Stock markets could continue to rise – and according to Goldman Sachs, a major factor behind this is the FOMO effect, or ‘fear of missing out’. In the weeks surrounding the US elections, many investors were particularly cautious, fearing that political uncertainty could weigh on the markets.

But Goldman expert Scott Rubner sees it differently: instead of remaining cautious, many investors may now be driven by the fear of missing out on further price gains. This FOMO effect is boosting markets because investors are now more likely to aim to capture potential returns rather than hedge against them.

Rubner explains that the election itself could be a kind of ‘risk asset cleansing event’ that clears existing market uncertainties and paves the way for new risk assessments. So investors worried about missing out on price gains may bet on even higher share prices after the election. This fuels a kind of chain reaction in which each potential price increase attracts more investors looking to expand their positions.

Goldman Sachs also points out that November is traditionally a particularly active month for share buybacks, which has often led to additional capital flowing into the markets in the past. This time, over $100 billion could enter the market in the form of buybacks and increased capital inflows from investment and pension funds. Fear of missing out could therefore drive the market further – an effect that pushes up prices even in uncertain conditions.

FOMO drives the markets

The Dow Jones index skyrocketed by a whopping 3.69% on Wednesday after the US election.

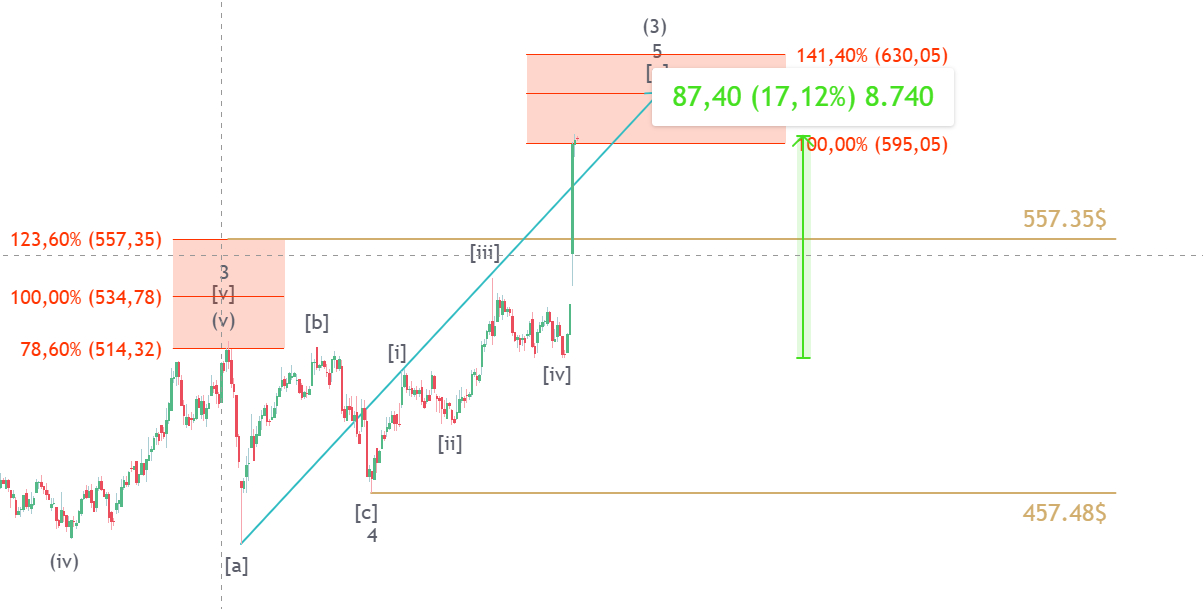

Goldman Sachs (NYSE:GS) shares have even risen by over 17% in just one day.

We have set the right course. On 5 November, exactly one day before the US election, we bought Coinbase (NASDAQ:COIN) shares and informed our customers (trading signal).

The share price skyrocketed immediately afterward. At its peak, it even recorded a price gain of over 33%. We assume that the stock has now fully arrived in bull mode. There is still a residual risk of a final sell-off to $134, but in our view, the chance of further price increases is clearly higher.

In the next step, we expect the red box to be reached at $276.91 to $300.64 or even significantly higher. After that, there should be a minor correction, which we would like to use for further purchases. Overall, Coinbase will probably be able to break above $300 and head for new all-time highs.

Disclaimer/Risk warning:

The information provided here is for informational purposes only and does not constitute a recommendation to buy or sell. It should not be understood as an explicit or implicit assurance of a particular price development of the financial instruments mentioned or as a call to action. The purchase of securities involves risks that may lead to the total loss of the capital invested. The information provided does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either explicitly or implicitly, for the timeliness, accuracy, appropriateness or completeness of the information provided, nor for any financial losses. These are expressly not financial analyses, but journalistic texts. Readers who make investment decisions or carry out transactions based on the information provided here do so entirely at their own risk. The authors may hold securities of the companies/securities/shares discussed at the time of publication and therefore a conflict of interest may exist.