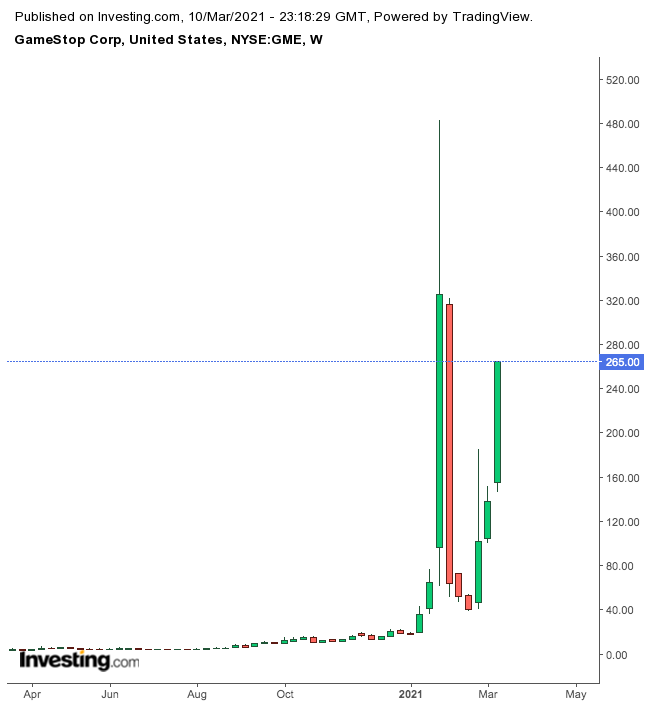

GameStop (NYSE:GME), the video game retailer favored by Reddit 'rebels,' is back in play. Shares of the unprofitable brick-and-mortar electronics vendor have gained more than 147% in the past five trading days.

The rebound comes after a spectacular plunge in the stock's value when it fell from $483 in January to less than $40 in late February. Unlike the previous boom, which was spurred by a battle between Reddit-inspired investors and the hedge fund managers who were short on the stock, this time, GME lovers see a great turnaround story unfolding.

The current rally in GameStop shares accelerated after the Texas-based company said this week that it had picked Chewy (NYSE:CHWY) founder and activist investor Ryan Cohen to lead its e-commerce push.

While forming a strategic planning and capital allocation committee, headed by Cohen, GameStop said the new setup will identify actions that can transform the company into a technology business and help create enduring value for stockholders.

This announcement has hardly changed the market perception that the GameStop mania is purely speculative, fuelled by social media channels, and doesn't justify the company’s $22-billion market valuation.

While this debate is unlikely to abate as long as GameStop remains the darling of speculative investors, it’s also important to analyze the chances of a potential turnaround that Cohen could bring to this troubled company. His track record as an e-commerce entrepreneur is impressive and deserves investors’ attention.

E-Commerce Transformation Plan

Cohen established the online pet supply retailer Chewy in 2011. His leadership was a key force in helping the upstart successfully compete against Amazon (NASDAQ:AMZN) and Walmart (NYSE:WMT). Six years later, after helping Chewy reach more than $1 billion in annual sales and win a leading share of the online pet space, Cohen sold the company to PetSmart Inc., for $3.35 billion. A couple of years after that, Chewy went public and is now worth about $38 billion.

Will Cohen be able to use the same playbook for GameStop is anybody’s guess at this point, but his game plan for the company’s turnaround is impressive.

In a letter to the board in November, Cohen emphasized that GameStop needs to evolve into a technology company that “delights gamers and delivers exceptional digital experiences,” in order to transform from a retailer that over prioritizes its brick-and-mortar footprint and stumbles around the online ecosystem. He is recommending slimming the company's brick-and-mortar presence, selling overseas operations and building out GameStop’s e-commerce capabilities.

Since November, Cohen has been successful in bringing about some structural changes that could put GameStop on a growth path. Last month, the company announced a few new hires that resonate with his strategy.

Matt Francis, previously an engineering leader at Amazon Web Services, was appointed as the company’s chief technology officer; Kelli Durkin, a former Chewy executive, was brought in as senior vice president of customer care; and Josh Krueger, who had prior senior roles at Amazon and Walmart, as vice president of fulfillment. In addition, the company is looking for a new chief financial officer who has a technology background.

With the gaming industry market expected to reach $217.9 billion by 2023, there are sufficient growth opportunities available. If Cohen succeeds in his restructuring plan, GameStop could get a slice of that.

Bottom Line

Our growth investing approach doesn’t recommend that readers buy speculative stocks such as GameStop. But the active involvement of a successful technology entrepreneur indicates that the company is serious about restructuring its business. At some point, GameStop could begin producing growth.

Wall Street, however, doesn’t see that outcome yet. The majority of analysts are continuing to rate GameStop as a 'sell.'