- Investors saw the 60/40 portfolio face challenges in 2022 but witnessed a strong recovery in the following years.

- The rapid advancement of AI is now reshaping this classic strategy.

- With bonds set to play a different role in today's 60/40 portfolio, we'll examine whether this strategy is still effective in today's market.

- For less than $8 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

The 60/40 portfolio - a mix of 60% equities and 40% global bonds - has faced its share of ups and downs. The low point came in 2022 when bonds, instead of providing their usual defensive role during a stock market decline, suffered even more.

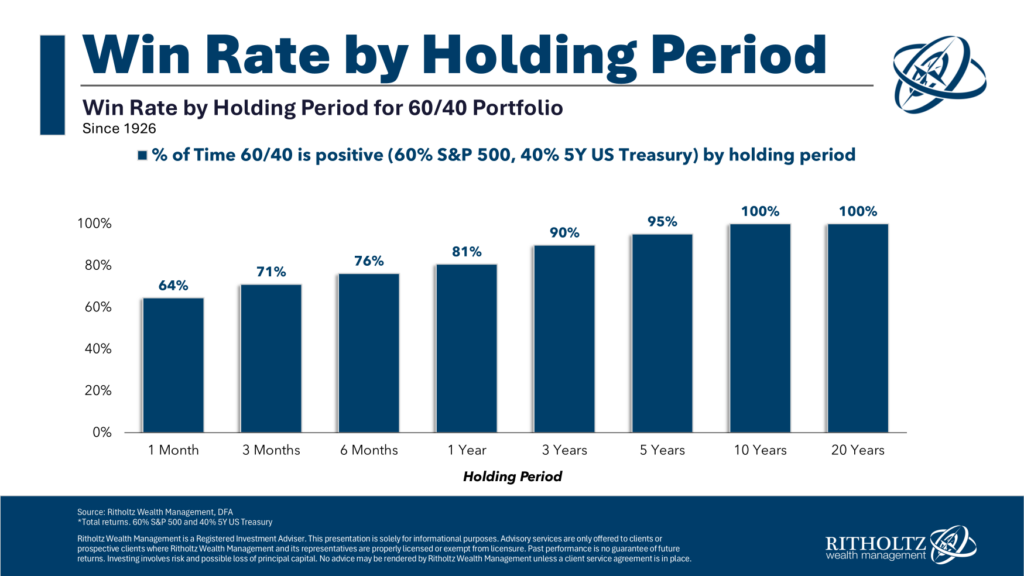

However, the following two years showed strong signs of recovery, reminding us that time often heals market wounds. Patience generally pays off, especially with long-term investment horizons.

Today, the rapid advancement of artificial intelligence (AI) is reshaping the financial landscape and in turn, portfolio strategies.

AI's Impact on 60/40 Portfolio

AI's influence extends beyond boosting the performance of tech companies in the stock market; it also impacts investment strategies, risk management, and asset allocation.

Investors with significant holdings in S&P 500 tech stocks have benefited from the AI-driven boom, as leading companies innovate and stimulate economic growth.

Investors with significant exposure to S&P 500 stocks have reaped the benefits of the AI-driven technology boom. Leading tech companies are redefining industries and driving economic growth with innovative products and services. Key players include:

- Nvidia (NASDAQ:NVDA): A leader in graphics processors (GPUs), crucial for training AI models.

- Alphabet (NASDAQ:GOOGL) : A pioneer in AI, with products like Google Assistant, Google Search, and the TensorFlow framework.

- Amazon (NASDAQ:AMZN): Dominates cloud computing with AWS, which offers AI and machine learning services, and integrates AI into logistics and consumer products like Alexa.

- Microsoft (NASDAQ:MSFT): Offers Azure AI, a suite of services used globally by companies through its Azure cloud platform.

- IBM (NYSE:IBM): Known for IBM Watson, a leading AI system used across industries such as healthcare, finance, and retail.

- Palantir (NYSE:PLTR): Specializes in advanced data analytics and strategic insights through AI.

- Salesforce (NYSE:CRM): Utilizes Einstein AI to enhance CRM operations with automation and predictive analytics.

Thanks to AI's influence, technology companies, especially those in the S&P 500, have driven significant growth in the 60/40 portfolio in recent years.

However, this growth comes with the risk that valuations in these sectors remain above historical averages. We must remember that a regression to the mean is inevitable.

The Evolving Role of Bonds in the Portfolio

On the bond side, today’s environment offers more attractive yields to maturity, even on the short and medium parts of the curve (currently between 2% and 4%), with considerably less risk than in the past.

This could provide a counterbalance in the event of a stock market reversal, unlike what we saw in 2022.

Therefore, the classic 60/40 portfolio, with periodic rebalancing, presents a solid solution with a favorable risk-return ratio. It's also crucial to consider emotional management and behavioral finance principles to support this strategy.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.