Inflation is high and, in our view, unlikely to peak soon. With Federal Reserve (Fed) rate hikes and quantitative tightening expected to address the rapid pace of inflation, investors face a challenging environment to navigate, with fixed income investors struggling for options outside of Floating Rate Notes. Exposure to high dividend strategies that capture both the value factor and companies with higher profitability levels, currently align with a rising rate view. In a time when profitability matters and unprofitable technology stocks are being squeezed, high dividend stocks are performing like the much sought-after shorter-duration assets. In this blog, we explore why these assets could provide some shelter for investors.

Will Central Bank policy move fast enough to address the pace of inflation growth? The global economy is now embroiled in the most severe inflation shock since the 1970s. Inflation is showing a stubborn persistence evident from the recent readings on inflation globally. In March, the US headline Consumer Prices Index (CPI) hit 8.5% annually and the Producer Price Index (PPI) rose to 11.2%. In the euro-area, headline CPI inflation surged to 7.5% and soaring gas prices pushed PPI beyond 31%. Within Emerging Markets, CPI inflation climbed to 11.3% in Brazil, 9.4% in Chile and 7.5% in Mexico. Even across emerging Asian economies inflationary pressures are cascading with great force, particularly among the commodity importers, with inflation reaching 5.7% in Thailand and 3.9% in the Philippines.

Peak inflation or not?

Clearly the Russia-Ukraine war continues to weigh heavily on the inflation outlook. Added to that, the surge in COVID cases in China and subsequent lockdowns have resulted in disruptions to production and shortages in supply chains which is likely to have a sustained upward pressure on prices of goods. Contrary to popular opinion, we don’t think inflation is likely to peak soon. Given the high PPI print in the US, we expect CPI to go even higher before it starts to moderate. In fact, the pace at which inflation moderates will be more significant than when inflation peaks. The war in Ukraine has unleashed a plethora of supply-chain pressures beyond energy. Russia and Ukraine are the largest exporters of wheat, processed nickel and fertilizers. As the conflict persists, we expect pressures on supply chains to mount. For developing countries, where the share of food in CPIs is much larger, and shipment of key agricultural products such as wheat, corn and fertilisers are under stress, the situation could be more severe. The role of Central Banks in addressing the near-term challenge of placating inflation has now taken centre stage.

Central Bank’s hawkish pivot

With the Federal Reserve (Fed) signaling a hawkish tilt to monetary policy, US interest rates have not only risen rather noticeably to the upside, but further increases are expected. Fed rate hikes are expected to include an additional increase of 200 basis points (bps) this year, with the potential for 50bps moves at the upcoming May and June Federal Open Market Committee (FOMC) meetings. In addition to rate hikes, the Fed has also provided forward guidance regarding balance sheet drawdown, or quantitative tightening (QT). Recent comments from Chairman Powell & Vice Chair nominee Brainard suggest QT could occur “at a rapid pace”. The combination of Fed rate hikes and QT is expected to put further upward pressure on Treasury yields all along the yield curve. While central banks in China and Japan intend to keep monetary policy fairly accommodative, the Fed’s hawkish stance is also having an impact on Chinese and Japanese central banks. The People’s Bank of China (PBOC) is holding off on broad-based interest rate cuts and is instead using window guidance and other measures to ensure banks continue to lend to key parts of the economy. In Japan, the central bank was forced to ramp up its bond purchases this week as investors continue to test its ability to keep yields low. In Europe, policy makers are pressing ahead with unwinding monetary stimulus this year. Money markets are pricing in more than a 50% chance of a 25bps rate hike by July, with 25bps of tightening certain in September and December.

Opportunities in Fixed Income

With the US money and bond markets expecting an aggressive tightening cycle from the Fed, there have been little, if any, options for fixed income investors. Traditional rate-hedging solutions such as Treasury inflation-protected securities (TIPS) have produced negative returns as real yields have skyrocketed by 100bps while corporate-based Floating Rate Notes (FRNs) and ultra-short-duration vehicles have also produced negative results since the start of the year. In contrast, Treasury FRNs are one of the only few options where investors have seen positive results as this rate-hedging tool resets every week with the US Treasury (UST) 3-month T-bill auction (1 week duration). Due to this weekly reset mechanism, investors can essentially ‘float with the Fed’ as the UST 3-month T bill will reflect Fed rate hikes in a timely fashion.

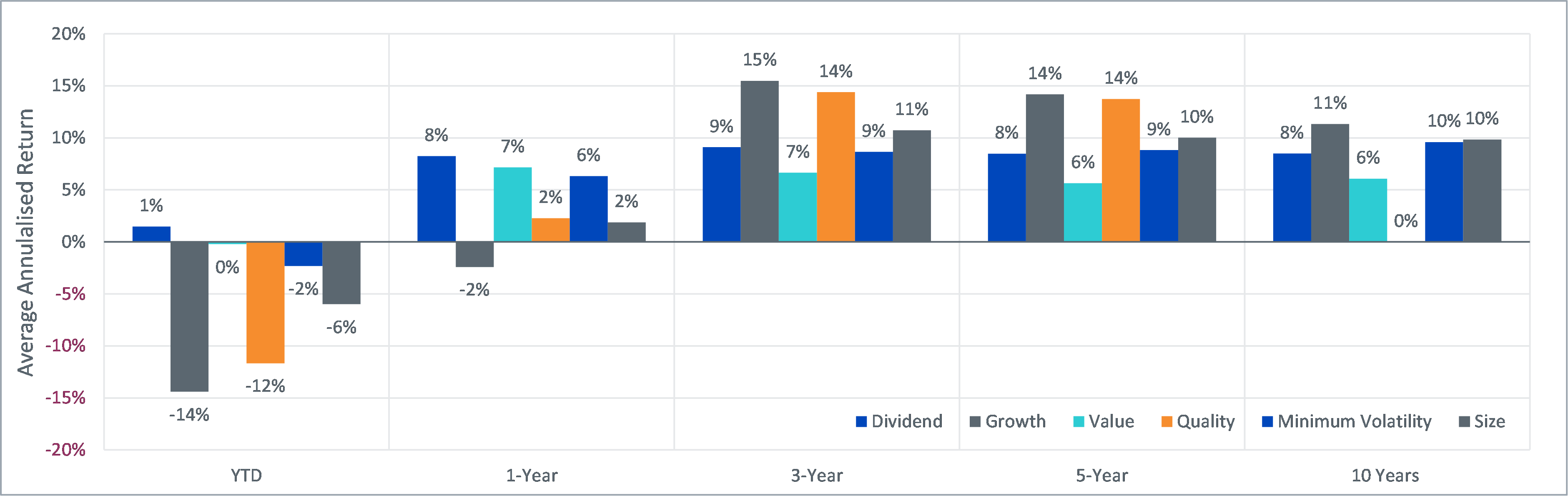

Figure 1 – Comparison of Factor performance over the past 10 years

Source: WisdomTree, Bloomberg. Period 20 April 2012 to 20 April 2022. Please note: Dividend - MSCI World High Dividend Yield Net Return Index; Value – MSCI World Value Index; Growth – MSCI World Growth Index; Quality – MSCI World Quality Price Index; Minimum Volatility – MSCI World Minimum Volatility Net Return Index; Size – MSCI World Size Tilt Net Return Index. Historical performance is not an indication of future performance, and any investments may go down in value.

High dividend & value factor continue to outperform within equities

The dividend yield factor is synonymous with an investment strategy that gains exposure to companies that appear undervalued and have demonstrated stable and increasing dividends. The reset in real rates in 2022 has been swift. With expectations for rates to continue to rise, investors are scrambling for short-duration assets. High dividend strategies currently have sector exposures that align with a rising rate view—including overweights to energy, materials and financials that are more cyclical sectors. The high dividend factor not only captures the value factor but in a manner that has greater exposure to companies with higher profitability levels. Currently 50% of the companies in the S&P500 Index have a dividend yield above the level of the US 10-year Treasury, and high dividend strategies would notably all be above the 10-year US Treasury. In a time when profitability matters and unprofitable technology stocks are being squeezed by rising rates, high dividend stocks are performing like shorter-duration assets.

While central banks get to grips with the pace of inflation, floating rate notes, high dividend and value factors could benefit in a rising inflation and interest rate environment, potentially offering some protection from some of the fundamental shifts we have seen since the onset of the recent geopolitical crisis.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.