By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

The sharp sell-off in Chinese stocks overnight and the intraday swings in oil kept investors on their toes throughout the North American trading session. Oil ended the day higher after dropping to a low of $29.25 a barrel and this recovery helped take the market’s mind off the meltdown in Asian equities. Most high-beta currencies such as the Canadian, Australian and New Zealand dollars traded higher versus the greenback despite mixed U.S. data. However the buck still managed to rack up gains versus the euro, yen and Swiss franc ahead of Wednesday’s monetary policy announcement.

In the next 24 hours, two major central banks will be delivering monetary policy announcements. We start with the Federal Reserve meeting and follow with the Reserve Bank of New Zealand’s rate decision. Both of these central banks have recently made policy moves, though they could not have been any more different. Last month the Fed raised interest rates for the first time in 9 years while the RBNZ cut interest rates for the fourth time last year. While monetary policy announcements are always important -- especially when they come from central banks who are considering more tightening/easing -- this month’s rate decisions could be far less exciting because no changes are expected. Of course monetary policy changes are not needed to ignite volatility in a currency -- forward guidance can be sufficient, but we don’t expect a major shift in bias by either central bank.

Having only raised interest rates last month, the FOMC may feel that adjusting its forward guidance is premature, especially since it didn’t commit to a specific timetable for additional tightening. Adopting a less-hawkish bias and then changing it later could cause more disruption to the financial markets than maintaining a steady stance and leaving the FOMC statement virtually unchanged. There are 2 nonfarm payroll reports and 7 weeks between the January and March meetings, so there’s plenty of time for the Fed to see how the market and economy performs before shifting its forward guidance. And if it waits until March, Janet Yellen could smooth the reaction through her press conference.

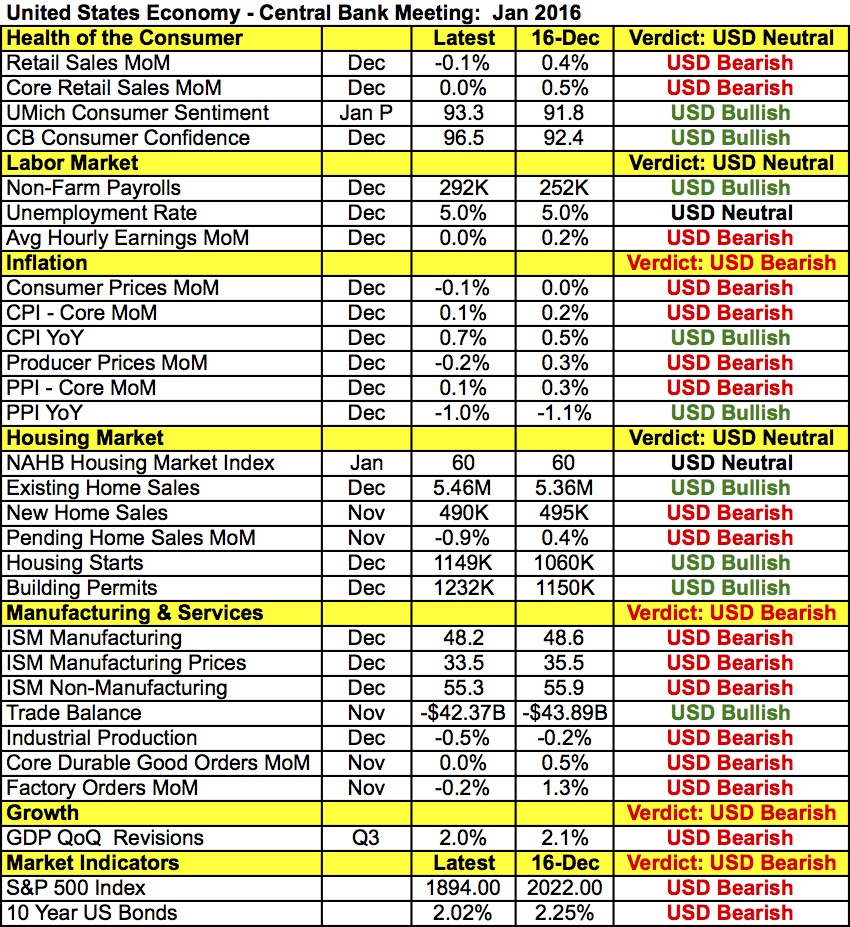

So the best way to trade the FOMC rate decision is to wait. If the Fed grows less hawkish, USD/JPY will be a sell for a move toward 117. If it maintains its stance and USD/JPY rallies to 119.50 or higher, it will be an attractive short as there is no doubt in our minds that the pace of tightening will be slowed by recent market developments. As we indicated in Monday’s note, there’s enough improvement in the U.S. economy since the last meeting for policymakers to still consider a March tightening. At the same time, weakness in retail sales, average hourly earnings, manufacturing- and service-sector activity along with GDP are all reasons for waiting. With 7 weeks and 2 nonfarm payrolls between the January and March meetings, we believe the Fed will reserve judgment for the time being.

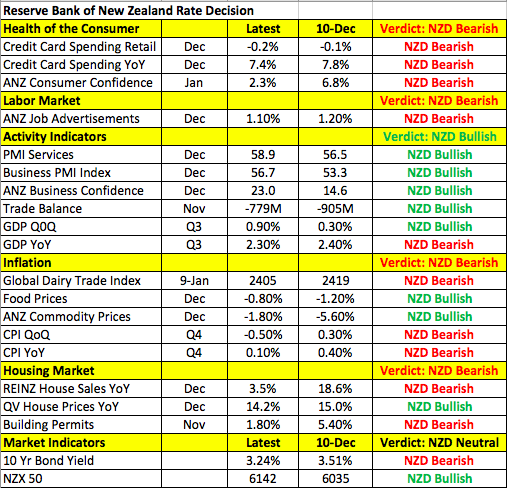

New Zealand has a lot more to worry about than the U.S. because of its reliance on China and the sharp decline in consumer prices. However as shown in the table below, there has been nearly as much economic improvement as deterioration since the December meeting. Service and manufacturing activity expanded at a faster pace helping to boost business confidence. GDP growth also picked up in the third quarter and even though CPI was lower, the decline in food and commodity prices eased. There’s no question that New Zealand’s economy faces serious challenges and the RBNZ may need to lower rates again in 2016 but having just said its inflation target can be achieved with current policy, Wheeler may opt to maintain a steady stance in light of stronger economic activity. So the best way to trade the RBNZ rate decision is to sell the post-RBNZ rally because at the end of the day, there’s more pressure on New Zealand’s economy.

Commodity currencies performed extremely well Tuesday with AUD, NZD and CAD enjoying strong gains. However Australian consumer prices were scheduled for release Tuesday night and between the slide in Chinese stocks and the decline in commodity prices at the end of last year, the rally in AUD could run out of steam. The Canadian dollar on the other hand is enjoying strong gains on the back of rising oil prices. There’s been a significant amount of daily and intraday volatility in oil -- Tuesday's prices closed sharply higher after falling to $29.25 a barrel. The initial decline was driven by concerns about China and the recovery was fueled by comments from Iraq’s oil minister who said Saudi Arabia and Russia have become more flexible on making production cuts. While it remains to be seen whether this is really true, it is becoming increasingly clear that oil is finding support between $26 and $30 a barrel. We have been looking for USD/CAD to drop to 1.40 and if oil continues to recover, this target could be reached in days.

There’s also been a lot of talk about Japan -- some reports suggest that it could ease further but policymakers such as Japan’s Hayashi believe the BoJ has less room to ease than others. We are not looking for the Bank of Japan to increase QE at this week’s meeting, but it may be increasingly willing to do so.

Sterling also traded sharply higher against the greenback despite dovish comments from Bank of England Governor Carney. He said conditions are not yet in place for a rate increase and in order for rates to rise, above-trend growth and unit-cost pickup is needed. Investors have already come to terms with the idea that the BoE will probably forgo raising interest rates in 2016 and while we believe there’s scope for further losses in sterling, risk appetite drove sterling higher on Tuesday.

Finally, the euro ended the day virtually unchanged against the U.S. dollar. No economic reports were released Tuesday morning and German's consumer confidence is the only noteworthy release on Wednesday’s calendar. While ECB dovishness should keep the euro under pressure, the FOMC announcement will determine how EUR/USD trades for the rest of the week.