- Honeywell earnings have not grown in recent years

- Shares substantially underperformed the US equity market

- Investing in product lines that should boost future earnings

- Wall Street consensus rating is bullish

- Market-implied outlook is bullish

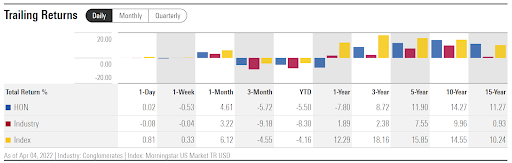

Honeywell (NASDAQ:HON) shares have fallen 7.8% over the past 12 months, compared to +12.3% for the US equity market as a whole.

The poor performance reflects low expectations for earnings growth over the next several years. Honeywell is in a transition period. The technology and manufacturing giant is investing in business lines with strong expected growth and potentially higher margins (including quantum computing, battery technology, green fuels and carbon capture), but EPS growth is currently low. The question is whether it is worth investing now.

Source: Investing.com

HON is currently trading at $194.44, 17% below the 12-month high closing price of $234.18 on Aug. 11.

The trailing three-year total return of 8.72% per year, is less than half the total return of the S&P 500 over the same period. However, over 10- and 15-year periods, the shares have provided total returns in line with the US equity market.

Source: Morningstar

An examination of historical quarterly earnings explains why the Charlotte, North Carolina-based mega-cap stock has underperformed. Even though it has met or slightly exceeded expectations for an extended period, there is no growth. Note that EPS for Q4 2019 of $2.06, $2.07 in Q4 2020 and $2.09 in Q4 of 2021 are almost identical.

Source: E-Trade

With a current dividend yield of 2% and 3- and 5-year dividend growth rates of 5.8% and 7.4%, respectively, the Gordon Growth Model supports an expected total return in the range of 8%-9% per year. The consensus outlook for EPS growth over the next three-to-five-year period is 9.65% per year.

These numbers are consistent with a stable company that is increasing the dividend at a conservative pace relative to expected earnings growth. The big question is can Honeywell generate this level of expected growth?

On Oct.18, 2021 I assigned a bullish/buy rating. Since then the shares have returned a total of -10.9% compared to +2% for the S&P 500.

The company reported Q3 2021 and Q4 2021 earnings over this period, very slightly beating EPS expectations for both.

My bullish rating in October of 2021 was motivated by expectations that Honeywell would be able to break out of its earnings rut. The Wall Street analyst consensus was bullish, with a 12-month price target close to $240, about 8.7% above the share price at that time. The options market was also indicating a modestly bullish view. These positive outlooks supported my buy rating. However, the anticipated earnings growth is not yet evident, which is why the shares have declined relative to the broader market.

While most readers will be familiar with the Wall Street analyst consensus, many will not have encountered outlooks calculated from options prices. A brief explanation will explain the approach. The price of an option on a stock reflects the market’s consensus estimate of the probability that the share price will rise above (call option) or fall below (put option) a specific level (the option strike prices) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probable price outlook that reconciles the options prices. This is called the market-implied outlook and represents the consensus view among buyers and sellers of options. For readers who want a deeper dive into the market-implied outlook than the information in the previous link, I recommend this excellent free monograph from the CFA Institute.

With almost six months since my last analysis, I have updated the market-implied outlook to early 2023 and compared it with the current Wall Street consensus outlook, as in my previous analysis.

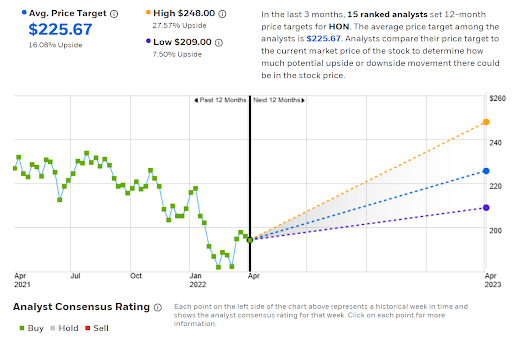

Wall Street Consensus Outlook For HON

E-Trade calculates the Wall Street consensus outlook for HON by aggregating the views of 15 ranked analysts who have published ratings and price targets over the past 90 days. The consensus rating is bullish and the consensus 12-month price target is 16.1% above the current share price.

Source: E-Trade

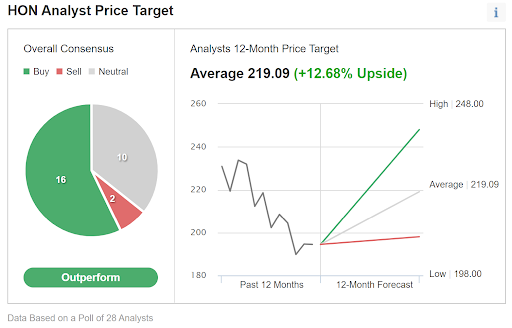

Investing.com’s calculation of Wall Street consensus combines price targets and ratings from 28 analysts and it is bullish with a 12-month price target of 12.7% above the current share price.

Source: Investing.com

Even though the price targets are lower than they were in October, the expected price appreciation is higher because of the share price decline over this period. With an average of 14.4% in expected price appreciation and a 2% dividend yield, the consensus outlook for expected total return is 16.6% over the next 12 months.

Market-Implied Outlook For HON

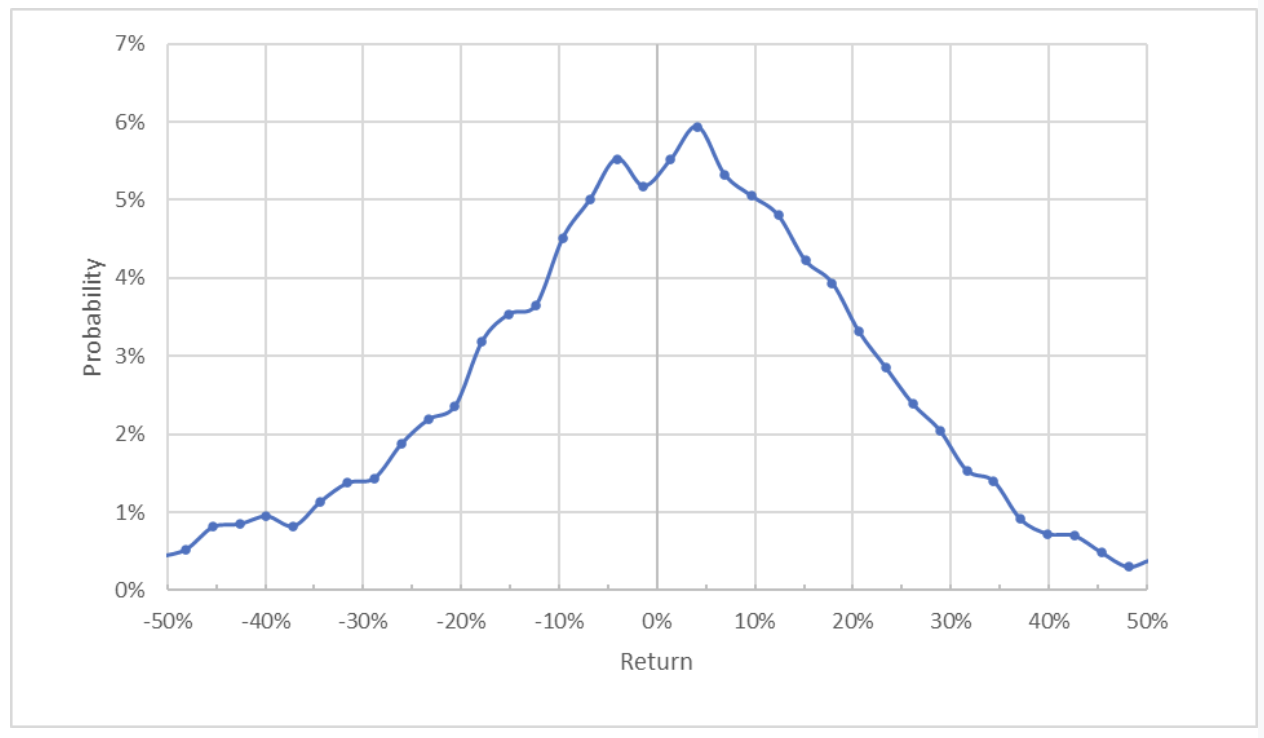

I have calculated the market-implied outlook for HON for the 9.5-month period from now until Jan. 20, 2023, using the prices of options that expire on this date. I chose this specific expiration date to provide an outlook through the end of 2022, and the January expiration date was the closest match to the end of the year.

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options prices from E-Trade

The market-implied outlook for HON for the next 9.5 months is generally symmetric, with comparable probabilities of positive and negative returns of the same magnitude, but the peak probabilities are tilted to favor positive returns. The maximum probability corresponds to a price return of +4% over this period. The expected volatility calculated from this outlook is 25% (annualized).

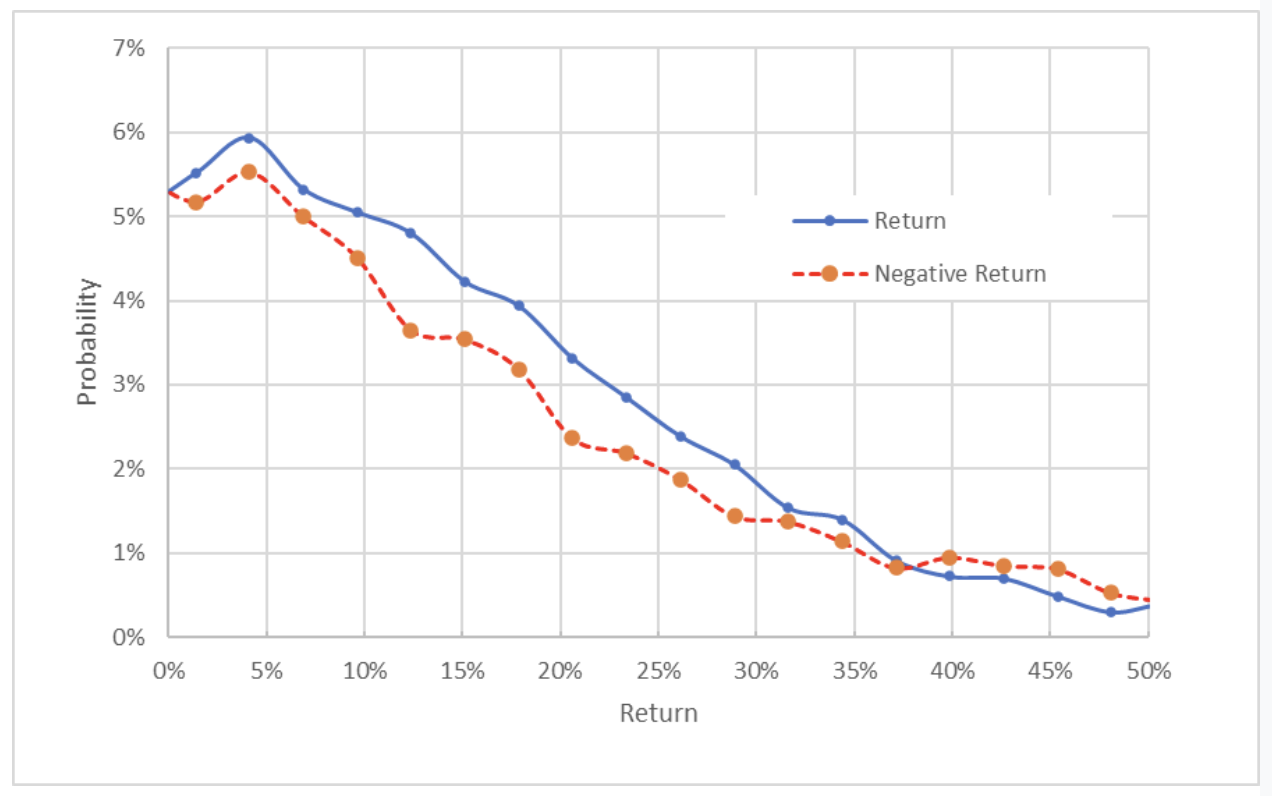

To make it easier to directly compare the probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Source: Author’s calculations using options prices from E-Trade

This view shows that the probabilities of positive returns are consistently higher than the probabilities of negative returns of the same magnitude, across a wide range of the most-probable outcomes (the solid blue line is above the dashed red line over the left three-quarters of the chart above). This is a modestly bullish outlook for HON.

Summary

While Honeywell has not managed to grow its earnings in recent years, the company is investing in higher-margin businesses that are expected to boost earnings.

The Wall Street consensus outlook is bullish, with a 12-month consensus price target that corresponds to 16.6% in total return. As a rule of thumb, for a buy rating, I want to see an expected 12-month return that is at least half the expected annualized volatility.

Taking the Wall Street consensus at face value, the 16.6% return is higher than half the 25% expected volatility from the market-implied outlook. The market-implied outlook for HON to early 2023 is modestly bullish so I am maintaining my bullish rating on HON.