- Home Depot stock is down more than 12% since the beginning of 2021.

- During the pandemic, many people stayed home and spent money on house renovation projects, providing tailwinds for HD stock, which is still up close to 35% in the past year.

- Long-term investors could consider buying dips in HD shares, especially if they decline toward $350.

Shares of the home improvement retail giant Home Depot (NYSE:HD) have lost 12.3% year-to-date. Despite the recent decline, HD stock returned more than 35% in the past 52 weeks. By comparison, the Dow Jones index, of which Home Depot is a member, is up 16.3% in the past 12 months, but down 3.5% since the start of 2022.

What a difference a few weeks have made for many stock prices on Wall Street. On Dec. 6, Home Depot shares went over $420 to hit a record high. But since then HD stock has lost more than 13%. Its 52-week range has been $246.59 - $420.61, while the market capitalization stands at $382.2 billion.

Atlanta-based Home Depot is the largest home improvement retailer in the world. In FY20, sales surpassed $132.1 billion. The group operates over 2,300 stores in North America, and sells around 35,000 products in store and a million products online.

Recent metrics highlight:

“In 2021, home improvement sales in the United States amounted to around US$538 billion. By 2025, this amount is expected to reach over US$620 billion.”

Home Depot’s market share in the U.S. is close to 60%. It's followed by Lowe's (NYSE:LOW); privately-held Menards and Ace Hardware; and Build.com, which is a subsidiary of UK-based Ferguson (NYSE:FERG).

In mid-November, Home Depot issued robust Q3 metrics. Revenue climbed 9.8% year-over-year to $36.8 billion.

Wall Street was pleased to see that same-store sales increased 6.1%, beating estimates of 2.2%. Management credited continued strong demand for home improvement products, which led to an increase in the average ticket from $72.98 to $82.38. Put another way, consumers spent about 13% more when they visited the retailer.

Net earnings for Q3 2021 were $4.1 billion, or $3.92 per diluted share. A year ago, comparable metrics had been net earnings of $3.4 billion, or $3.18 per diluted share.

Prior to the release of Q3 results, HD stock was around $370. Then, on Dec. 6, it hit an all-time high of $420.61. As of yesterday's close, shares are around $368 with the current price supporting a dividend yield of 1.65%.

We should remind readers that Home Depot is set to announce Q4 results on Feb. 22 before the market open. Therefore, choppiness in HD shares around that date is likely.

Next Move In Home Depot Stock?

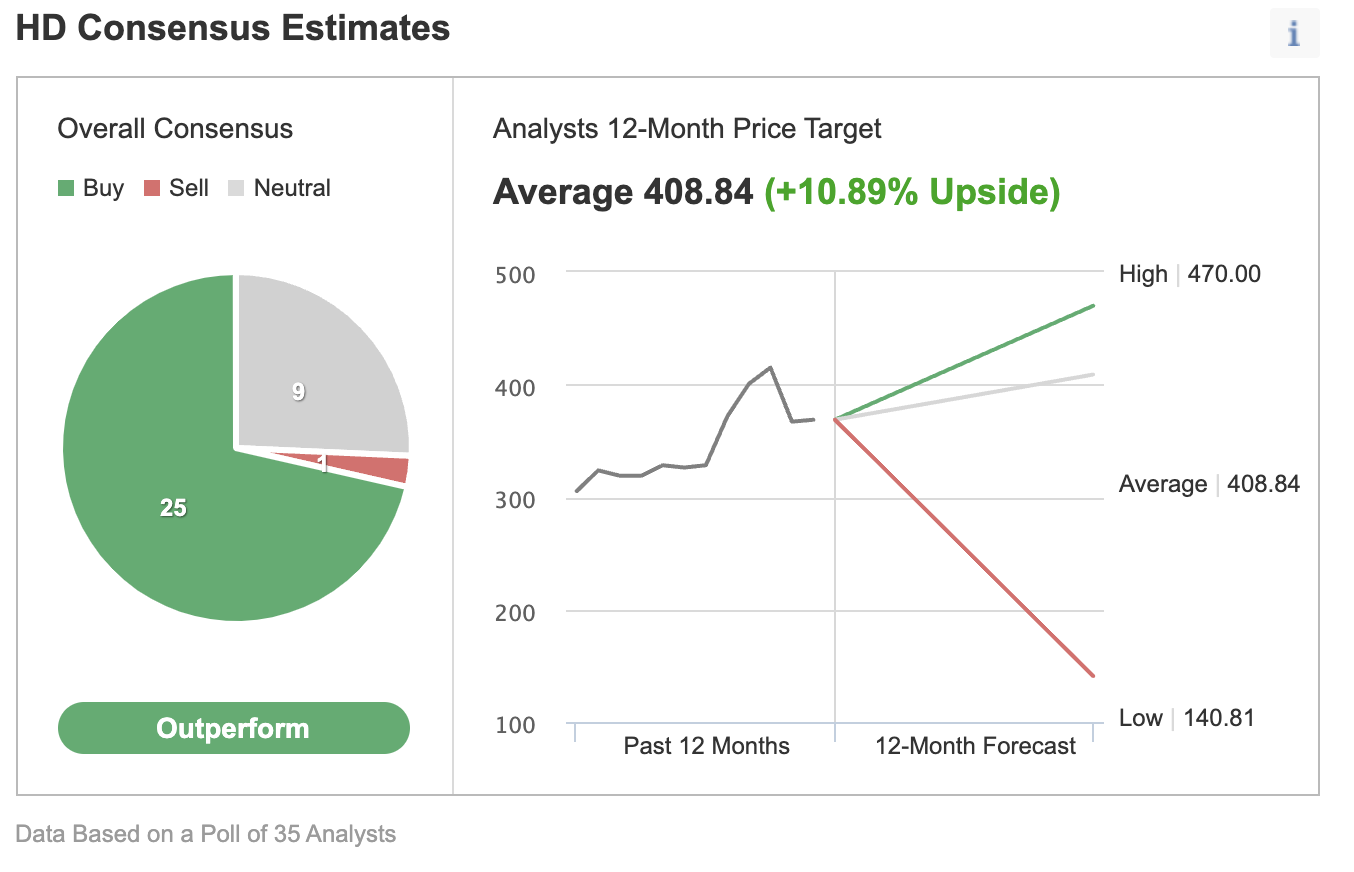

Among 35 analysts polled via Investing.com, HD shares have an “outperform” rating, with an average 12-month price target of $408.84. Such a move would imply an increase of about 11% from the current level. The target range is between $140.81 and $470.

Source: Investing.com

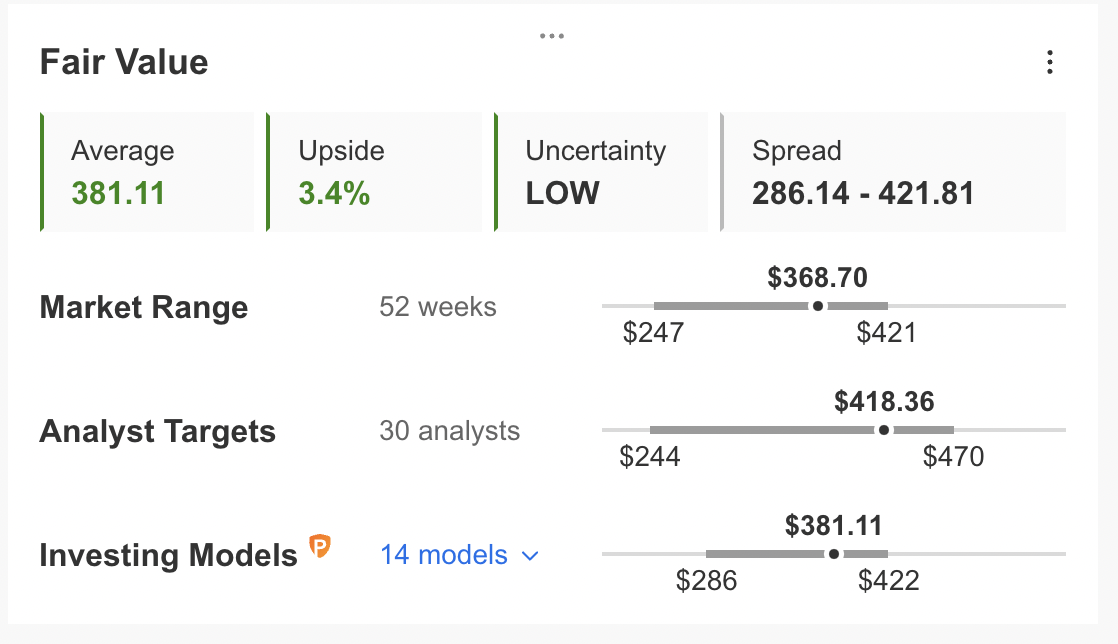

However, according to a number of valuation models like those that might consider P/E or P/S multiples, dividends or terminal values, the average fair value for Home Depot stock via InvestingPro stands at $381.11.

Source: InvestingPro

Given the recent sell-off on Wall Street, many investors are likely to be nervous about how HD shares might fare as the retailer gets ready to report Q4 metrics.

In the short run, we expect Home Depot stock to potentially drop toward $350, or less. Following such a potential decline, HD shares are likely to trade sideways for several weeks until they establish a base, possibly between $345-$355, and then start a new leg up.

Therefore, Home Depot bulls with a two- to three-year horizon who are not concerned about short-term volatility could consider buying the stock around these levels for long-term portfolios. Others, who are experienced with options strategies and believe there could be further declines in HD shares, might prefer to try a bear put spread.

However, option strategies are not suitable for all retail investors. Therefore, the following discussion is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Bear Put Spread On HD Stock

Intraday price at time of writing: $366.10

In a bear put spread, a trader has a long put with a higher strike price and a short put with a lower strike price. Both legs of the trade have the same underlying stock (i.e. Home Depot) and the same expiration date.

The trader wants HD stock to decline in price. However, in a bear put spread, both the potential profit and the potential loss levels are limited. Such a bear put spread is established for a net cost (or net debit), which represents the maximum loss.

Let’s look at this example:

For the first leg of this strategy, the trader might buy an at-the-money (ATM) or slightly out-of-the-money (OTM) put option, like the HD Mar. 18, 360-strike put option. This option is currently offered at $12.35. It would cost the trader $1,235 to own this put option that expires in about a month and half.

For the second leg of this strategy, the trader sells a HD put, like the Mar. 18, 350-strike put option. This option’s current premium is $8.75. The option seller would receive $875, excluding trading commissions.

Maximum Risk

In our example, the maximum risk will be equal to the cost of the spread plus commissions. Here, the net cost of the spread is $3.60 ($12.35 – $8.75 = $3.60).

As each option contract represents 100 shares of the underlying stock, we’d need to multiply $3.60 by 100, which gives us $360 as the maximum risk.

The trader could easily lose this amount if the position is held to expiry and both legs expire worthless, i.e., if the Home Depot stock price at expiration is above the strike price of the long put (or $360 in our example).

Maximum Profit Potential

In a bear put spread, potential profit is limited to the difference between the two strike prices minus the net cost of the spread plus commissions.

So in our example, the difference between the strike prices is $10 ($360 – $350 = $10). And as we have seen above, the net cost of the spread is $3.60.

The maximum profit, therefore, is $6.40 ($10.00 – $3.60 = $6.40) per share, less commissions. When we multiply $6.40 by 100 shares, the maximum profit for this option strategy comes to $640.

The trader will realize this maximum profit if the HD stock price is at or below the strike price of the short put (lower strike) at expiration, (or $350 in our example).

Short put positions are typically assigned at expiration if the stock price is below the strike price (i.e., $350 in this example).

However, there is also the possibility of early assignment. Therefore, the position would need monitoring up until expiration.

Break-Even HD Price At Expiration

Finally, we should also calculate the break-even point for this trade. At that price, the trade will not gain or lose any money.

At expiration, the strike price of the long put (i.e., $360 in our example) minus the net premium paid (i.e., $3.60 here) would give us the break-even price.

In this example: $360 − $3.60 = $356.40 (minus commissions).

Bottom Line On Home Depot Shares

We regard HD stock to be a solid long-term choice for most portfolios. Despite the short-term choppiness in shares, the growth trajectory remains intact for this home improvement retail giant.

Still, Home Depot stock could come under further pressure during this earnings season. Therefore, a trading strategy as outlined above might be appropriate for traders with a bearish outlook on HD shares.