Speaking to a couple of knowledgeable sorts yesterday and a recurring theme emerged: what is true innovation? What is a truly impactful stock? Is another streaming app really ‘innovation’? Is another social platform going to make us more productive? (no!) There’s lot of fake innovation out there; hardware masquerading as software, software as AI. The Metaverse sounds crap. Expect more reality checks. ESG is going through a similar reality check. Cutting through all this fakery is not an easy task and wasn’t really required when the liquidity was abundant and the party was in full flow these last 12 years. Now the punchbowl has been removed and the mask has slipped.

On that note, downgrades, or at least price target revisions, are coming for Tesla (NASDAQ:TSLA). I call this a***-covering. Daiwa Securities analyst Jairam Nathan lowered his price target on Tesla to $800 from $1,150 while maintaining an outperform rating. This is less than a week after Dan Ives at Wedbush lowered his PT on Tesla to $1,000 from $1,400 and kept his Outperform rating...reality is catching up with some of the most prominent Tesla bulls. Last week BNP Paribas’s EV World Cup left Tesla with no wins – competitors are already overtaking. The decline in the stock is entirely justified and the Street is playing catch-up. Ives on the situation last week: “While the Twitter (NYSE:TWTR) situation in theory does not impact the Tesla fundamental story, the distraction risks for Musk (perception is reality) are hard to ignore at a time that the Tesla ecosystem has never needed Musk more with the worst supply chain crisis seen in modern history.”

Shares in Tesla declined almost 7% to $628, a new low for 2022. But it wasn’t the worst performing of the big holdings in ARK Innovation ETF (NYSE:ARKK). Roku (NASDAQ:ROKU) fell almost 14%...needless to say Cathie was providing the liquidity, buying 231k shares for ARKK. Insiders meanwhile are getting out and she’s providing the off-ramp they need. She also bought 190k shares of Block (NYSE:SQ) as it declined 9%. Keep on doubling down...Zoom (NASDAQ:ZM) is now the number one holding at 9% of the fund.

Twitter AGM today is going to be interesting. Streams from 10 am Pacific Time. Does the board just Musk all the way to signing or does he back out, get a discount? Shares are not priced for the deal to go through as it stands.

Tech fell hard yesterday on that Snap (NYSE:SNAP) update. The reverberations were felt across global equity markets, but the Dow held up a small gain as the Nasdaq fell 2.5%. Snap itself dropped 43%, whilst Meta (NASDAQ:FB) declined 7% and Twitter slid over 5% to under $36.

Hardware masquerading as software: Today’s Ocado (LON:OCDO) update has all the hallmarks of the Target (NYSE:TGT)/ Walmart (NYSE:WMT) earnings reports last week. Since its last update in March, management noted how “the trading environment has deteriorated, as has been widely reported in industry data, with the cost-of-living crisis compounding the impact of a return to more normal consumer behaviours as restrictions have ended and many people return to the office”. The online grocery market has declined by around 20% compared with last year, they say. Shares are down 52% YTD and about 75% from the all-time highs.

M&S back in the black but a 1% rise in the share price is hardly covering the 43% decline this year. And despite the business starting to fire on more than one cylinder, a pessimistic outlook is hardly helping drive investors to pick up shares. “There is substantial inflation in both cost of goods sold and operating costs including fuel, power, building materials, and maintenance ... Consequently, customers' spending capacity is under pressure. We expect these pressures to increase as the year progresses. We are therefore planning for an adverse impact on volumes due to price inflation, slowing the rate of sales growth.” Meanwhile, it’s pulled out of Russia.

Retailers...looks tough given the consumer today but some pandemic momentum stocks doing well still – Pets at Home (LON:PETSP) up 8% as pre-tax profits rose 40% on +15% revenue growth. I guess not everyone has kicked out their lockdown panic purchase pooches yet. Shares are still down by a third in 2022.

SSE (LON:SSE) is today’s energy complex in microcosm: operating profits up 15% to £1.5bn but profits are its renewables business are down 22% quite simply because it wasn’t windy enough. Shares rebound almost 5% after taking a hit yesterday apparently on windfall tax fears and a downgrade at Citi to neutral from buy.

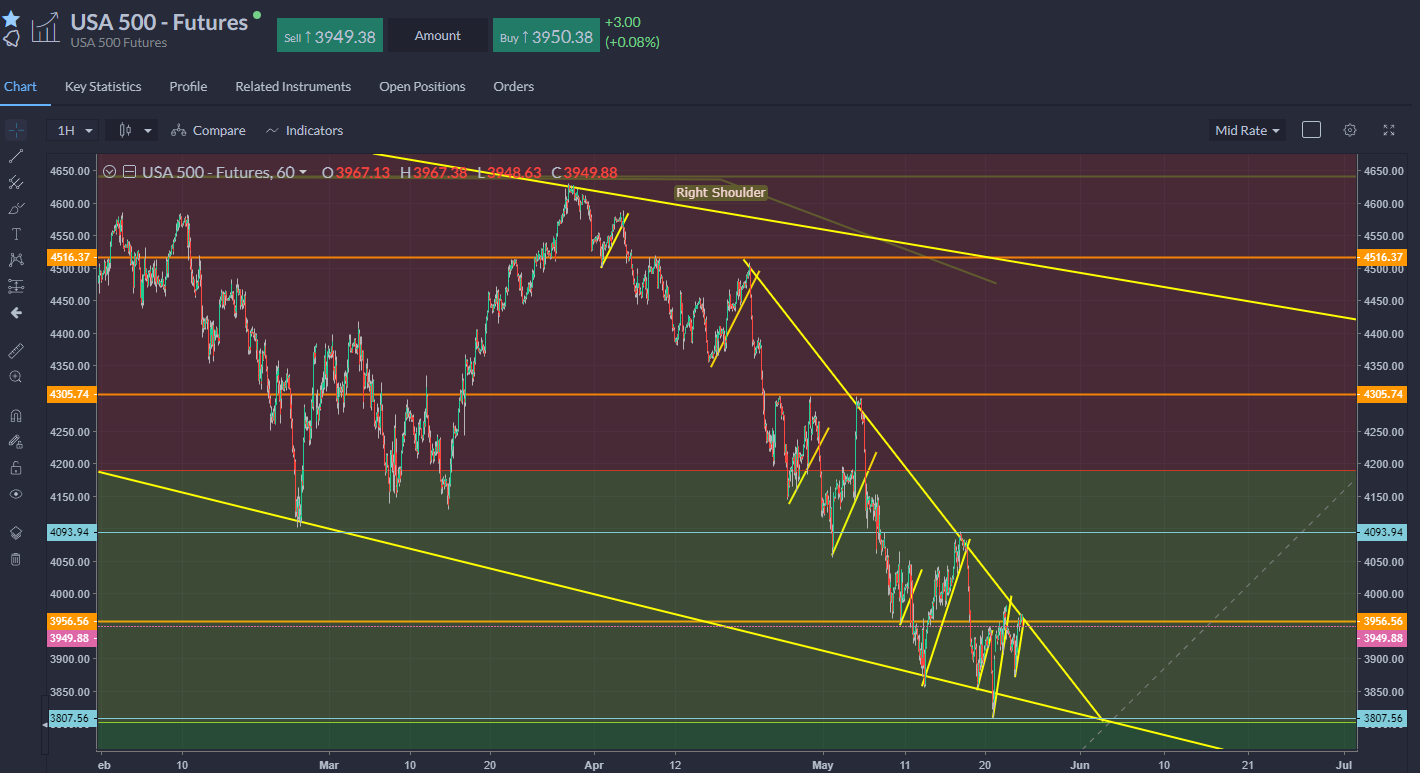

European stock markets nudged up in early trading on Wednesday, with shares in London and Frankfurt up around half of one percent. US futures are holding up ok this morning. E-minis here running into the trend resistance – watching for a break here as the descending wedge plays out...vicious bear market really or capitulation moment? Vix still not doing anything but hang around the 30 mark, evidence of no great downside fear but equally no surge in optimism...slow grind lower territory.

Yesterday, Atlanta Fed President Raphael Bostic suggested the central bank could pause hikes in September and cast doubt on back-to-back hikes of 50bps in June. Markets reacted by reducing the chances for a move in September. The Fed can be relatively happy for now that tightening is producing a relatively orderly decline in stock markets as opposed to a panic. But it’s still walking a very fine line. FOMC minutes are due today

Elsewhere, crude oil continues to hang around the $110 level even with Chinese lockdowns, a massive SPR release, a recession round the corner and a major sell-off of risky assets. Imagine where it can go after the ‘wall of worry’ (horrid phrase) crumbles...EIA inventories today seen at -2.2m after API reported a surprise build of 0.6m barrels. Gasoline and distillate inventories continued to fall amid a shortage of refining capacity just as the US enters the high-demand summer season.

In FX, the New Zealand dollar built on recent gains versus its US counterpart after the RBNZ raised rates 50bp to 2.0%, its fifth straight rate hike in a row and “agreed to continue to lift the OCR at pace” which was a hawkish surprise for the markets.

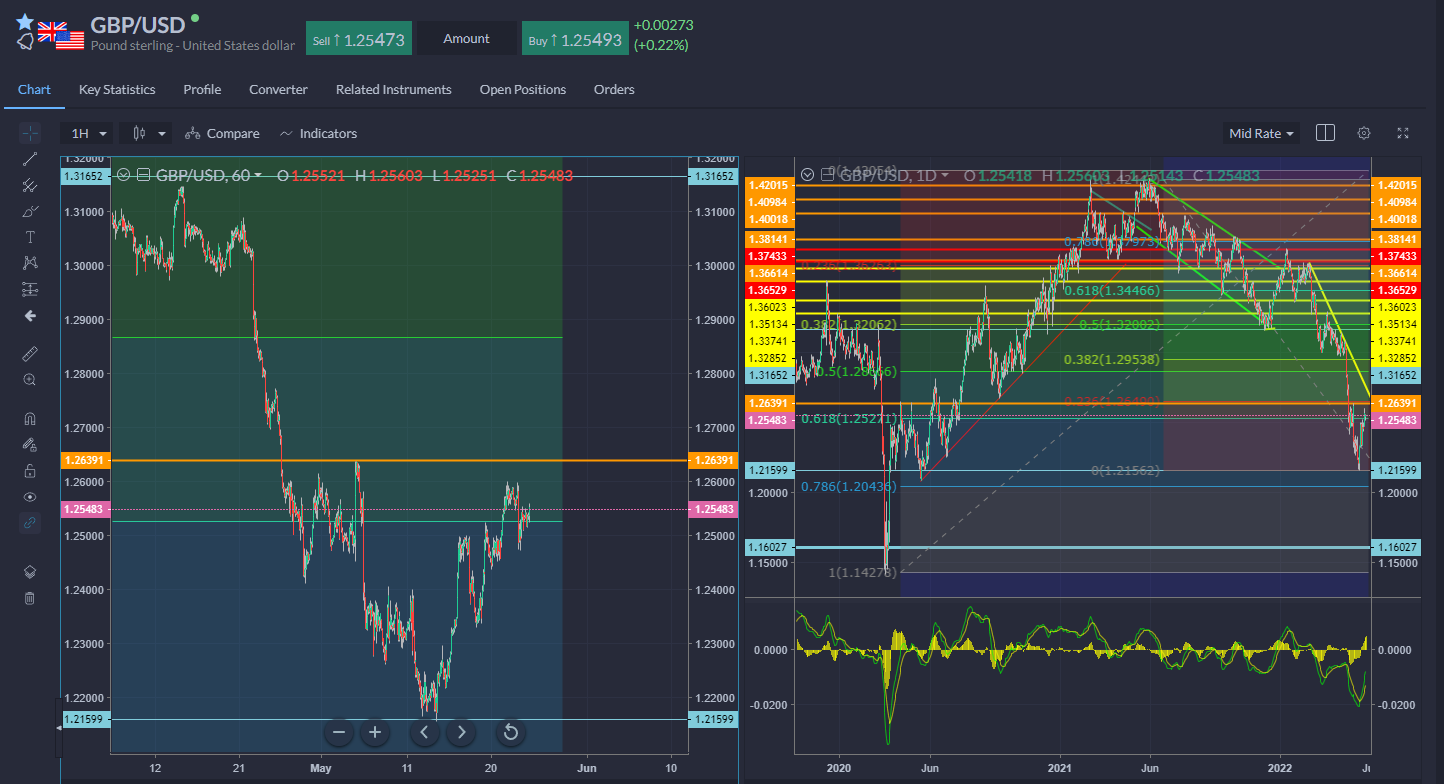

Sterling took a major hit yesterday as on some pretty dreadful PMI figures. Activity is slowing fast, hitting a 15-month low and the outlook is horrendous. It’s a horrible data set and traders are scaling back rate hike bets in its wake with the 2yr gilt down 14bps on the news before ticking up a touch along with sterling. Not a great setup for the pound but can still make headway as the long-dollar positioning is apt for further unwinding. Neckline of inverted head and shoulders at the 61.8% retracement of the longer-term move is the support/resistance for now. Looking for this to provide springboard for 1.2640 area even though macro setup looks so poor...bullish MACD crossover on the daily charts still in force.