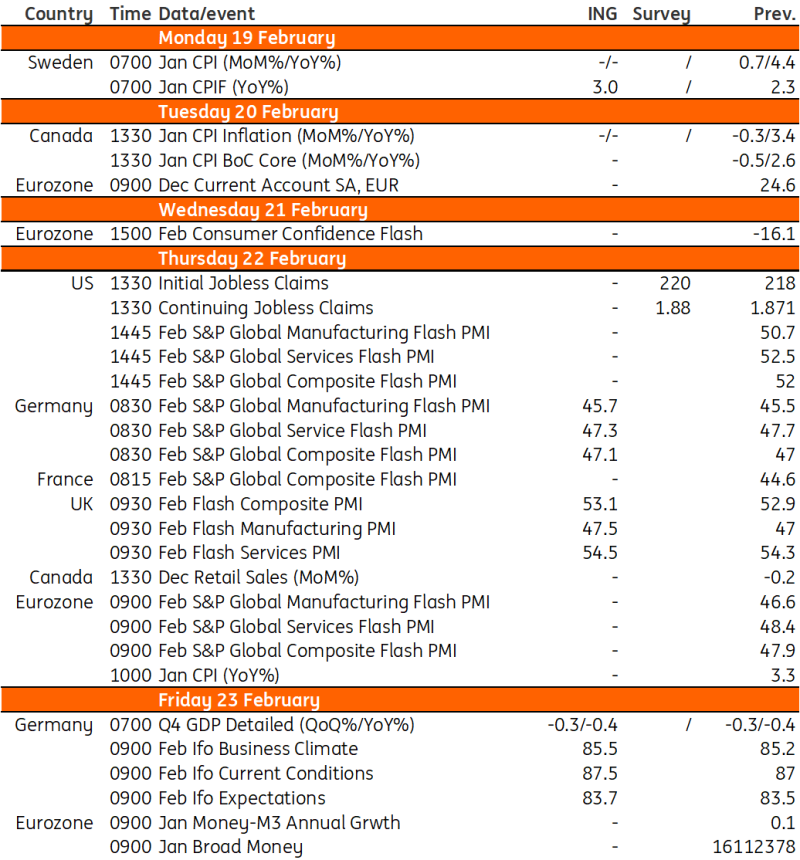

UK: PMIs to point to recovery in activity during 1Q

The UK entered a technical recession in the final quarter of 2023, though in practice the economy broadly stagnated last year. Things are looking up in 2024 though, and we’ve seen an encouraging recovery in the service-sector purchasing managers index (PMI) over the past couple of months. Interestingly that’s in contrast to the eurozone equivalent index, which has been more subdued. We think the economy should return to modest growth both in this and coming quarters, with the consumer outlook improving and rate cuts on the horizon. That said, the growth figures aren’t what will determine the timing of the first rate cut from the Bank of England, which instead is focused on services inflation and wage growth as key guiding metrics.

Canada: Inflation hovering just above 3%

In Canada we will have inflation data which is likely to show inflation hovering just above 3%. This won’t be enough to trigger an imminent Bank of Canada policy rate cut, but we do expect them to start easing by the June policy meeting.