- US: Pushback from the Fed

- UK: Bank of England to offer push back against rising tide of rate cut expectations

- Norway: Norges Bank to keep rates on hold after all

- Poland: Inflation in focus

US: Pushback from the Fed

The Federal Reserve is widely expected to leave the Fed funds target range at 5.25-5.5% at next week’s FOMC meeting. Softer activity numbers, cooling labour data and benign inflation prints signal that monetary policy is probably restrictive enough to bring inflation sustainably down to 2% in coming months, a narrative that is being more vocally supported by key Federal Reserve officials. The bigger story is likely to be contained in the individual Fed member forecasts – how far will they look to back the market perceptions that major rate cuts are on their way? We strongly suspect there will be a lot of pushback here. The steep fall in Treasury yields in recent weeks is an easing of financial conditions on the economy and there is going to be some concern that this effectively unwinds some of the Fed rate hikes from earlier in the year.

We expect the Fed to retain a relatively upbeat economic assessment with the same 50bp of rate cuts in 2024 they signalled in their September forecasts, albeit from a lower level given the final 25bp December hike they forecasted last time is not going to happen.

We think the Fed will eventually shift to a more dovish stance, but this may not come until late in the first quarter of 2024. The US economy continues to perform well for now and the jobs market remains tight, but there is growing evidence that the Federal Reserve’s interest rate increases and the associated tightening of credit conditions are starting to have the desired effect. We look for 150bp of rate cuts in 2024, with a further 100bp in early 2025.

UK: Bank of England to offer push back against rising tide of rate cut expectations

Financial markets are rapidly throwing in the towel on the “higher for longer” narrative that central banks have been pushing hard upon for months. Admittedly so far, that market repricing has been less aggressive for the Bank of England. But with three rate cuts now priced for 2024, the Bank of England is starting to sound the alarm. Governor Andrew Bailey said in recent days that he is pushing back “against assumptions that we're talking about cutting interest rates".

Those comments followed a firming up of the Bank’s forward guidance back in November, where it said it expected rates to stay restrictive for “an extended period”. Expect that narrative to be reiterated on Thursday. A 6-3 vote in favour of no change in rates is our base case, and that matches the vote split from November.

Could the Bank go further still and formally say that markets are overpricing 2024 easing in the statement? It hasn’t commented in this way since November 2022, in what was then a stressed market environment. We doubt they’ll do something similar this month. Policymakers may be uneasy about the recent repricing of UK rate expectations, but central banks globally have learned the hard way over the last couple of years that trying to predict and commit to future policy, with relative certainty, is a fool's game. The Bank will also be gratified that the data is at least starting to go in the right direction. Services inflation came in below the Bank’s most recent forecast.

Markets may be right to assume that the BoE will be a little later to fire the starting gun on rate cuts than its European neighbours. But when the rate cuts start, we think the BoE’s easing cycle will ultimately prove more aggressive. We expect 100bp of rate cuts from August next year, and another 100bp in 2025.

Norway: Norges Bank to keep rates on hold after all

Back in September, Norway’s central Bank signalled that a December rate hike was likely. By November, policymakers were watering down those promises and said that further progress on the inflation outlook could lead to a pause. Since then, we’ve seen both a pronounced fall in oil prices and a big repricing lower in global rate expectations. Both are dovish from the point of view of Norges Bank’s model-based approach to setting policy. It’s a close call, but we think the balance has shifted in favour of no rate hike at Thursday’s meeting. Market pricing is leaning this way too.

Poland: Inflation in focus

CPI (Nov): 6.5% YoY

We think that the Polish statistical office is unlikely to markedly change its flash estimate of November CPI. As we expected, November brought a substantial increase in fuel prices when compared to October, while food prices also increased in monthly terms. The decline in household energy prices turned out to be smaller than our forecast and core inflation moderated more than we had projected. The details of November's CPI reading should allow us to scrutinise the factors behind this lower core inflation print and potentially make some adjustments in the projected path of core inflation, depending on whether November's surprise was down to one-off drivers or was broad-based.

Current account (Oct): €2200mn

We forecast a large surplus on the current account balance in October on the back of a substantial improvement of the primary balance (a much smaller deficit than in the previous months) amid continued surpluses on both goods and services trade. According to our forecasts, exports fell by 3.2% YoY, while imports declined 11.1% YoY. The 12-month cumulative current account surplus improved to 0.8% of GDP vs. 0.6% of GDP after September.

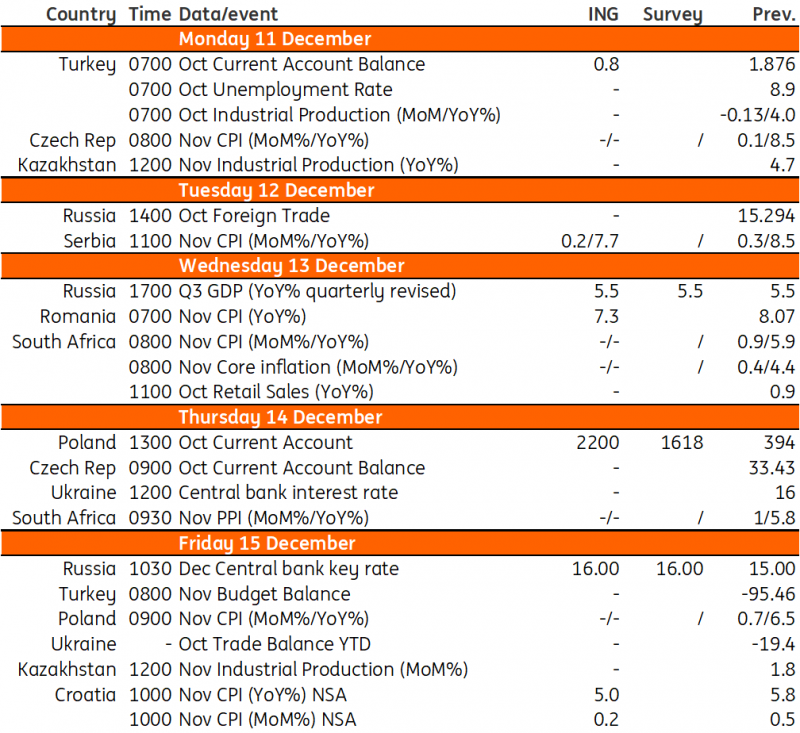

Key events in developed markets next week

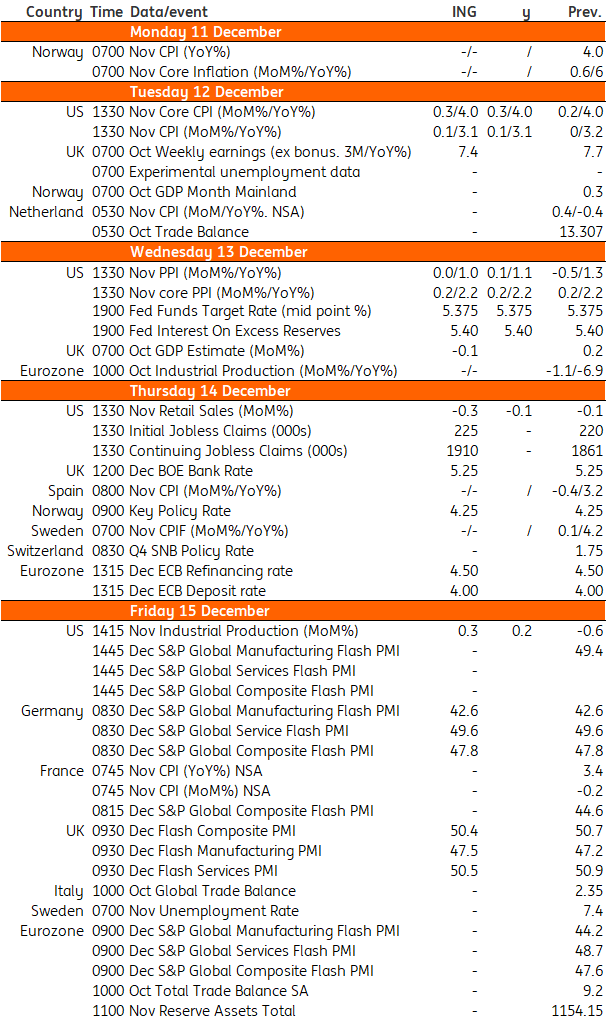

Key events in EMEA next week