The last full week ahead of the US election is jam-packed with key economic reports. As a result, the potential for surprises that could sway voters is in high gear in the days to come. Here’s a quick rundown of the key releases this week.

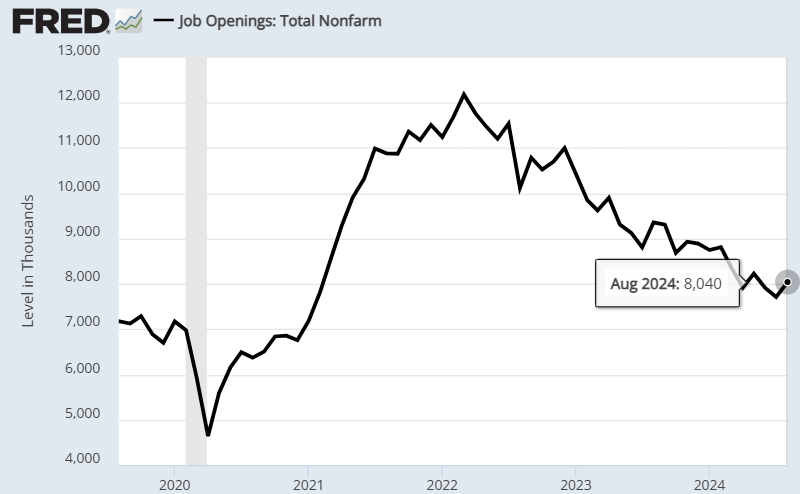

Tuesday, Oct. 29: Job openings for September are the main event. Openings have been sliding for two years. The optimistic view is that the trend is normalizing after a sharp rebound from the pandemic. But as the number of new openings approaches the pre-pandemic level, the debate over the implications of the slide will heat up.

Economists expect that new openings fell to 7.9 million in September from 8.04 million in the previous month, based on the consensus point forecast via Econoday.com. Tuesday will also see an update on the Consumer Confidence Index for October, which is expected to tick higher and remain in a middling range relative to recent history.

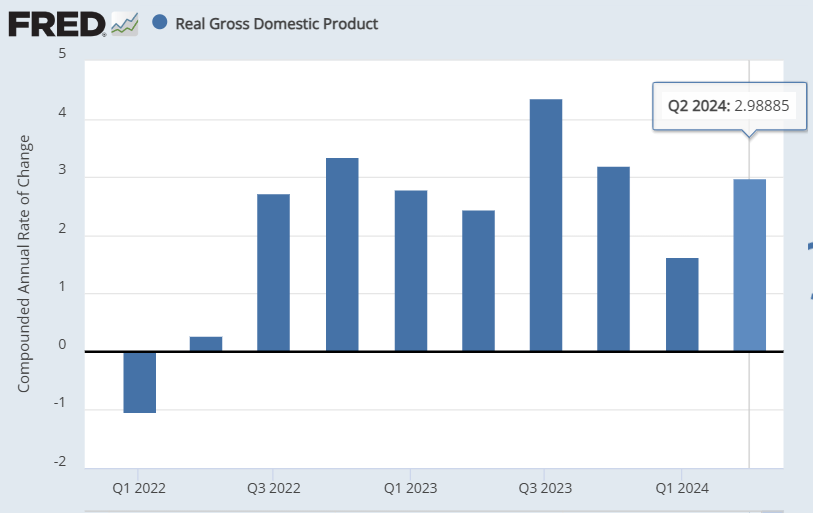

Wednesday, Oct. 30: The government’s initial estimate of third-quarter GDP is expected to post a strong increase. The consensus forecast sees a 3.0% annualized advance, matching the strong increase in Q2.

The other key release for Wednesday is the ADP Employment Report for October, which is expected to report that payrolls at US companies increased by a subdued 115,000 this month, extending the recent downshift in hiring.

Thursday, Oct. 31: The final monthly report on US consumer spending ahead of the election is on track to report a pickup in growth for September. The consensus forecast sees a 0.4% monthly increase, up from 0.2% in August. If correct, the rise will mark a middling advance vis-a-vis recent history, marking another extension of back-to-back increases in recent months.

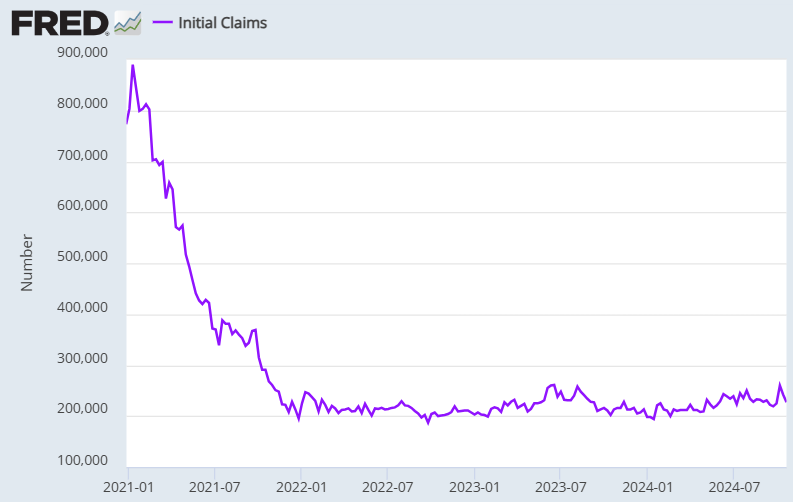

The weekly update on jobless claims is also on tap today. Economists see a moderate increase over the previous week but at a level that’s in line with recent history that highlights a low number of new filings for unemployment benefits.

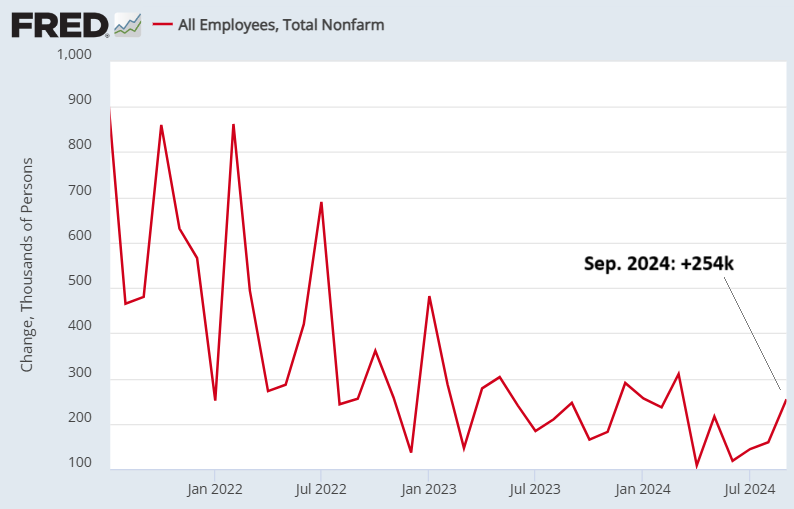

Friday, Nov. 1: Nonfarm payrolls, the week’s main event for economic data, is on track to post a sharp slowdown for October, according to the consensus forecast. Economists expect a rise of 125,000, down sharply from September’s strong 254,000 increase.

The question is how much of the softer pace of hiring for this month is due to temporary factors, namely: the lingering effects of two hurricanes in September that struck the Southeast US and ongoing strikes at Boeing (NYSE:BA) and several hotels. The other key number for Friday to watch: the ISM Manufacturing Index for October, which is forecast to show that the sector’s contraction continued at the start of Q4.