The first week of 2024 will be a big one, with a lot of data that will either justify the market rally and expectations for rate cuts or not.

Data that comes in too hot will kill the idea of rate cuts starting as soon as March, and data that comes in too cold will kill the idea of a soft landing. It means Goldilocks must return from her Christmas trip to Aruba and appear this week.

For December, the ISM manufacturing index is expected to rise to 47.1 from 46.7, while the service index falls to 52.5 from 52.7. ADP is expected to show 113,000 new jobs were created in December versus 103,000 in November.

Finally, the official BLS job report predicts 163,000 new jobs will have been made, down from 199,000 in November.

Overall, these numbers are consistent with their prior trends and suggest no significant change in economic growth. The Atlanta Fed GDPNow model indicates that the fourth quarter is growing by a 2.4% seasonally adjusted annualized rate.

At least, based on the estimates, there doesn’t seem to be enough to support rate cuts any time shortly. If it comes in as expected, I think that data is probably enough to turn higher the recent decline in rates and tighten financial conditions.

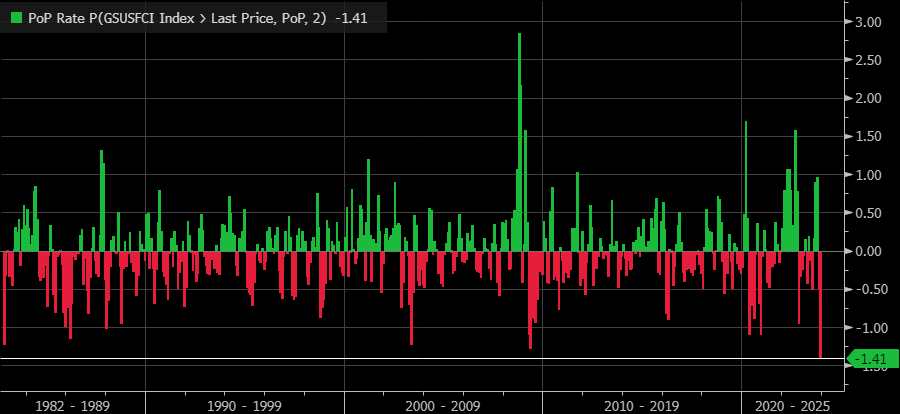

By most standards, financial conditions have eased so much that the easing could have already substituted for rate cuts.

In fact, over the last two months, the GS financial conditions index has reduced by its most ever. One could argue this could have a stimulative effect on the US economy as we move forward.

On top of this, we have started to see shipping rates rising, as noted by the WCI Composite Container Freight Benchmark, which has increased from 1381 on November 30 to 1660 on December 21.

It will be interesting to see if the recent increase in freight cost shows up in the ISM manufacturing Priced Paid PMI for December.

There are no estimates currently, but the index was 49.9 in November. If one thing is clear, higher freight costs and easing financial conditions lead to higher prices over time.

Rates Will Likely Reverse in the Long-Term

If this shows up, then I would think the recent decline in long-term rates will likely reverse; how high rates on the back of the curve go from here is unclear, but there are signs that the 10-year rate can also go higher from a technical standpoint.

The RSI is starting to consolidate and is even showing signs of turning higher. The big test will be when the 10-year reaches the 10-day exponential moving average and if it can breathe above that moving average.

If the 10-year does break higher, the downtrend at 4% becomes the next target, and after that, we would be talking about a 10-year moving higher to around 4.35%.

Overall, I think this will likely result in the 10/2 curve moving higher, with most of the heavy lifting coming from the back of the curve. It certainly appears like the curve is breaking out of a downtrend.

S&P 500: Higher Rates and Steeper Curves Might Deter the Bulls

As for the S&P 500, higher rates and steeper curves will present problems, especially if it is because we begin to start seeing the effects of easing financial conditions in this week’s data points.

The S&P 500 also broke below a rising wedge pattern and is closing in on the 10-day exponential moving average, which hasn’t been broken since November 2.

That moving average comes at 4,745 and is around the zero gamma level.

The zero gamma level is the line that separates positive from negative gamma; a break below the zero gamma level would push the index back into negative gamma and increase volatility. I still think a return to 4,100 over the next several weeks is likely.

So, at this point, it seems a lot is riding on the data this week, and to keep the market moving higher, it will take the data coming in just right. Anything too hot or cold will be a big blow to the end-of-year rally.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.