- Humana's stock has seen a 24% drop YTD due to slashed profit forecasts.

- Wall Street responded with analyst downgrades and lowered EPS expectations ahead of the Q1 report.

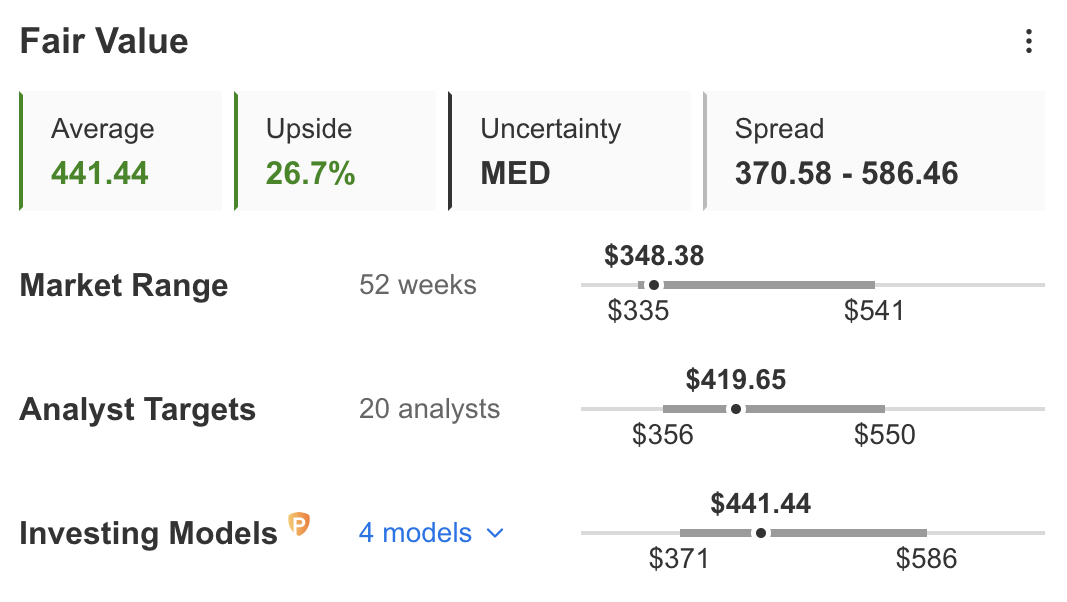

- Despite challenges, InvestingPro suggests that Humana's stock is currently undervalued by 26.7%.

- Subscribe to InvestingPro now for under $9 a month and never miss another bull market again!

Humana's (NYSE:HUM) stock experienced a significant decline of nearly 24% since the start of the year, primarily due to the company revising its full-year profit expectations downward.

This adjustment was prompted by an unexpected rise in medical cost trends. Humana attributed the revised forecast to the assumption that the elevated medical costs experienced in the fourth quarter of 2023 would persist into 2024.

Following the revision, several Wall Street analysts downgraded Humana’s rating and reduced their price targets.

This shift in perspective is evident in the adjustments to the company’s EPS forecast for the upcoming quarter, scheduled for April 24. Analysts have reduced this quarter's expectations by 41.5% for EPS from 10.32 per share to 6.03 per share over the last 12 months.

Source: InvestingPro

Earlier this month, Argus downgraded Humana from Buy to Hold, citing challenges to revenue and earnings growth due to unexpected increases in medical utilization. The downgrade underscores concerns about the sustainability of growth in Medicare Advantage despite the demographic tailwind from an aging population. “Underwriters of Medicare Advantage plans compete on pricing, leading to higher risks of unanticipated increases in medical utilization,” mentioned Argus.

However, InvestingPro’s Fair Value analysis suggests that Humana is currently undervalued, with an upside potential of 26.7%, compared to Wall Street’s growth projection of around 20%.

Source: InvestingPro

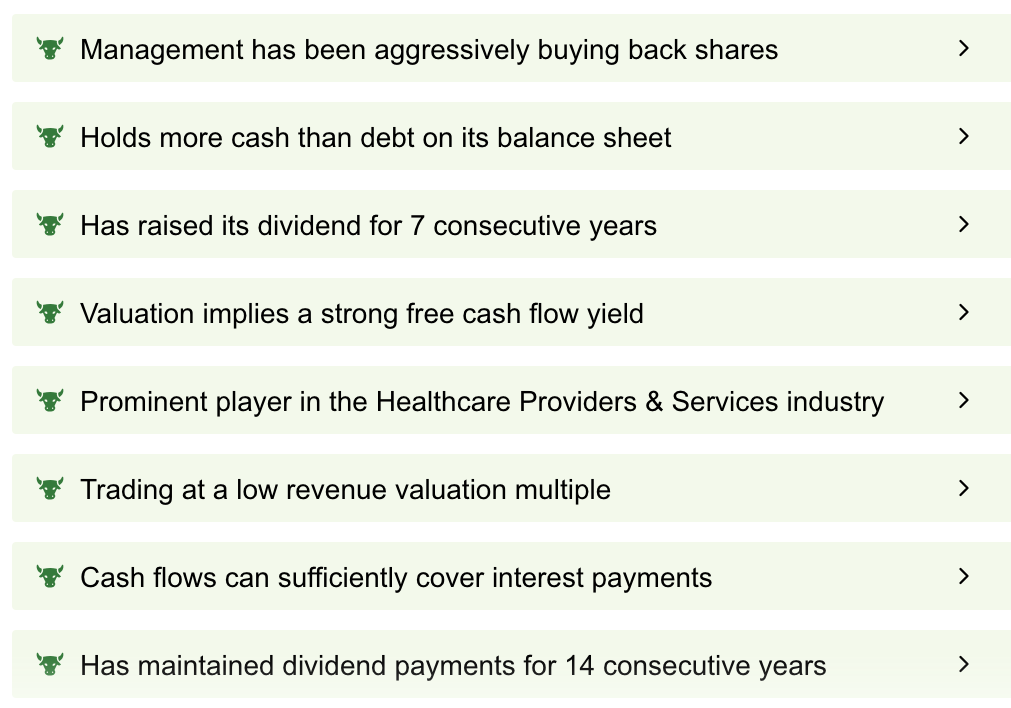

InvestingPro’s ProTips summary highlights Humana’s strengths, including aggressive share buybacks, a seven-year streak of dividend increases, and a low revenue valuation multiple, among others.

Source: InvestingPro

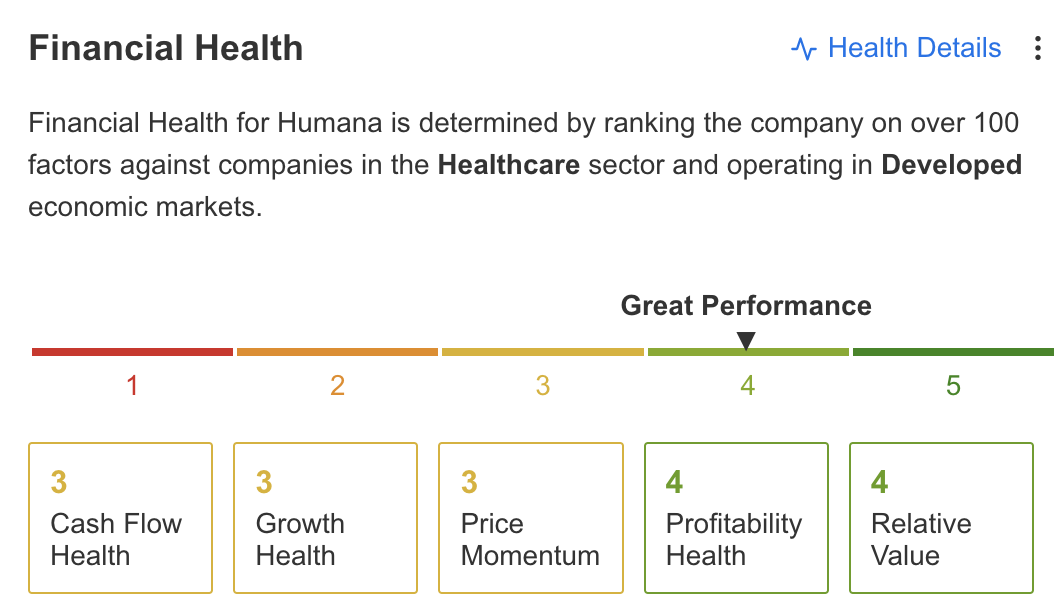

Additionally, InvestingPro rates Humana’s financial health as “Great,” determined by ranking the company on over 100 factors against companies in the Healthcare sector and operating in Developed economic markets.

Source: InvestingPro

To summarize, although Humana confronts considerable challenges related to medical cost trends, InvestingPro emphasizes the company's strengths, suggesting that the market may have overreacted, and indicating that the stock is currently undervalued.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

*Readers of this article get an extra 10% off our annual and 2-year Pro plans with codes OAPRO1 and OAPRO2.

Subscribe here and never miss a bull market again!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.