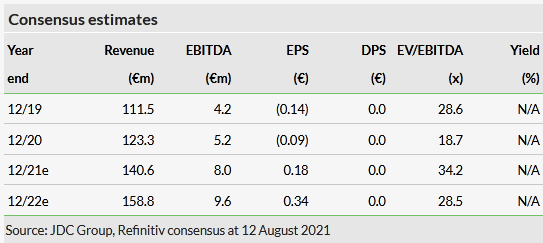

Bancassurance advisory and service platform JDC Group (DE:JDC) (JDC) reported strong H121 results and has raised FY21 revenue and EBITDA guidance to what we still believe to be conservative levels. Large client wins are starting to feed into the platform and the pipeline of new major clients looks promising. Based on 2021/22e consensus EV/sales and EV/EBITDA, the valuation does not seem demanding compared to its other platform peers.

Share Price Graph

Business description

JDC Group is a leading German insurance platform, providing advice and financial services for professional intermediaries, banks but also directly for end customers. JDC’s digital platform, for end clients and for the administration and processing of insurance products, is also provided as a white label product.

Bull

- Strong position to support digital investment.

- New client wins.

- Profitable consolidation opportunities.

Bear

- Capital market weakness from third wave COVID-19 related uncertainty or another cause affecting investment results in advisory.

- Low interest rates and regulatory uncertainty affect the insurance industry.

- Transfer of contracts to JDC platform could stall.

EBITDA up almost 40% in H121

JDC reported strong H121 results. Revenue growth is accelerating, up 19.2% in Q221 versus 13.9% in Q420, 14.4% in Q121 and 11.4% in FY20.

H121 revenues increased 16.6% to €68.6m. The Advisortech segment, which includes JDC’s platform business, reported 13.9% revenue growth to €56.4m, another step up from 11.1% in 2020. This compares favourably to its competitor, Hypoport (DE:HYQGn), which reported a 12% increase in revenues to €23.7m in its Insurtech division in H121.

The key accounts, which will be the growth driver for JDC Group in the coming years, generated 20.9% revenue growth, compared to 8% higher net policy premiums on Hypoport’s insurance platform.

JDC’s Advisory business recorded 23.5% revenue growth to €17.3m driven by a weak comparative base in 2020 due to the pandemic and strong financial markets.

Click on the PDF below to read the full report: