- The market is currently at a standstill, with no clear direction

- Equities have outperformed bonds, but the major driving force has been a handful of large tech stocks

- But, potential opportunities in small to mid-cap stocks lurk as they have mostly remained stagnant

After enjoying a solid run from January to July, the market understandably took a breather in August, experiencing a correction of around 5-6%. Now, as September begins, we're entering a historically challenging month.

From a long-term perspective, we entered a transitional phase when 2023 began. Currently, markets appear uncertain about their next move and are essentially at a standstill.

Source: Goldman Sachs (NYSE:GS)

Goldman Sachs provides an average of key market indicators that serve as a gauge for determining whether we are currently in a risk-on or a risk-off phase.

The dark blue rhombuses indicate that the market is currently positioned squarely in the middle, representing a state of equilibrium.

Now, how should you navigate these market conditions?

In addition to the strategies I consistently emphasize, such as portfolio rebalancing, maintaining existing positions, and reviewing strategic asset allocations, let's delve into some additional insights relevant to managing the tactical aspects of your portfolio.

Relative Valuations

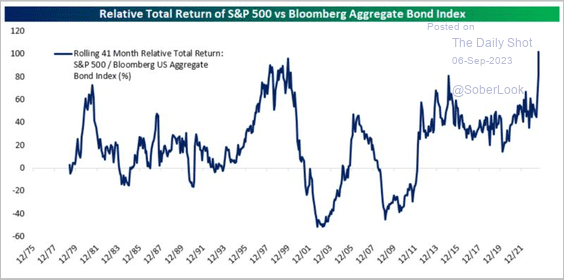

In this market scenario, it's evident that equities have outperformed bonds. Bonds are still grappling with the actions of major central banks and the recent rise in interest rates, particularly on the shorter end of the spectrum, and now, extending to the longer-term rates.

On the equity side, it's worth noting that the major driving force in 2023 has primarily been the 7-8 large U.S. tech stocks, including Apple (NASDAQ:AAPL), Nvidia (NASDAQ:NVDA), Meta (NASDAQ:META), Alphabet (NASDAQ:GOOGL) among others. Meanwhile, the remaining 493 stocks in the S&P 500 have largely remained stagnant.

Source: The Daily Shot

Source: Bloomberg

As mentioned earlier, the S&P 500, mainly propelled by a handful of large stocks, has outperformed both bonds and small to mid-cap stocks.

This situation prompts us to explore potential opportunities among the latter two asset classes, particularly for those looking to make tactical investment decisions.

Stock Picking in This Market

When it comes to selecting individual stocks, there are indeed some high-quality options available within the equity segment.

To highlight a couple of recent trades, I recently closed a short-term position in Zoom Video Communications (NASDAQ:ZM) with a gain of +8.7%.

Additionally, UiPath (NYSE:PATH) pleasantly surprised us with strong quarterly results yesterday.

However, it's crucial to remember that the usual principles still apply, even in times of uncertainty like this. Patience and discipline remain essential virtues in the world of investing.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.