As a group, UK housebuilders have produced astonishingly good financial results over the last decade.

This has given their shareholders equally astonishing returns, with average share price gains from the largest housebuilders at close to 1,000% since the 2009 financial crisis.

One housebuilder in particular, Bellway PLC (LON:BWY), sits at the very top of my stock screen, thanks to its impressively consistent double digit growth, high profitability, low debts and a dividend yield of around 4% (at a share price of 3,800p).

And following the Conservative’s win in the 2019 general election, Bellway’s share priced jumped another 10% or so, rewarding shareholders with yet more capital gains.

So are housebuilders set to produce similarly impressive returns over the next decade, or has this particular house party already run its course?

I’ll try to answer that by first looking at the financial results which underpin those impressive share price gains.

Bellway’s financial results are astonishingly good

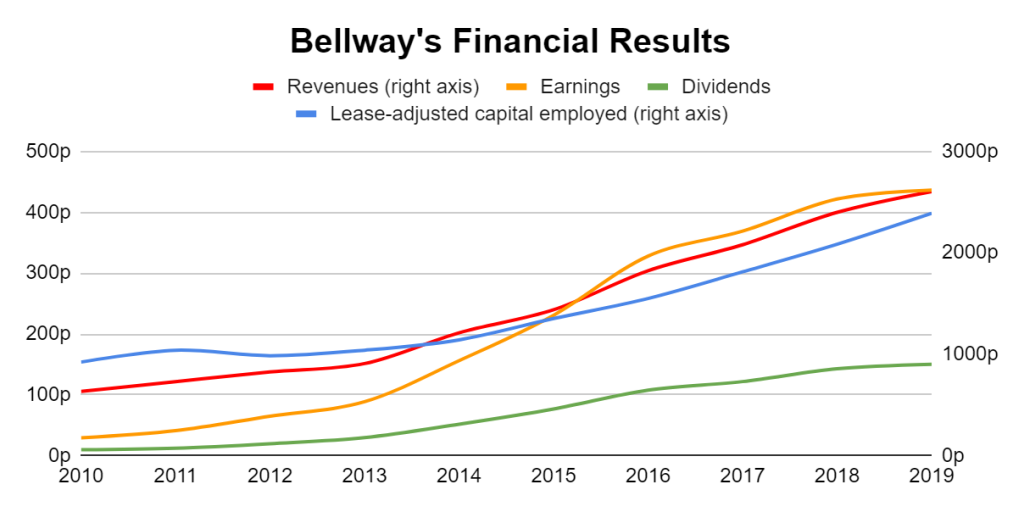

I’m going to stick with Bellway (LON:BWY) as it’s one of the better housebuilders in my opinion. Here’s a quick chart showing its quite frankly amazing results over the last decade:

Growth this fast and consistent is very rare indeed

As you can see, everything that’s good (revenues, earnings, dividends etc) has gone up over the last decade, by a lot. For example, its:

These are incredible results and, on top of that, the company has no large pension liabilities and hasn’t made any large or risky acquisitions in recent years.

These are exactly the sort of financial results I like to see in a company, so I think Bellway (LON:BWY) is definitely worth looking at in more detail.

People will always need houses

Bellway’s core business is housebuilding which means, unsurprisingly, it builds houses.

It does this in the UK, with a fairly even split between houses built in the north and south (split about 48% to 52%, respectively).

It builds mostly for the private market (88%), with a small amount for the social housing market (12%).

Revenues, earnings and dividends have grown enormously over the last decade, primarily because Bellway (LON:BWY) has built more houses and sold them at higher prices:

- The number of houses sold by Bellway (LON:BWY) has more than doubled from 4,595 in 2010 to 10,892 in 2019 (a 137% increase)

- The average price of each house sold has almost doubled from £167,000 in 2010 to £295,000 in 2019 (a 76% increase)

- The average net profit per house sold has increased sixfold from £8,000 in 2010 to £49,000 in 2019 (a 533% increase)

These are fantastically good results for a relatively mature company operating in a very mature market. Some might say too good, so let’s look at some negative factors.

The housing market is cyclical

Houses are capital goods, which means they’re expected to last many years, unlike short-lived products like toothpaste or food. Once you buy a house, you won’t necessarily need to buy another one, ever.

This makes it very easy for people to not buy houses if they’re worried about their job, their spouse's job, or the economy in general.

If people are reluctant to buy a house then forced sellers (e.g. those who can’t afford their mortgage or those who need a large cash lump sum) will have to lower their asking price and this can have a significant impact on overall house prices.

For example, at the peak of the previous housing cycle in 2007, Bellway (LON:BWY) sold 7,638 homes. At the nadir of that cycle, in 2009, Bellway sold 4,380 homes.

That’s a decline of 43%, which is a lot by almost any reasonable standard. This was compounded by a decline in the average selling price, from £177,000 in 2007 to £156,000 in 2009.

And since Bellway’s was unable to reduce its expenses in line with its revenues, the 2007-2009 decline in house prices and homes sold caused profits to decline from £167 million in 2007 to a loss of £28 million in 2009.

That should give you a very clear picture of what can happen to highly cyclical companies (even high quality ones) during a cyclical downturn.

However, a company isn’t uninvestable just because it’s highly cyclical (at least I don’t think it is). But it does mean we should probably try to work out how much of its recent performance (good or bad) is down to where we are in the cycle, and how much is down to the company’s underlying strengths (or lack thereof).

Is the housing cycle largely responsible for Bellway’s results (and those of other housebuilders)?

If we compare Bellway’s results from the current cycle (approximately 2010-2019, so far) to a similar period from the previous cycle (approximately 2000-2009 for the sake of simplicity) then we can see how much it’s grown from one cycle to the next, rather than how much it’s grown within a single cycle.

Here are the raw numbers. Bellway’s:

So Bellway’s average annual growth, from one cycle to the next, has been about 9%. That’s still very good, but it’s 14% short of the 23% growth rate achieved from the beginning of this current cycle.

Very simplistically then, we could make a ballpark guess that Bellway (LON:BWY) is responsible for 9% of its recent annual growth rate, while the housing cycle is responsible for the remaining 14% (this is more about providing context than the specific numbers).

If I’m right that the housing market cycle is mostly responsible for Bellway’s impressive recent results, then other housebuilders should also have impressive results, regardless of the underlying quality of their businesses (because a rising tide lifts all boats, good, bad or ugly).

And consistently spectacular results over the last decade is exactly what we see among the UK’s largest housebuilders:

| Housebuilder | 10-year revenue growth to 2019 | Barratt Developments (LON:BDEV) | 140% | Berkeley Group | 388% | Bovis Homes (LON:BVS) | 255% | Persimmon (LON:PSN) | 138% | Taylor Wimpy | 132% |

All of these mature companies, operating in a very mature market, have grown revenues by more than 100% over the last ten years. Either these are some of the best companies in the world, run by some of the greatest business minds to have ever lived, or...these companies are riding a cyclical boom and just happen to be in the right place at the right time (Nasim Taleb would probably call them “lucky idiots“).

I know which I think is more likely.

My next question then, is this: can Bellway (LON:BWY) consistently grow by about 9% per year from one cycle to the next, or is that cycle-to-cycle growth just down to the size of the current housing boom relative to the previous boom? In other words:

Are housebuilders simply riding the mother of all housing booms?

To answer that, let’s take a walk through some recent UK housing market history.

First of all, you don’t have to be a property investor to know that the UK went through a massive housing boom during the 2000s.

In the run up to the 2009 financial crisis, banks were handing out money to pretty much anyone that had a pulse. In some cases, they would lend up to 125% of the value of a house, completely removing the need for any sort of deposit and effectively putting the buyer into negative equity from day one.

Of course, that all came to an end with the credit crunch, when the obvious unsustainability of those loans finally turned around and bit the banks (and the taxpayer) on the backside.

But anyone who expected UK house prices to decline from seven-times earnings in 2008 to their historic average of about four-times earnings was sorely disappointed.

Yes, after the credit crunch house prices did decline, from £177,000 to £156,000 in Bellway’s case. And banks did tighten up their lending criteria, which dried up demand as most potential first time buyers in 2009/2010 had no chance of raising a 10% deposit on a £150,000 starter house.

But after the crisis, a combination of record low interest rates and a flawed planning system were more than enough reverse the short-lived price decline by fuelling demand and constraining supply.

This combination was so effective that by 2011 Bellway’s average selling price had surged to £180,000. That’s higher than at the peak of what was then the biggest property bubble in history, and just a couple of years after the near-collapse of the global financial system.

So against all the odds, UK property prices didn’t mean revert back to normal levels after 2009. Instead, a new housing bull market began from already very elevated house price to earnings multiples.

At first the new housing bull market began quite slowly, with Bellway’s average selling price increasing by about 6% per year between 2010 and 2013, and the number of new homes built going up at about the same rate.

But then something odd happened.

New build house prices jumped by 10% in 2014, 5% in 2015 and then a massive 13% in 2016. After that initial price explosion, new build prices have increased at a more pedestrian pace, but still enough to leave Bellway’s average selling price at just shy of £300,000 today.

That’s almost double the price of a new build house at the peak of the 2000-2009 housing bubble.

Along with this sudden jump in house prices came a sudden jump the number of houses sold. Before 2014, Bellway (LON:BWY) was increasing its number of homes sold by about 6% per year, but in 2014 it sold 21% more homes than in 2013. 2015 and 2016 also saw double digit increases, although as with prices, that has slowed to low single digit growth over the last couple of years.

Thanks to that explosion of new build house prices and homes sold, Bellway (LON:BWY) now sells twice as many homes as it did a decade ago and at almost twice the price.

This has increased the company’s return on sales (profit margin) to almost 17%, which is about twice the average return on sales it generated through the housing boom of the 2000s.

And with Bellway’s surging revenues and profit margins come surging profits, from £40 million a decade ago to more than £500 million today.

Now, I don’t profess to be an expert in property market cycles, but this certainly doesn’t look like a normal cycle to me (and neither did the last one, come to think of it).

Given that the last UK property bubble ended with the highest property valuation ratios in history, it seems inconceivable to me that UK house prices can continue to double every ten years or so, especially when the earnings that pay for those houses are not increasing even half as quickly.

So although Bellway (LON:BWY) has grown by about 9% per year from one point in the last cycle to a similar point in this cycle, I think much (most?) of that is due to the incredible scale of the current housing boom, even when compared to what was previously the largest housing bubble in history.

However, before I dismiss the success of Bellway (LON:BWY) and other housebuilders as simply the result of a housing bubble built on top of the previous bubble, it would be useful to know what caused this huge housing boom in the first place.

Because if we understand what caused the current boom, we might understand what will end it as well.

Help to Buy: It looks a lot like a government sponsored ponzi scheme

It may come as no surprise that Help to Buy is a key driver (in my opinion) of the current house price bubble.

Help to Buy is, in simple terms, a government scheme to help first time buyers buy new build houses (in practice there are many nuances and loopholes which are not super relevant to this article).

The flagship Help to Buy Equity Loan scheme:

This of course means that first time buyers can (at least during the first five interest-free years) afford to pay 20% more for a house than before (or if they could already afford it then Help to Buy makes it even more affordable by reducing their borrowing costs).

Help to Buy also means that banks are willing to lend to first time buyers who can only raise a 5% deposit, because the government is providing an additional 20% equity buffer.

And finally, not only will banks lend to Help to Buy buyers with mere 5% deposits, but because of the government’s 20% equity stake, banks only have to lend up to 75% of the value of the house, which means lower interest rates for those eligible for Help to Buy as well.

Somewhat unsurprisingly, this has led to an increase in the price of new build properties, to the point where Bellway’s average selling price is now 50% higher than when Help to Buy was first launched (about 30% to 40% of Bellway’s homes are sold through the Help to Buy scheme).

Also somewhat unsurprisingly, Help to Buy funding has flowed straight from the taxpayers’ pocket, through the fingers of first time buyers and into the pockets of Bellway (LON:BWY) and the other large UK housebuilders.

I say “unsurprisingly” because anyone with even the slightest interest in the interaction between supply, demand and prices would have seen this coming a mile off. For example:

So Help to Buy has been an incredible windfall for UK housebuilders, but their current record levels of revenues, profits and dividends depend almost entirely on continued government interference in the supply and demand side of the housing market, and that’s a very risky position to be in.

When Help to Buy ends, what will happen to house prices?

Help to Buy is set to end in 2023, unless the government decides to double down on this unsustainable policy and extend it even further.

Let’s assume for now that Help to Buy does end in 2023. Then what?

Well, Bellway (LON:BWY) sells about 30% to 40% of its homes through the Help to Buy scheme, and others such as Persimmon (LON:PSN) rely on Help to Buy to shift around 50% of their stock. So clearly there will be a material impact on these companies when the scheme ends.

And given how high UK house prices are relative to earnings, I think there could be a lot of downward pressure on prices once Help to Buy is killed off.

I think likely impacts could include:

Exactly what this would mean for Bellway (LON:BWY) and other UK housebuilders is impossible to know in detail, but I think they could end up selling significantly fewer homes at significantly lower prices, and that would have a dramatic impact on their results.

For example, if Bellway’s profit margins reverted back to their historic average of 9% from their current Help to Buy inflated 17%, that alone would virtually halve the company’s earnings, which would put pressure on the dividend. And that’s without factoring in lower revenues from selling fewer homes and at lower prices.

In summary then, I think it’s reasonable to describe the current house price boom as a government fuelled house price bubble, and that record housebuilder revenues and profits are largely dependent on Help to Buy.

So although it’s impossible to know how the cycle will evolve form here, one thing I don’t want to do is invest in a highly cyclical housebuilder somewhere near the peak of the largest UK house price boom in history (one that’s so big and unstable it needs explicit government support to stop it from imploding).

A target price for Bellway (LON:BWY)

Despite all the negative factors facing UK house builders, I actually quite like Bellway (LON:BWY). It was, after all, the only large UK housebuilder to continue to pay a dividend through the financial crisis.

Its margins and returns on capital through both of the last cycles are also quite good, averaging about 10% and 12% respectively. And it currently has no debt, which is very sensible for such a highly cyclical company.

But despite Bellway’s reasonably attractive 4% dividend yield (at a share price of 3,800p), I still think the price is far too high given where we are in the housing cycle (possibly somewhere near the top; almost certainly nowhere near the middle or the bottom).

My preference with highly cyclical companies is to buy them somewhere near the bottom of the cycle rather than somewhere near the top. In Bellway’s case, the last market bottom occurred around 2009.

Back then, when many investors thought the UK housing bubble would burst catastrophically, Bellway’s share price was below 500p. That gave the company the following valuation ratios:

These multiples just about meet my valuation rule for buying highly cyclical companies:

That valuation rule is very demanding and 90% of the time even highly cyclical companies won’t be anywhere near that cheap. But sometimes they are, and that sometimes almost always occurs near the bottom of their market cycle, which is almost always the best time to buy highly cyclical companies.

For Bellway (LON:BWY) to hit those valuation benchmarks in the current cycle, its share price would have to fall below 2200p, in other words:

That would require a decline of about 35% from the current share price, which really isn’t all that much in the grand scheme of things.

But even if its price did fall below my target, I still probably wouldn’t buy until the current housing bubble popped, or significantly deflated at the very least.

For now then, I’m happy to sit back and watch Bellway (LON:BWY) with detached interest, but not to buy.

As for the other UK housebuilders, I think we’re far too late in the mother of all housing booms for any housebuilder valuation to be attractive, and I think new build house prices are massively overblown thanks to a series of badly thought through government interventions.

Of course, if you’re a cynic and think the government’s intention all along was to inflate the housing market, then Help to Buy was a stroke of pure genius which will probably be extended far beyond 2023, in which case UK homebuilders could still represent excellent value.