- Home Depot faces uncertain earnings outlook

- But it has strong cash flow and consistent dividend yield

- Share price weakness offers buying opportunity as fundamentals remain sound

- For tools, data, and content to help you make better investing decisions, try InvestingPro+

- Inflation

- Geopolitical turmoil

- Disruptive technologies

- Interest rate hikes

The recent downturn in Home Depot (NYSE:HD) stock leaves no question that the era of easy growth has ended for the home improvement giant. Its stock is down more than 34% year-to-date, underperforming the already bearish S&P 500 for the same period.

The pullback comes after the company's remarkable pandemic performance, fueled by the housing market boom and low interest rates—two catalysts that lured Americans to spend more on their homes.

During that period, the demand for professional contractors and do-it-yourself customers was so strong that the Atlanta, Georgia-based home improvement retailer posted double-digit growth in sales.

However, amid a 4-decade high inflation and rising interest rates, those favorable conditions seem to have reversed, clouding the company's earnings outlook.

According to Chief Financial Officer Richard McPhail in a recent call with analysts:

"Broader uncertainty remains concerning the impact of inflation, supply-chain dynamics, and how consumer spending will evolve through the year."

Home Depot now predicts comparable-sales growth of 3% this year, down from 14.4% from the previous year.

The Biggest Threat

The biggest threat to housing-linked stocks is whether the US Federal Reserve will continue to raise interest rates to fight inflation. If that happens, it will hurt demand for single-family homes, one of the main drivers of demand for home improvement during the pandemic.

According to Mark Zandi, chief economist at Moody's Analytics:

"[Rates in the US] have quickly gone from being a massive tailwind to the housing market to a massive headwind."

He expects home prices to flatten over the next 18 to 24 months, with potential declines in high-flying parts of the South and West.

Robust Demand

Despite growing headwinds, the home-furnishing giant remains one of the top defensive stocks to buy, especially after such a major stock price correction.

Solid revenue for the last 2 years has helped generate an impressive cash flow. In addition, consumer staples are a defensive play during recessions as they pay stable dividends.

Over the past five years, Home Depot's quarterly dividend has expanded, on average, 22% per year, to $1.9 a quarter, or an annual dividend yield of about 2.8%. There's much more room to grow due to the company's solid payout ratio of 50%.

Improved Resilience

Home Depot has also restructured its business, becoming more resilient in dealing with housing market downturns by expanding its focus to professional contractors, who now account for roughly 45% of the company's revenue.

Furthermore, as part of its cost-cutting drive, the company stopped opening new stores and has approximately 2,300, the same number it did a decade ago.

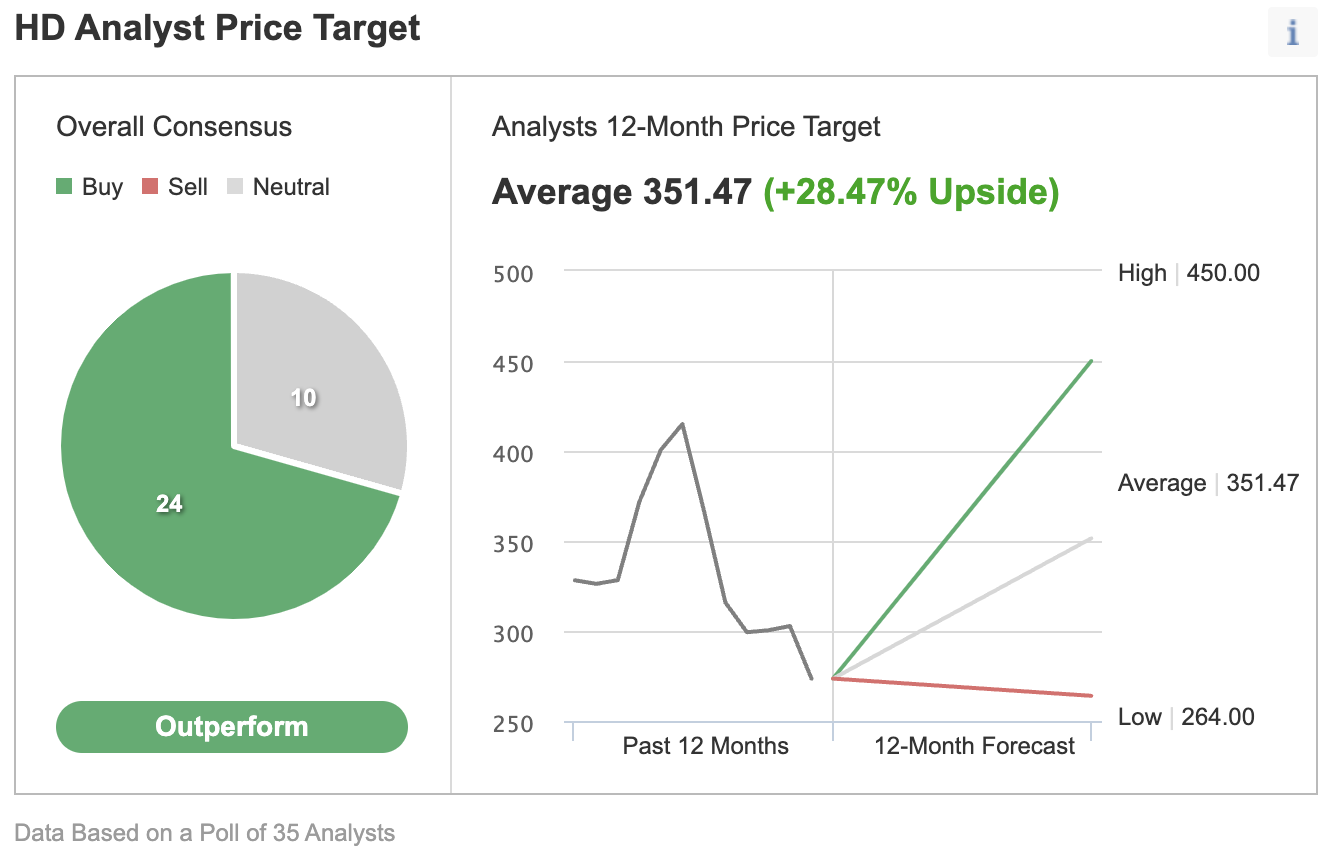

Analysts continue to rate HD stock a buy, with their 12-month consensus price target implying a 28.4% upside potential from the current level, according to a survey by Investing.com.

Source: Investing.com

In a recent note to clients, Wells Fargo named Home Depot a best-in-class stock, following its recent survey checks that showed the home-improvement category is holding up well despite the challenging macro environment. Explaining:

"Adding it all up, it does appear that homeowners are becoming somewhat more cautious. However, given little anecdotal evidence of a slowdown coming from the two largest home-improvement players (which likely reflects some level of share gains), we're inclined to believe that home-improvement spend should remain relatively healthy."

Morgan Stanley also rated HD as "overweight," saying its survey checks show home improvement is "healthy and moderating".

Bottom Line

HD stock may seem risky as concerns loom over the US housing market's future. But the current stock dip offers long-term investors a chance to buy a quality stock that pays an attractive dividend and is well-positioned to perform during an economic downturn.

***

The current market makes it harder than ever to make the right decisions. Think about the challenges:

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI