- It's often said that stocks perform well in January as new money enters the market

- Small caps often enjoy bullish price action

- With a recent bearish January trend, however, the start of 2023 will be particularly critical as to how the rest of next year unfolds

The January Effect is an old-school Wall Street stock market anomaly. The story goes that stocks should see a boost to start the new year as fresh investment dollars enter the market and hope abounds for a bullish year.

Perhaps some share repurchases following end-of-year tax-loss selling and maybe new retirement plan contribution money help to lift equities. Part of the historical trend is also that small-cap stocks usually see a particular bounce.

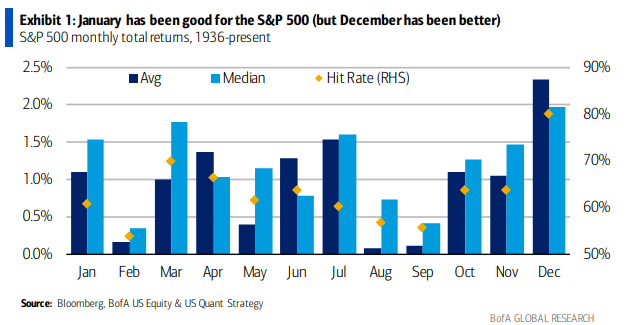

According to Bank of America Global Research, the first month of the year indeed enjoys a more than 1% average rise with a median return slightly above 1.5%. And it has been positive nearly two-thirds of the time since 1926. Not too shabby.

The bulls need to watch out for volatility and sometimes downside price action in February, though – it is stealthily one of the worst months on the calendar.

S&P 500 Often Climbs to Start the Year

Source: Bank of America Global Research

Does the January trend still hold water, though?

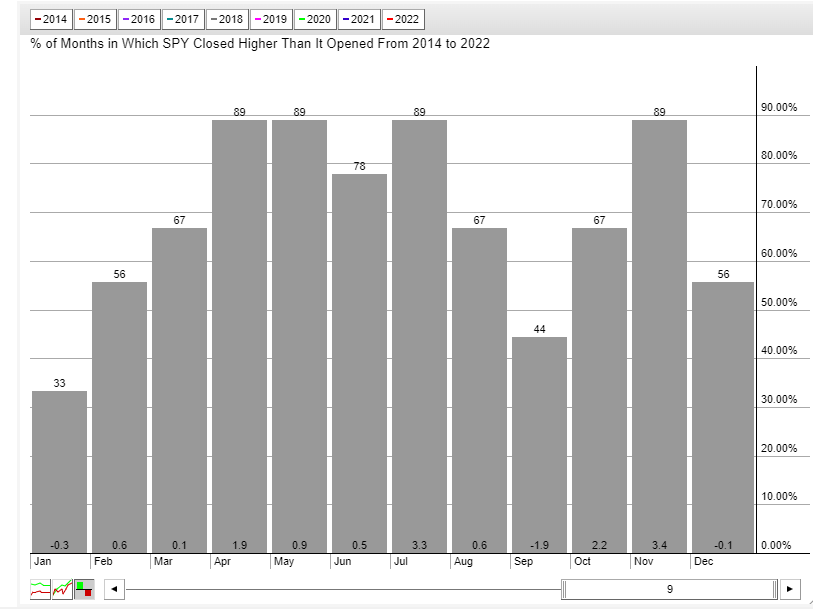

Apparently, not. I found that in the last nine years, January has been positive just three times, and the average return is slightly negative. That’s particularly soft since the S&P 500 has produced strong returns since 2014. The good news is that after a sometimes-volatile kick-off to the year, material gains are seen over the ensuing months.

The Recent Trend in January Performance Favors the Bears

Source: StockCharts.com

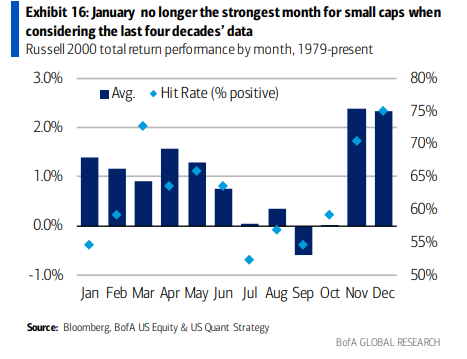

BofA also notes that the so-called January Effect has been a bit better for small caps in the last 40 years, but it's nothing to write home about. The Russell 2000 index is higher by a robust 1.4%, on average, across all Januarys since 1979, with a lukewarm hit rate of about 55%. Data suggests that investors might be getting ahead of bullish tailwinds early in the year by bidding up small caps in November and December. The chart below shows that the Russell 2000 enjoys its best seasonal stretch leading up to year-end.

Small Cap Gains Pulled Forward Since 1979

Source: Bank of America Global Research

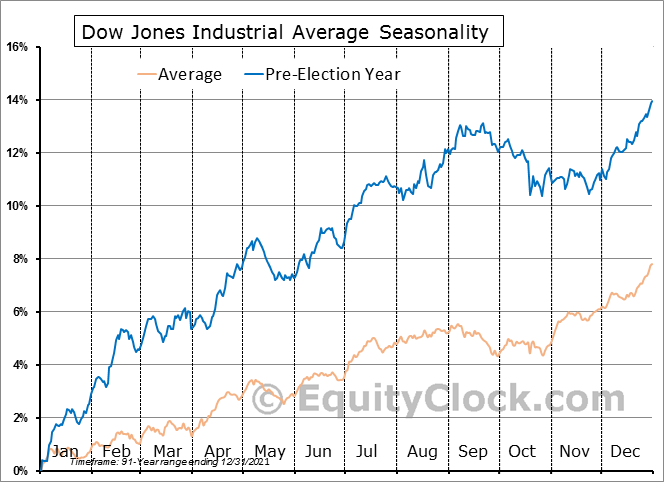

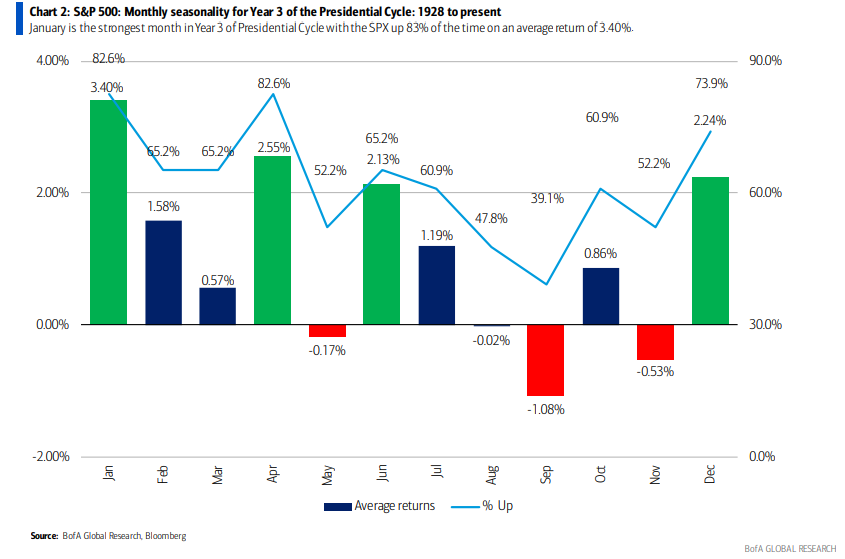

Finally, it’s not all doom and gloom when it comes to how equities might perform early in 2023. We must also remember that a bullish pre-election year is waiting in the wings. Year 3 of the election cycle has typically been the best of the four.

According to data from Equity Clock going back to 1930, the Dow Jones Industrial Average rose about 3% in January. Gains usually persist with little let-up through mid-September. Moreover, Steve Suttmeier at BofA notes that since 1928, January has been the best month of the year during pre-election years. It has averaged a 3.4% gain and is up 83% of the time.

Source: Equity Clock

Source: Bank of America Global Research

The Bottom Line

Will this time be different? Is a recession going to stand in the way of this impressive stock trend?

I assert that January will be the tell – a positive beginning to 2023 should lead to further gains. If we see red on Wall Street next month, a protracted bear market might be the theme of the year once again.

Disclaimer: Mike Zaccardi does not own any of the securities mentioned in this article.