- The US economy is expected to enter a recession by the end of the year.

- Despite the risks, investing in equities may still be a viable option.

- The S&P 500 appears to be in an uptrend, but the 4200 level remains a strong resistance.

- Apple and Microsoft have accounted for nearly 50% of the movement over the past year.

- If you add the rest of the FAANGs, you get over 94% of the S&P 500's return over the past year.

It is almost certain that the US will enter a recession later this year. The problem is no one knows when it will actually happen or the direct impact of such an event on markets. We could be years away from a market downturn, and investors could lose potential gains by over-hedging risks during the process. In the meantime, the likelihood is that a larger percentage of cash in portfolios will lose value due to inflation.

According to the National Bureau of Economic Research, there have been 30 recessions since 1871. Bloomberg analyzed how the S&P 500 performed 6 months before each recession. They found that it had a positive total return 21 times.

So having a good percentage of equities in the portfolio in the months leading up to a recession would probably still be the way to go, even if we knew that a recession was coming.

Furthermore, equities also produced a positive total return 15 times in the 6 months before the end of each recession. And in 12 out of 30 recessions, the market delivered a positive total return.

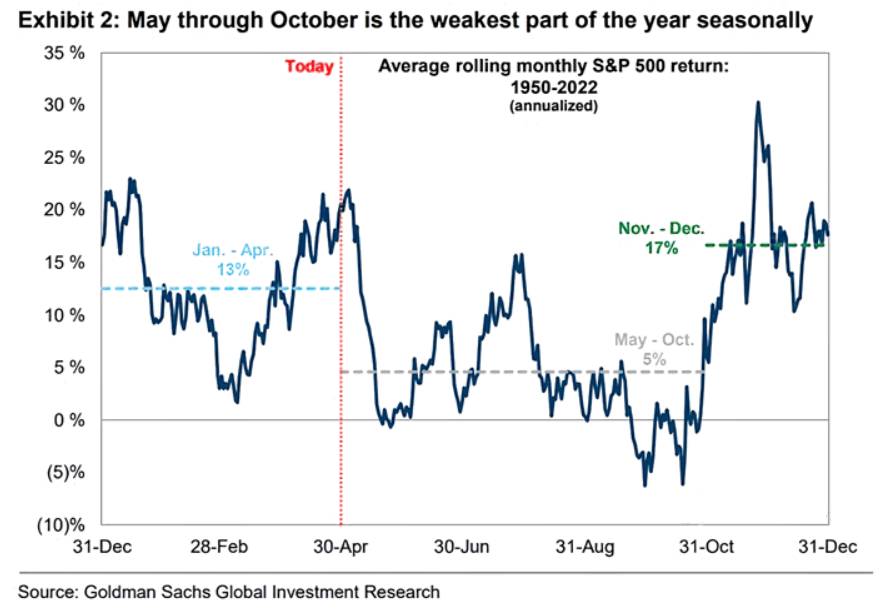

Moreover, the average annualized return of the S&P 500 from May to October has been 5% historically (1950 to 2022).

This shows that the stock market and the economy do not necessarily move in tandem. The recession will affect all aspects of the economy, but not necessarily in the same way.

This is also because stocks tend to price in these risks well in advance. So could it be the case that the S&P 500 has already priced in recession fears over the past year and that the current performance is a sign that it is already looking ahead?

It is difficult to say. You cannot invest based on economic forecasts. We didn't expect it, but the S&P 500 survived April. The VIX briefly dropped below 16 points on the last trading day of the month, returning to the same level as November 2021.

When investing, having an absolute conviction can lead to a loss of opportunity or capital. After all, the market does not just move according to data, it constantly adapts to events like a living organism. Consequently, so must we.

So far, tech earnings have supported the market, and the overall sentiment (Apple (NASDAQ:AAPL) and Microsoft's (NASDAQ:MSFT) combined weighting in the S&P 500 has risen to 14%).

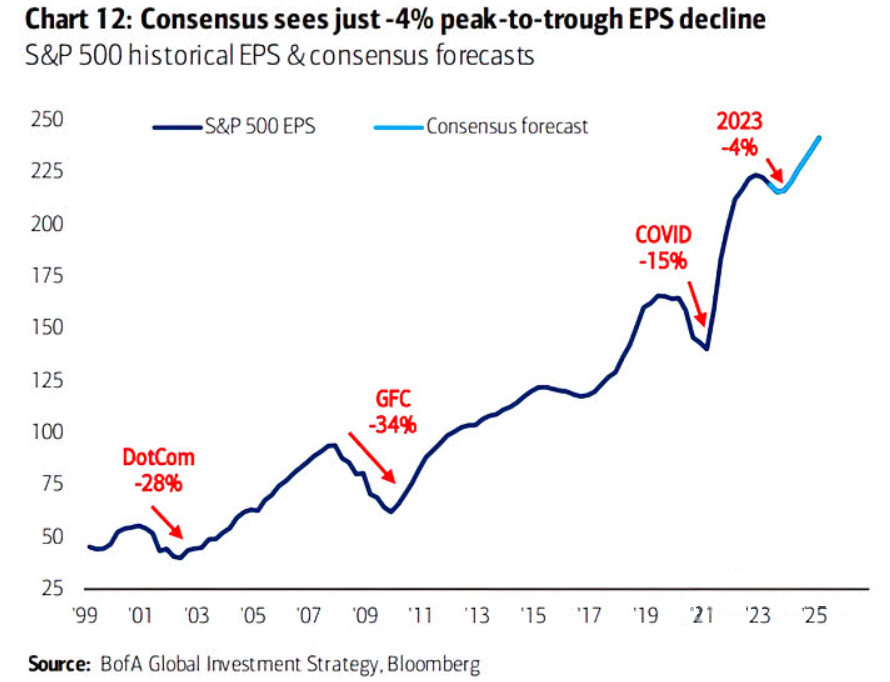

In fact, the consensus expectation was for EPS to fall by 7% year-on-year, but this is not happening. 54% of companies have beaten consensus estimates by at least one standard deviation (versus the historical average of 48%).

The five biggest stocks in the index were responsible for most of the S&P 500's gains:

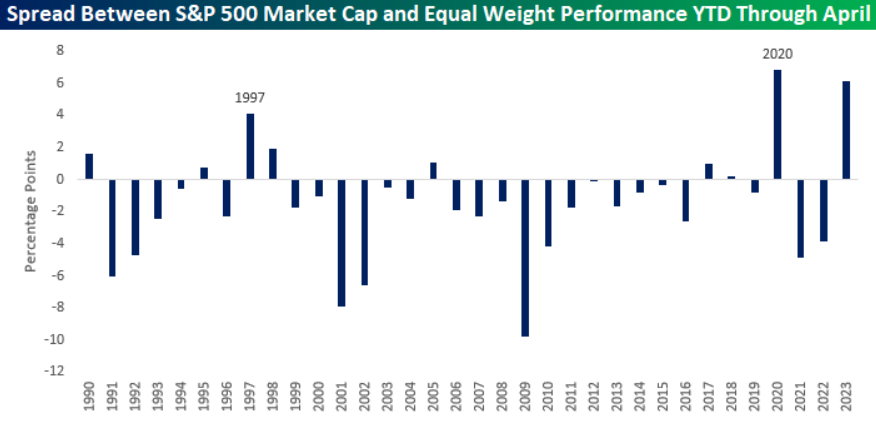

This narrow lead is confirmed by the spread on the capitalization-weighted S&P 500, which outperformed the S&P 500 Equal Weight by more than 5% year-on-year. This is the second widest spread in the last 34 years and is only lower than the 6.8% spread recorded in 2020.

However, this might suggest that such a small proportion of equities is in a bear market. However, the bearish thesis could be disproved by 1997, another year in which the spread gap was greater than 2%; in both cases (1997 - 2020), the performance of the S&P 500 over the rest of the year was more than +20%.

We should also not forget that April was the fourth month in a row that the S&P 500 closed above its 10-month moving average. The market appears to be in an uptrend, but the 4200 level remains a strong resistance.

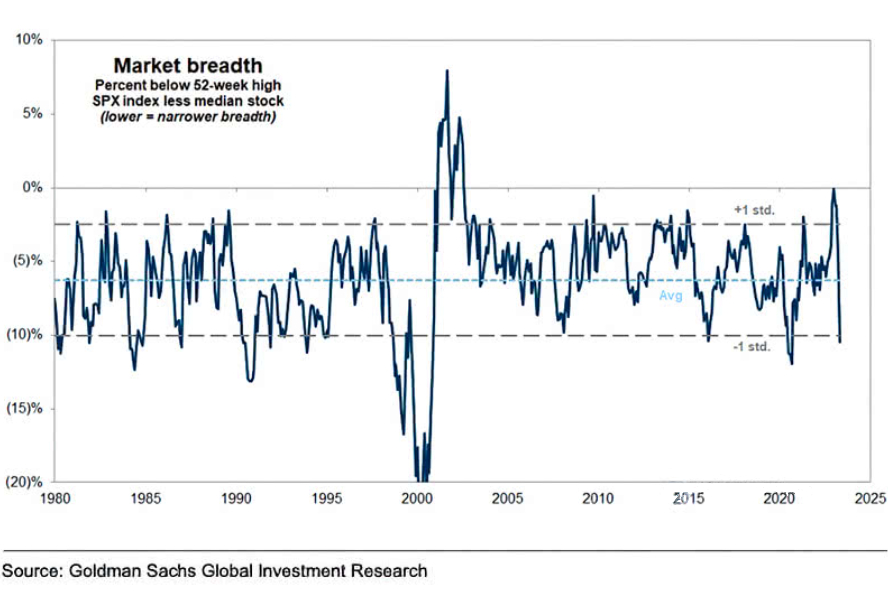

Indeed, the index's breadth is narrowing as it touches lows. Is this a bearish signal?

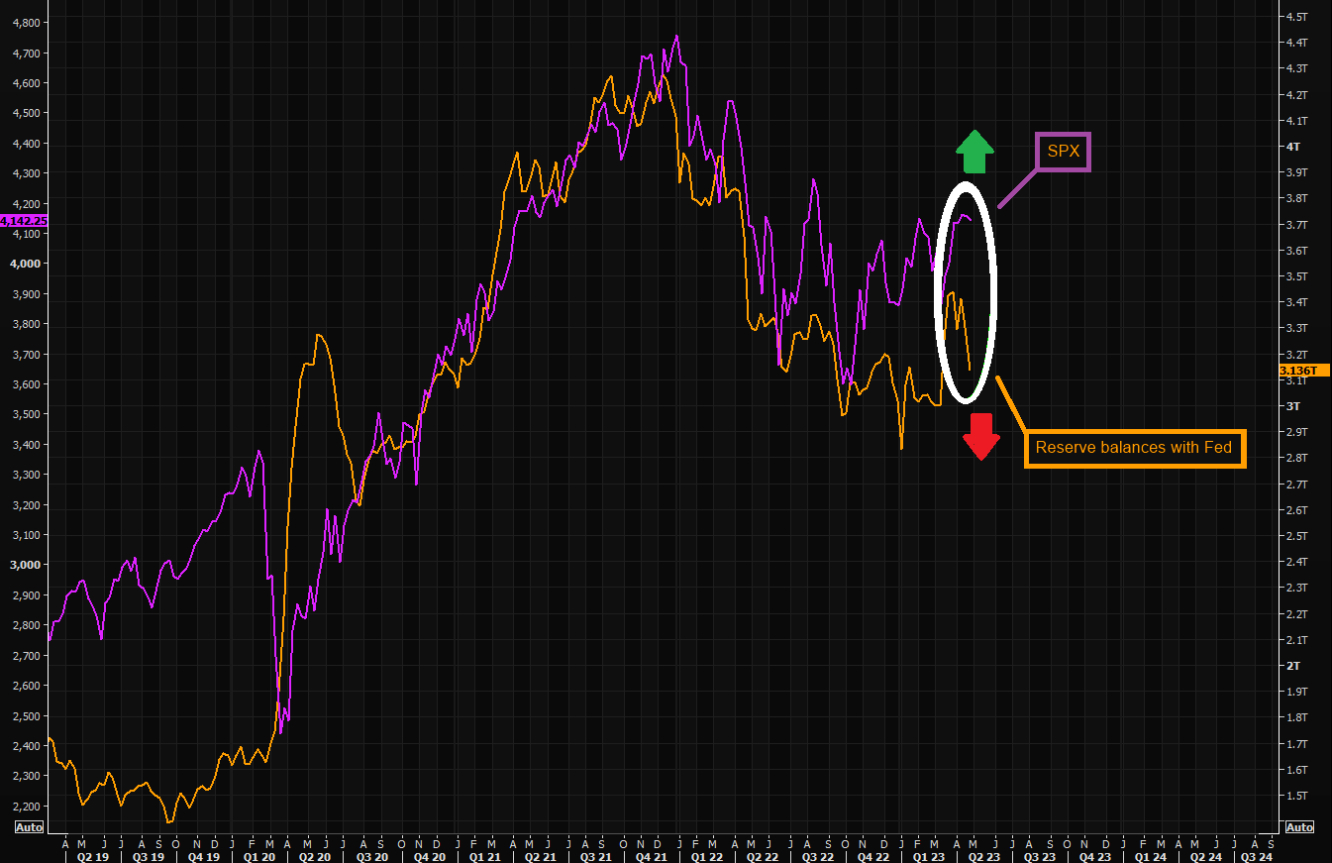

This thesis is supported by the liquidity factor, which is fundamental to the market. Fed reserves continue to fall.

And as we can see from the chart, the index has always followed a drop in Fed's reserves. Is it likely to do so again?

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset is evaluated from multiple points of view and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.