The financial markets have been expecting more cuts in the federal funds rate (FFR) than Eric and I have all year so far. At the start of this year, the markets anticipated six to seven rate cuts in 2024.

We expected two to three at most.

The markets are more dovish on the rate outlook than we were because of investors’ widespread belief that the Fed would have to lower interest rates several times to avert a recession, following the historical script. At such times in the past after a round of tightening, the economy fell into a recession even though the Fed eased in response to its weakening. This time, we’ve had more confidence in the resilience of the economy. Since the summer, we’ve been predicting one rate cut in September for the rest of this year and thinking maybe two to four cuts in 2025. We’ve been more on the mark than the market so far in 2024: There hasn’t been even a single rate cut yet this year.

Now our one-and-done outlook for the remainder of 2024 looks less likely after Friday’s weak employment report. Consider the following:

1 - September odds at 100%

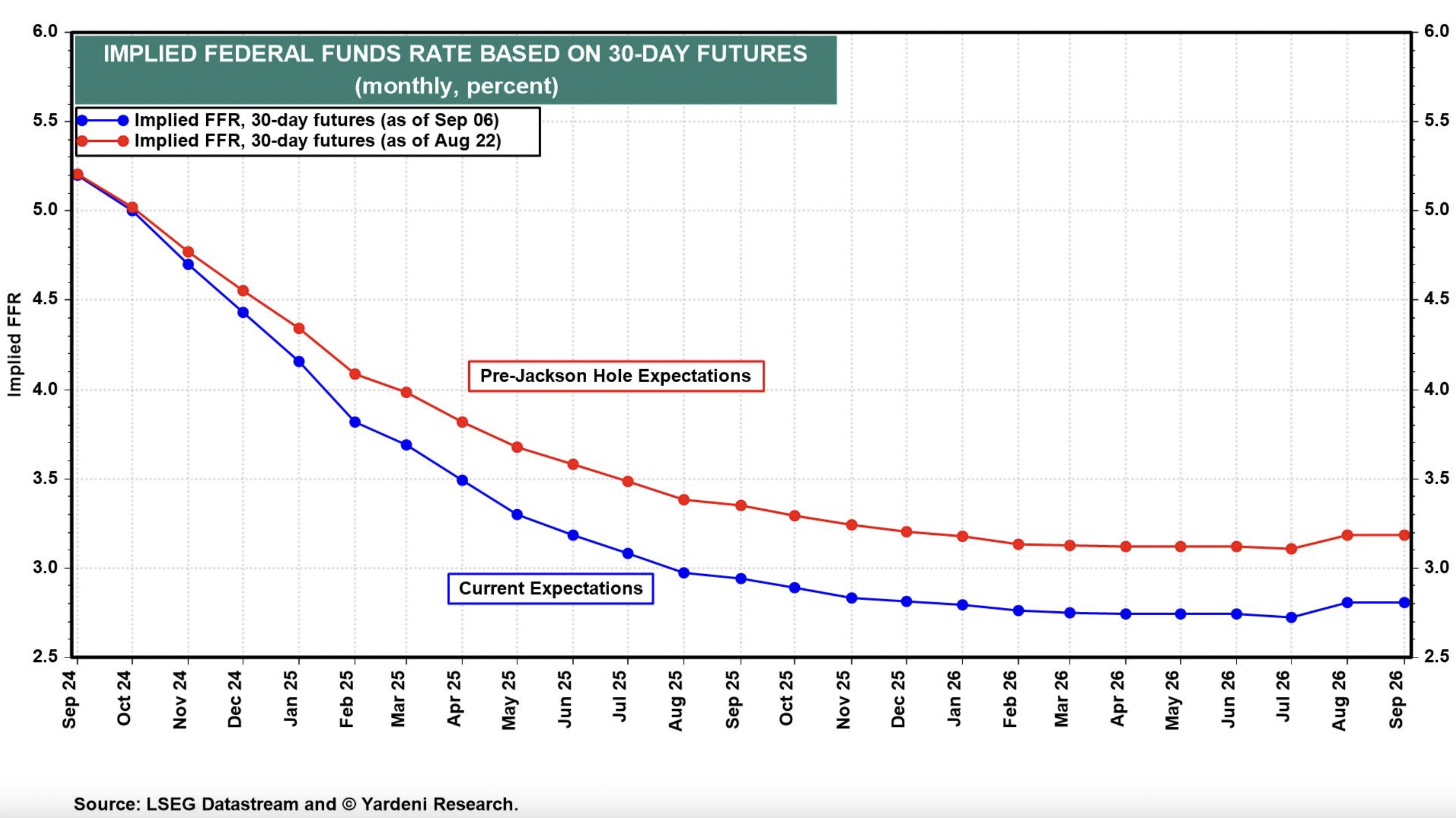

The market’s odds of a 25bps cut on September 18, when the latest FOMC Statement will be released, are now at 70%. The odds that the cut might be 50bps are 30% currently. That’s according to the CME Group’s FedWatch. Five of the last six rate cutting cycles began with 50bps rate cuts. (Hat tip to John Mauldin.) Rate cuts now are also widely expected following the November and December FOMC meetings.

2 - Markets expecting multiple cuts.

The federal funds rate (FFR) futures market is currently anticipating 25bps rate cuts in November and December.

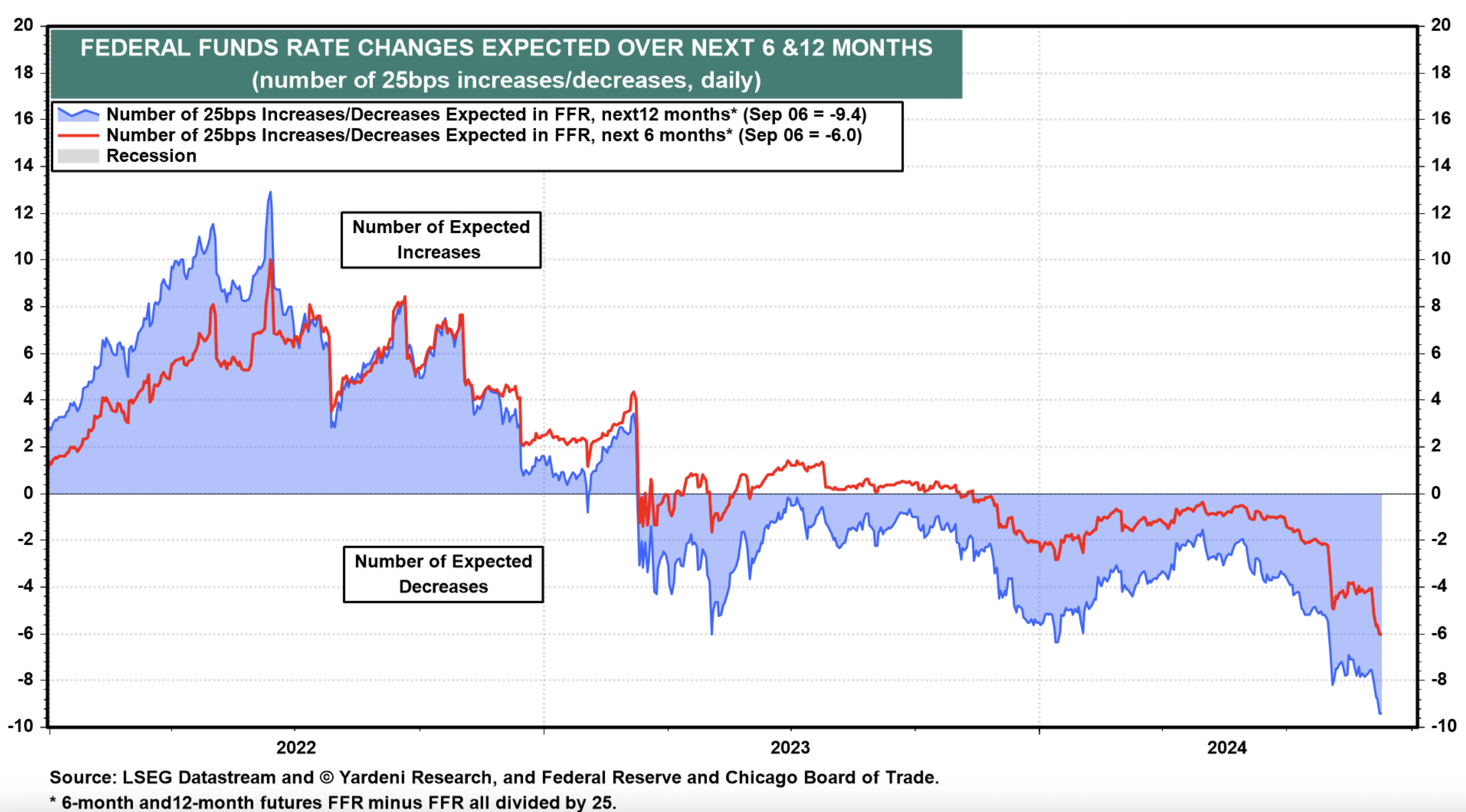

Six and nine 25bps cuts in the FFR are expected over the next six and 12 months. Those expectations suggest that the FFR will fall 150bps to 3.75% in six months and 225bps to 3.00% in 12 months. Of course, those expectations were heightened by Fed Chair Jerome Powell’s Jackson Hole speech on August 23, when he said: “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

3 - The Fed’s projections

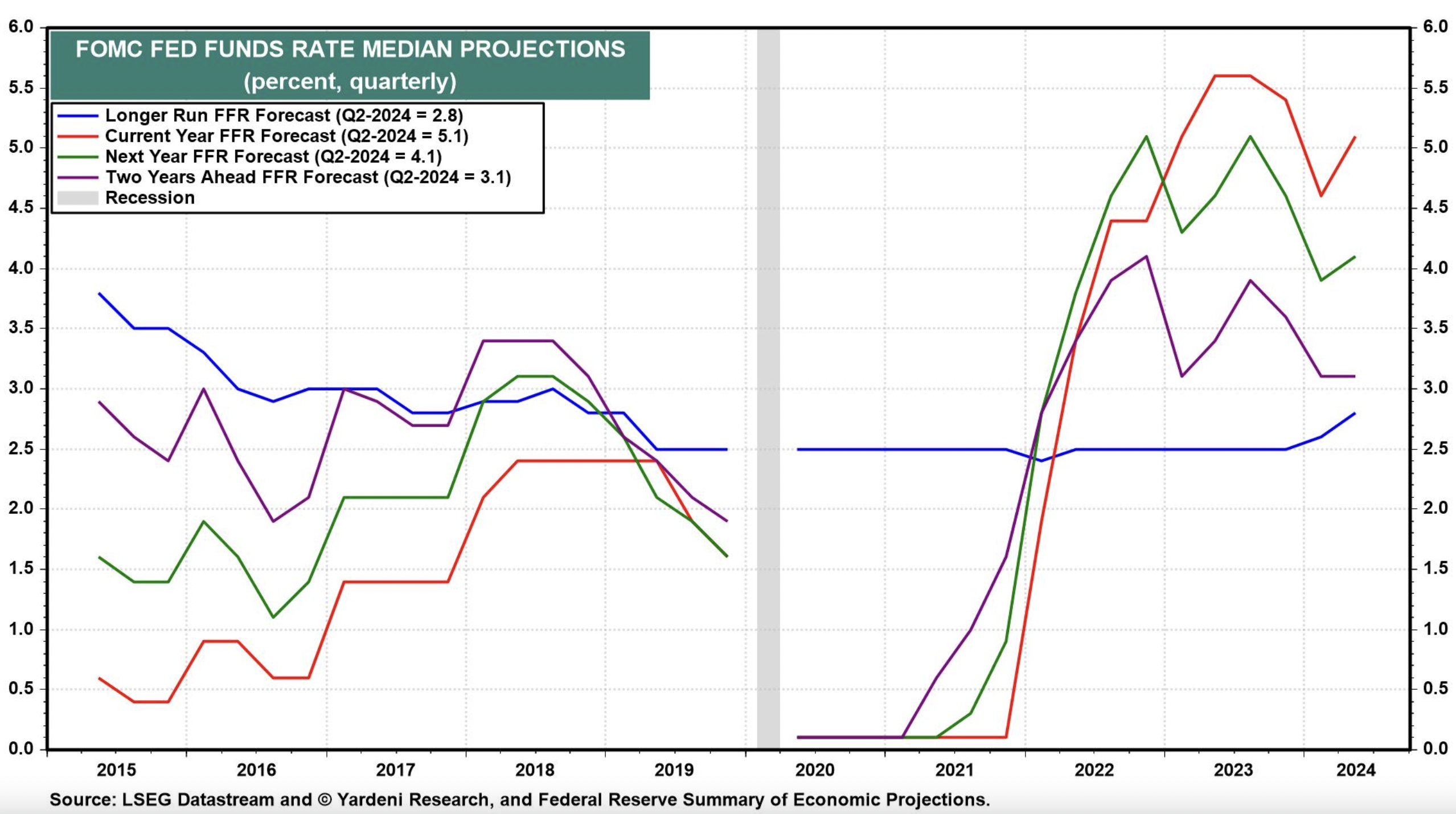

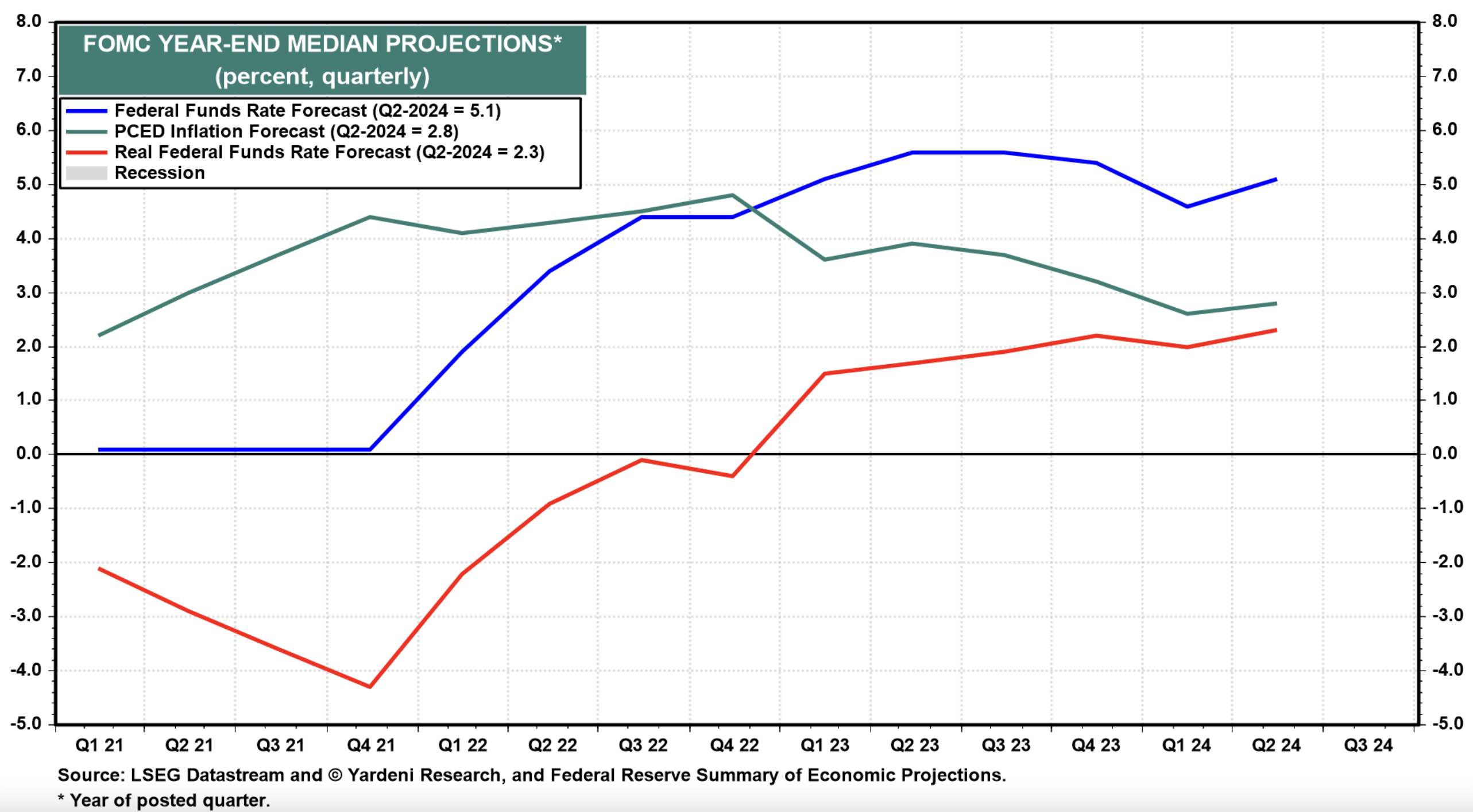

Every quarter, the FOMC releases the committee’s Summary of Economic Projections (SEP). The last one is dated June 12, and it showed the FFR at 5.1%, 4.1%, and 3.1% at year-ends 2024, 2025, and 2026.

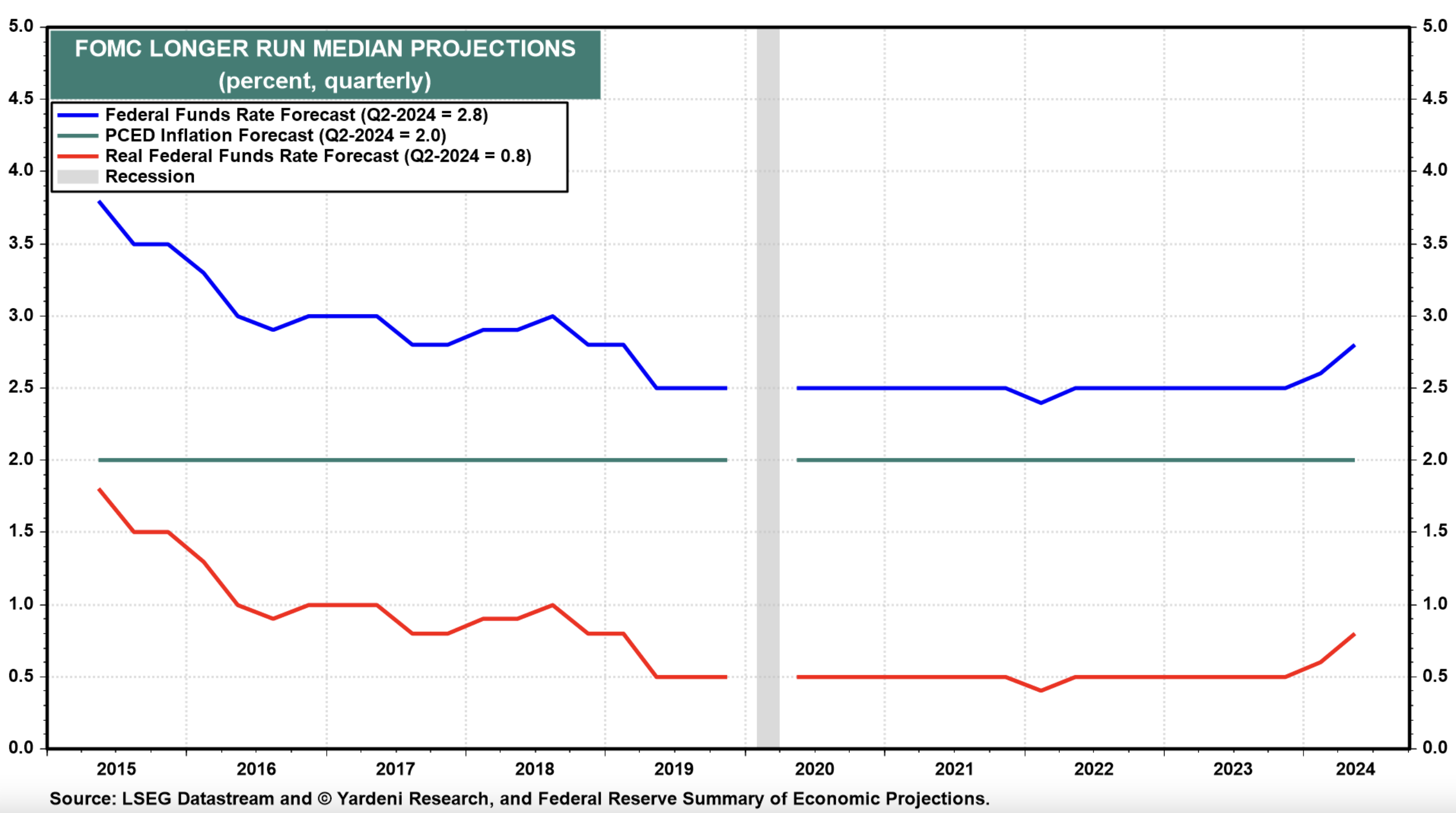

The so-called “longer-run” FFR was estimated to be 2.8%, up from 2.6% in March’s SEP.

Presumably, the longer-run FFR is the committee’s projection of the so-called neutral FFR.

So the FFR futures market is predicting that September’s SEP will show that the committee’s projections have been lowered. We agree, though perhaps not as much as currently suggested by the futures market. June’s SEP anticipated just one rate cut by the end of this year.

September’s SEP might show two or three rate cuts. It will be interesting to see whether and by how much FOMC participants lower their FFR projections for 2025 and 2026. Again, we doubt they will be as dovish as the market’s current projections. In addition, we won’t be surprised if they slightly raise their assessment of the long-run FFR given the resilience of the economy.

4 - Our assessment

What about our projections for the FFR? Our contrary instinct is that what’s happening now is no more than another growth scare that will pass. Once again, we expect that the economy will surprise to the upside. Our assessment of Friday’s employment report is that it wasn’t as bad as widely believed. Furthermore, some of the apparent weakness in employment suggests that productivity growth may continue to surprise to the upside.

5 - Don’t fight the Fed (!)

In any event, we learned early in our careers to respect the following adage: “Don’t fight the Fed.” Powell & Co. have clearly signaled that they are intent on lowering the FFR to avert a recession now that they’ve in effect declared “Mission Accomplished” on inflation—i.e., they’ve brought it down close enough to their 2.0% target that they are confident it will get there shortly on its own even if they start easing monetary policy to keep the jobless rate from rising.

Again, we aren’t convinced that the economy needs much help from the Fed to keep growing. However, we do agree that inflation will end up this year even closer to 2.0%, as we’ve been predicting since the summer of 2022. So an easier-than-necessary monetary policy may very well boost real economic growth. We expect that might come from faster productivity growth, rather than employment growth.

As for inflation, we will worry about it much more if either the Democrats or the Republicans sweep the November 5 elections.