Despite the notable setback in Asian markets during Q122, Invesco Asia Trust (IAT) continues to generate a double-digit annualised NAV total return (c 11% over the past 10 years), supported by consistent income. It has continued to pay a regular six-monthly dividend equivalent to 2% of NAV (4% per year). In January 2022, the fund management team was enhanced when Fiona Yang was appointed co-manager alongside Ian Hargreaves, who has run the portfolio since 2011 (from 2015 as a sole manager). IAT’s team targets double-digit annualised returns from each portfolio holding over a rolling three-year period.

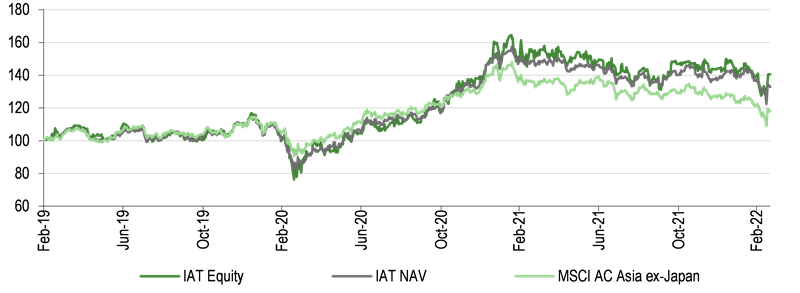

IAT outperforms Asian equities during 2021 and 2022

Why IAT now?

The team believes that the current investment environment benefits skilful stock pickers, who can navigate volatile markets and invest in companies with strong future prospects, particularly in China and Indonesia.

As the team witnessed the recent investment outflow from China, the managers observed that a similar level of pricing was last seen in 2009 and therefore believe that some high-quality, high-growth stocks have been underpriced. While valuations remain low, they will continue to look for more buying opportunities.

The analyst’s view

2021 portfolio performance (54 holdings at 28 February 2022) benefited considerably from blending growth and value styles. The team has achieved solid absolute and relative performance over the long term, since Hargreaves began co-managing IAT.

We believe that dividend enhancement, introduced by the board in 2020 (see page 6 for details) brings additional stability to the fund’s performance and underlines the board’s focus on total return.

Fund objective

Invesco Asia Trust’s objective is to provide long-term capital growth by investing in a diversified portfolio of Asian companies. On 1 May 2015, the trust adopted a new benchmark, MSCI AC Asia ex-Japan, in place of the former benchmark, MSCI AC Asia Pacific ex-Japan. While the benchmark excludes Australasia, the trust may still invest in these markets.

Bull points

- A total return approach with relatively high dividend income and enhanced dividend policy.

- IAT is able to use revenue and capital reserves when necessary.

- Strong track record of manager Ian Hargreaves, supported by the co-manager Fiona Yang and an experienced team of eight Asia investment specialists.

Bear points

- IAT has yet to build a track record of covering dividend with revenue, on a 4% yield.

- Negative sentiment towards Chinese equities can impede performance.

- Investments in value stocks made during 2021 have yet to contribute positively to performance.

Click on the PDF to read the full report: