Hellenic Petroleum (AT:HEPr), a leading oil refiner in Greece, reported Q321 EBITDA of €125m, up 90% from Q320 (€66m), with improved performance across all segments. We expect it to continue to benefit from favourable refining margins and higher demand for transport fuels in the coming months due to increased economic activity. However, this should be partially offset by higher operating costs due to sharply rising energy prices.

Improvement in refining environment

The strong Q321 performance was driven by a significant increase in benchmark margins ($3.3/bbl versus -$0.8/bbl in Q320), higher fuel demand and operational improvements. However, at the profit level it was partially offset by high carbon costs and exceptionally high energy costs. As natural gas and electricity prices have been higher than expected and remain so, we have updated our assumptions, which translates into a 15% reduction in our FY21 EBITDA estimate (-32% in refining). With the realisation of Vision 2025, this could be mitigated by electricity generation from renewables.

Restructuring is ongoing

Hellenic is progressing with the demerger of its refining, supply, trading and petrochemical businesses, subject to final approval by shareholders at its general meeting in December. The resultant new company structure will support the growth of its clean energy activities via appropriate financing and increase Hellenic’s value transparency. Meanwhile, the company confirmed the planned start of a 204MW photovoltaic park in Kozani in Q122 and has an additional c 700MW in its renewable energy sources portfolio at an advanced permitting stage.

Sale of DEPA may boost dividend in 2022

Hellenic expects the sale of DEPA Infrastructure (in which Hellenic owns a 35% share) to be completed in H122, subject to regulatory approvals. Management indicated that it plans to return 50% of the proceeds to shareholders in FY22, equating to c €128m or €0.42 per share. This is in addition to the annual dividend, which the company expects to be higher than in 2021 (€0.10).

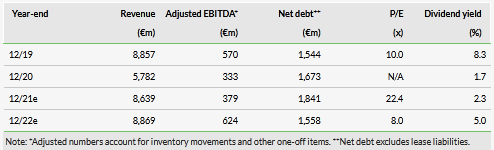

Valuation: Blended valuation of €6.91/share

Our valuation is based on the company's current state, and is derived from a blend of DCF, EV/EBITDA and P/E. Hellenic is trading at a premium to European peers (6.6x FY22e EV/EBITDA versus 5.0x and 8.2x FY22e P/E versus 7.3x). Our valuation increases to €6.91/share from €6.80/share, reflecting higher peer group multiples, while our DCF valuation is unchanged at €7.41/share.

Share price performance

Business description

Hellenic Petroleum operates three refineries in Greece with a total capacity of 344kbod. It has sizeable marketing (domestic and international) and petrochemicals divisions.

Click on the PDF below to read the full report: