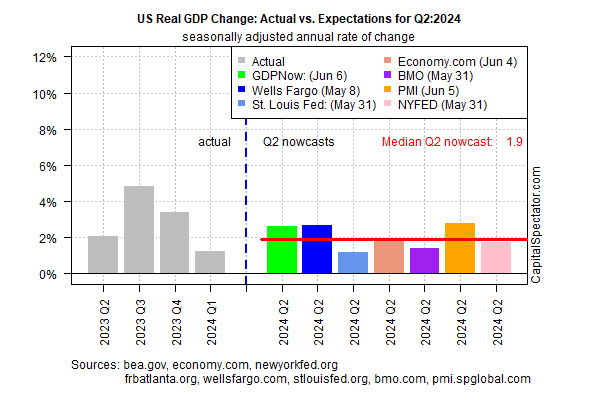

Recent economic estimates suggest US growth has slowed compared with previous estimates, but today’s revised GDP nowcast for the second quarter still points to a modest pickup in output over Q1.

The median estimate for a set of projections compiled by CapitalSpectator.com indicates output rising 1.9% in Q2. If accurate, growth will strengthen, albeit modestly, relative to Q1’s sluggish 1.3% rise.

Today’s median nowcast marks a slight downgrade from the previous update on May 31, when Q2 growth was projected to rise 2.0%.

Some economists advise that consumers have turned cautious on spending, which may be a warning sign for the economy.

Bank of America (NYSE:BAC) CEO Brian Moynihan reports that the growth rate of spending has slowed, based on credit cards data. The 3.5% rise this year marks a sharp deceleration from the comparable 10% growth rate for the year-earlier pace, he notes.

“We’ve got to keep the consumer in the game in the U.S. economy, because they’re such a big part of it,” Moynihan tells CNBC. “They’re getting a little more tenuous, and that is due to everything going on around them.”

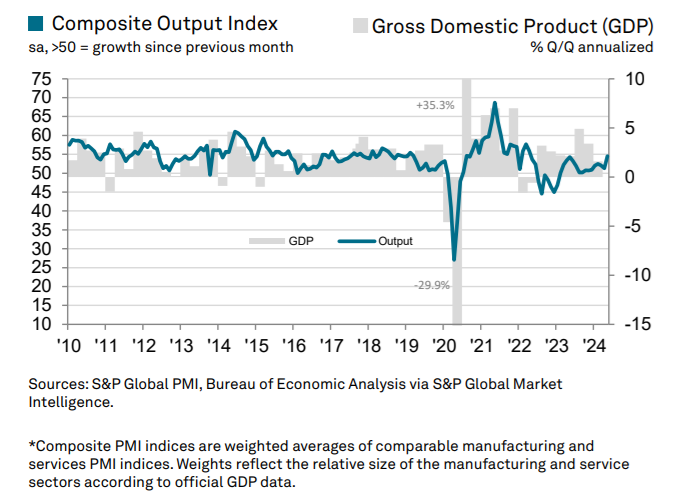

Yet new survey data for May paint a brighter profile, based on the US Composite PMI, a GDP proxy. This index points to the fastest growth rate in more than two years.

The bond market, however, seems to be pricing in softer growth lately. The 10-year Treasury yield has dropped sharply in recent days.

One factor weighing on yields: this week’s news that US job openings fell to the lowest level in over three years – a possible early warning of softer economic conditions ahead.

Overall, the case for expecting a sharp acceleration in output in Q2 has faded–a scenario that looked more likely a few weeks ago.

On the other hand, the current nowcast suggests that while growth isn’t taking off again, the path ahead still appears set to deliver a modest if unimpressive improvement vs. Q1.