US stocks saw a belated start to the week after the Presidents' Day holiday, and fears over the escalating Russia-Ukraine conflict have major indices testing key support levels across the board.

In case you haven’t been following along closely, Russian President Vladimir Putin officially recognized the independence of two breakaway regions in Ukraine, ordering troops into the disputed area. While Ukraine’s President Volodymyr Zelenskyy said there would be no war with Russia, other nations are less more concerned, with the UK characterizing the move as an “invasion of Ukraine.” Western countries have enacted sanctions against Russia and prominent Russian citizens, but most of these sanctions are seen as relatively mild (so far).

Looking ahead, many geopolitical analysts take it as a given that Russia will take control of Luhansk and Donetsk; the bigger questions are around whether Putin will stop there and how Ukraine and the West will respond. For traders, signs that Putin is satisfied and is de-escalating the conflict in the coming days would be viewed as a positive development for markets and risk appetite, whereas a continued incursion deeper into Ukraine could turn the current market unease into an outright rout.

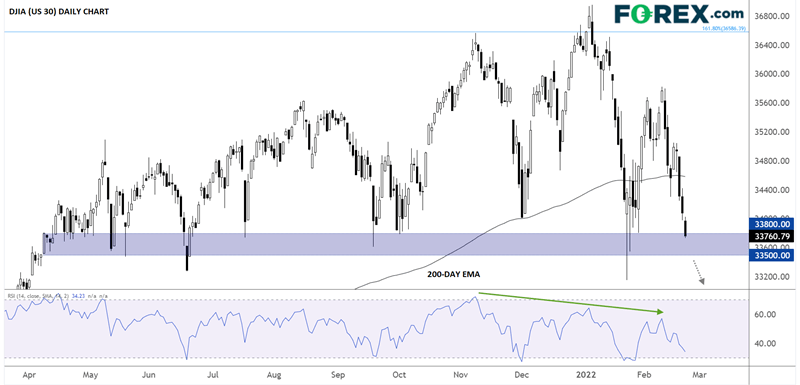

Reflecting the uncertainty in the geopolitical situation, the Dow Jones Industrial Average (US 30) is also teetering on a knife’s edge. As the chart below shows, the index has broken below its 200-day EMA and is testing a key support zone in the 33,500-33,800 range that has reliably put a floor under prices for the past 10 months:

Source: TradingView, StoneX

An escalation of the conflict between Russia and Ukraine would likely see the DJIA break below this critical support zone, setting up a deeper retracement toward the 23.6% or 38.2% Fibonacci retracements of the entire post-COVID rally near 32,500 and 30,000 respectively. On the other hand, a de-escalation of the current conflict may see traders breathe a collective sigh of relief and prompt the index to bounce off the current support zone toward its 200-day EMA near 35,000.

For the (at least) 99% of those reading this who aren’t experts on Eastern European geopolitics, the best course of action in the current environment is almost certainly to let price action guide our near-term trading bias!