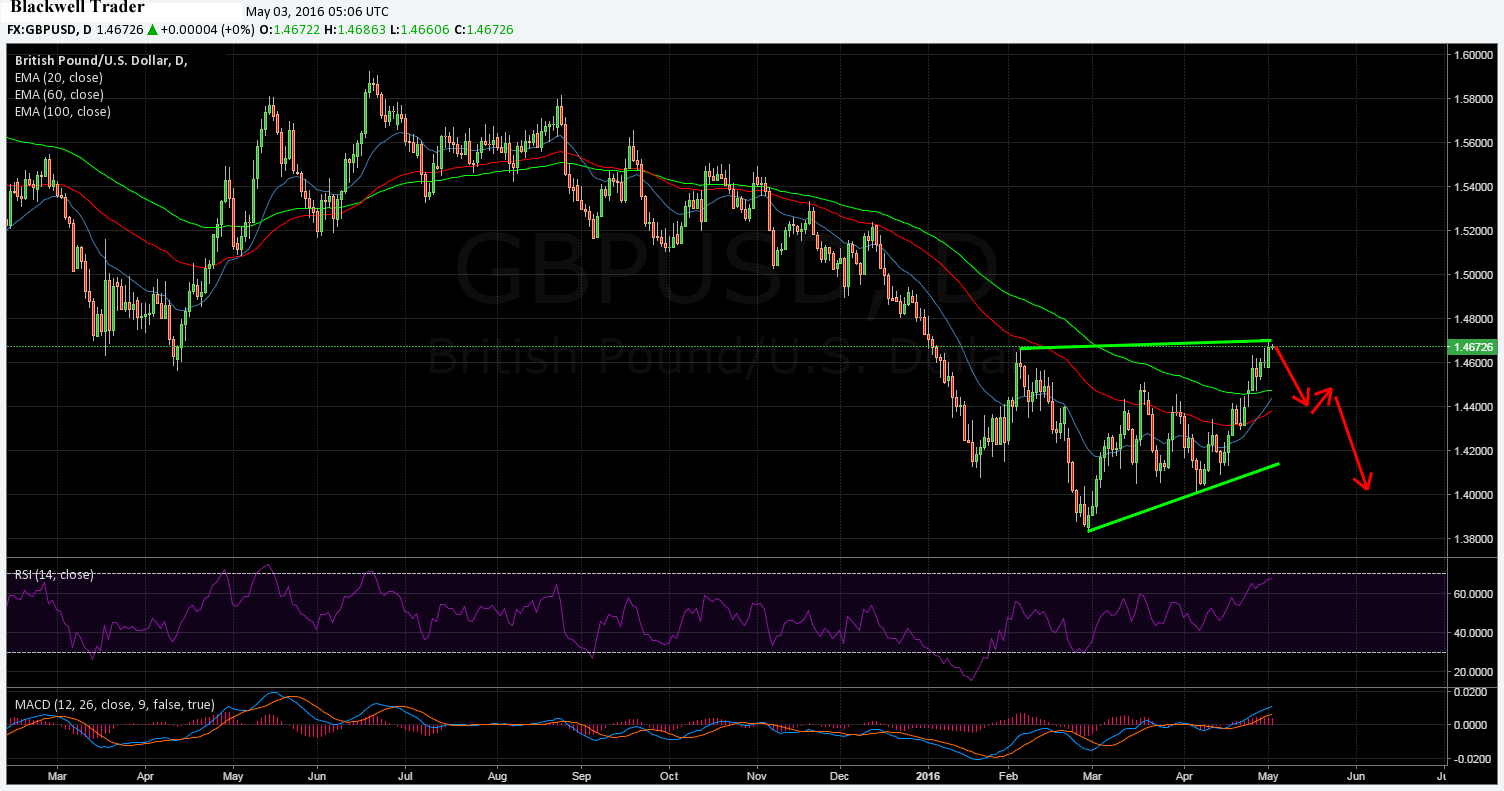

The cable has largely had a couple of strong weeks since the currency appeared to turn the corner in early April. However, despite the recent rally to the top of the range, the pair now faces some stiff resistance that is likely to see it retrace in the coming sessions.

Taking a look at the technical indicators and various chart patterns demonstrates the pair’s rapid rise of late. However, what the chart also makes clear is that price has now abutted against a relatively strong area of resistance that is likely to be difficult to breach. In addition, the RSI oscillator is flirting with the overbought levels on the daily chart which may predispose it for a retracement.

Subsequently, although the cable’s rally has been extended throughout today’s trading session there is little in the way of any concerted buying to support a move beyond the current 1.4675 level. Given the importance of the key reversal zone, a failure is likely to see a pullback towards the downside at 1.4004 at the bottom of the bearish channel.

Additionally, the UK Manufacturing PMI figures are due out directly and the reality is that the dataset is unlikely to signal any fundamental reason for a rally. In fact, the result could provide some fuel to a significant retracement in the pair if a negative result is seen. However, from a fundamental point of view, the largest risk event of the week is the US Non-Farm Employment Change result which will be watched closely for the trend direction moving forward.

Ultimately, it is probable that the pair will return to a continuation of the bear trend as both the technical and fundamental indicators largely favour the downside. However, a weak US NFP result could provide the cable with some significant buoyance following the announcement. Subsequently, watch your exposure levels in the lead up to the jobs announcement.