For many years, the Japanese yen has been the world’s most desirable currency for carry trading due to favorable rates. Now, China’s COVID-19 response and JPY’s diminishing value have combined to crown CNY as the new star of carry trading.

The yen has long been a popular currency for forex traders because of significantly lower costs of borrowing, making the Japanese currency an attractive option for carry trading and relatively low-risk investments.

However, Q3 2023 has seen major international forex players like Goldman Sachs (NYSE:GS), Citigroup, Invesco, and TD Securities all recommend the yuan as a key option for leveraging carry trades as the cost of borrowing in China falls towards historical lows.

Carry trades are the practice of borrowing currency at low-interest rates to invest at a higher rate of return. While Japan has long been acknowledged as an advantageous location for carry trades, recent trend reversals have put the yuan in the driving seat.

With JPY’s carry trade dominance contested by CNY, I believe we’re seeing a fundamental shift in Asia’s forex landscape. But how did China replace Japan at the forefront of carry trading? And is this shift sustainable?

China’s Dominance Comes at a Price

The struggles experienced by JPY have seen the currency decline throughout 2023, with the springtime serving as a difficult period for the yen.

One cause of JPY’s struggles has been a conflict of interest between the currency’s performance and governmental policy, whereby key figures have sought to find a balance between the yen’s falling influence in the world of forex and meeting policy objectives.

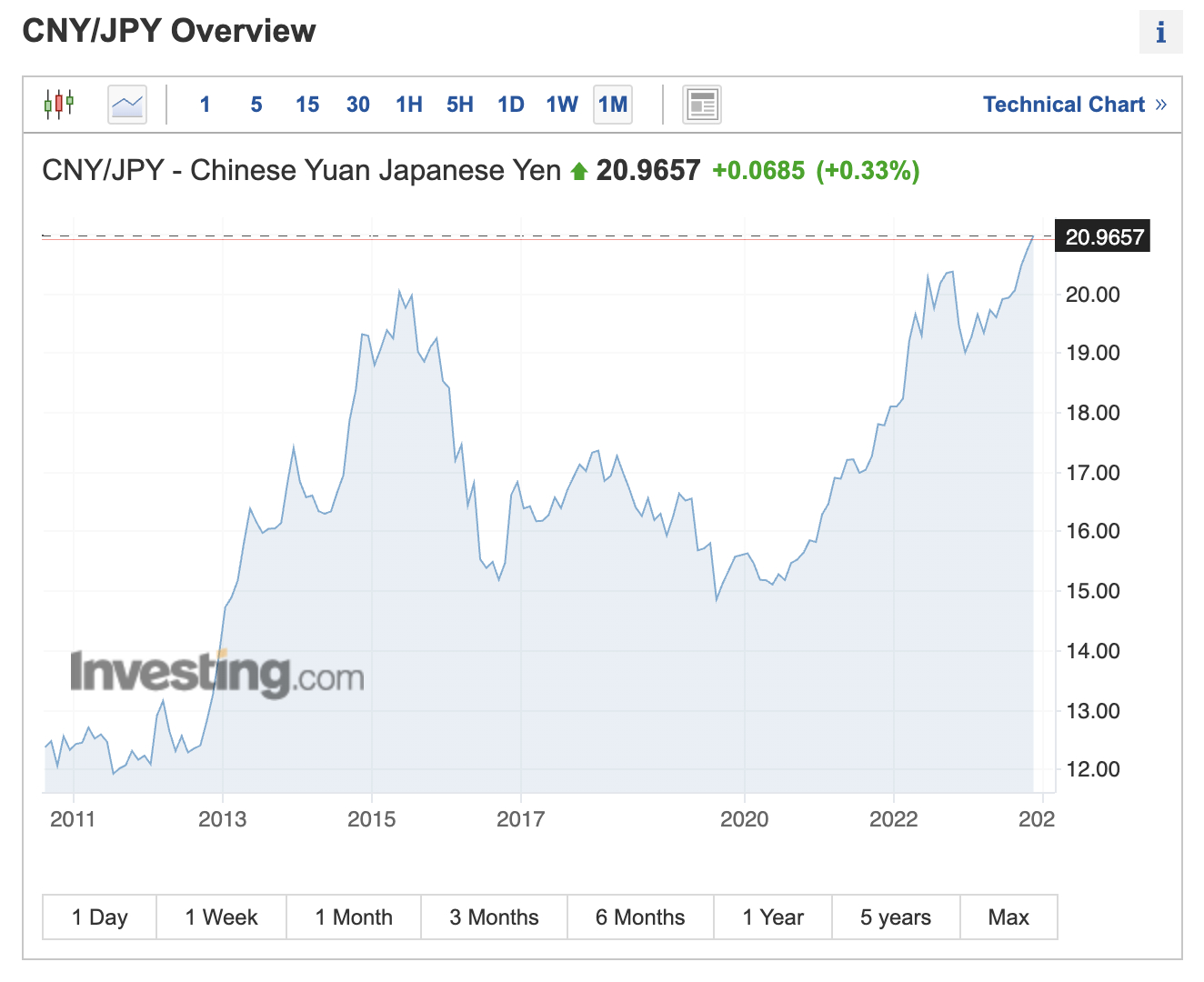

The ongoing tussle for Asian dominance has seen CNY/JPY climb to its highest levels since the early 1990s, signifying a rise that’s caused some difficulties in China’s trading relationship with Japan.

The relative strength of CNY against one of its biggest trading partners forced the Peoples Bank of China (PBOC) to devalue the yuan against the US dollar, which helped to decelerate the weakness of the yen against the USD.

However, the move also saw more devaluation occur throughout the Asia Pacific region, stretching from the Indian rupee to the Taiwan dollar.

Why is the Yen Weaker?

The weaker position of JPY has been caused by a number of factors, and its struggles have seen USD/JPY climb to a 20-year high to underline the yen’s recent shortcomings.

Japan’s reliance on crude oil has played a major role in the yen’s difficulty, and with higher inflation rates and subsequent Federal interest rate hikes expected, the rising cost of living has carried a significant impact on the yen within forex circles and Treasury yields.

This dependence on importing crude oil, gasoline, natural gas, heating oil, and diesel to supplement Japan’s energy needs has hurt the growth of the yen and forced the Bank of Japan to adopt a loose monetary policy in a bid to keep long-term yields low.

As a result, the recent strength of USD/JPY has been allowed to manifest itself throughout much of 2023 with no signs of a reversal in place.

Weakening Correlations Cloud the Yuan’s Future

China’s Covid-19 pandemic response played a key role in the relative strength of CNY and its deposition of JPY as a carry trading favorite. This is because China’s zero-Covid policy enabled the nation to buck the trend of raising interest rates to counter inflation.

Instead, China opted to cut interest rates to encourage growth, helping CNY to become a strong option for carry trades due to the yield that investors can receive.

However, the yuan’s position as a star of carry trading has led to an imbalance throughout the other Asian assets CNY correlates with.

China’s bid to cut rates has led to weaknesses among its closest related currencies like the Japanese yen and Malaysian ringgit due to the volume of trade that the nations enjoy.

Elsewhere, assets that formerly correlated closely with CNY are experiencing a decoupling such as the Indonesian rupiah, Vietnamese dong, and Taiwan dollar.

While the Vietnamese dong was correlating at close to zero in 2023, the Indonesian rupiah’s correlations were close to negative as the currency stood firm in the face of inflationary pressures with a healthy growth outlook.

In my opinion, these weakening correlations could adversely impact the long-term sustainability of CNY’s outperformance in relation to JPY, and a reversal is likely to occur as China continues to move away from its zero-Covid policy.

How Asian Volatility is Impacting Forex

Because of the yen’s difficulties and the yuan’s favorable position as a key asset for carry trades, this role reversal has had an impact on Asia’s forex ecosystem in bringing greater levels of volatility to the landscape.

For traders exposed to Asian FX markets, this can present new problems as volatility causes trading pairs to behave in a more erratic manner. However, with stronger levels of fundamental analysis, it’s possible to identify new opportunities for higher yields.

With this in mind, traders can utilize reporting tools to compare and contrast their fundamental analysis with past performance.

In a recent MetaQuotes update for MetaTrader 5, we can see a strong example of how profit and loss analytics can identify trend reversals early on within trading strategies.

This empowers traders to combine market volatility and recent trading histories to better understand the performance of Asian assets and achieve more fluency in navigating a shifting FX landscape.

While the long-term sustainability of CNY’s position as a copy trade leader could be called into question, it’s clear that the forex market will continue to react to these new Asian market movements long into the future.