Gold prices have stabilized near $1934.00 per Troy ounce, showing signs of weakness in recent times.

In the past week, gold experienced a 2.1% decline, with Friday witnessing the precious metal's fastest price drop in the last four months.

One major risk for XAU/USD (the symbol representing the gold price in relation to the US dollar) is the possibility of another interest rate hike by the Federal Reserve System. Last week, Fed Chair Jerome Powell did not rule out such a chance.

The concern lies in the fact that higher interest rates increase expenses for investors holding gold. As gold itself does not generate guaranteed income, it becomes less attractive amidst monetary turbulence, potentially leading to a drop in prices.

Furthermore, the physical demand for gold appears limited this year, depriving the precious metal of fundamental support.

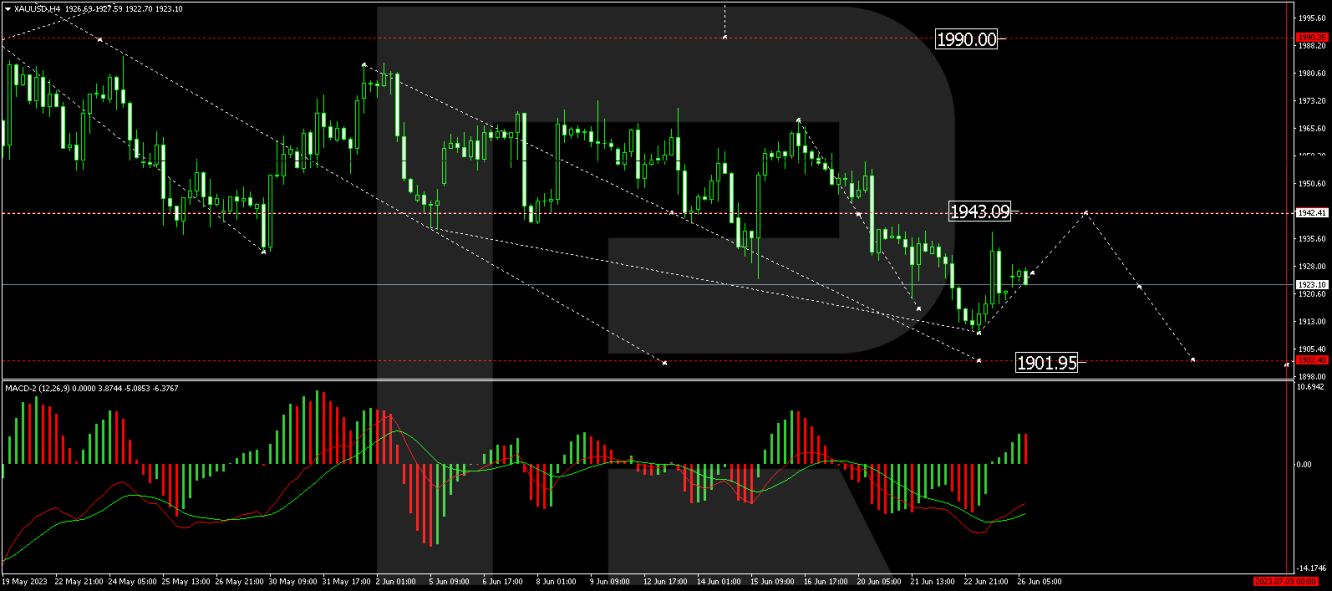

Technical analysis reveals that XAU/USD has formed a wide consolidation range around 1934.00 on the H4 timeframe. Breaking out of this range downwards, it completed a decline structure to 1910.00. A correction to 1943.00 (a test from below) could potentially occur today. Once this correction concludes, a new wave of decline to 1902.00 might follow. This technical scenario finds confirmation from the MACD indicator, as its signal line is below zero and steadily moving upwards.

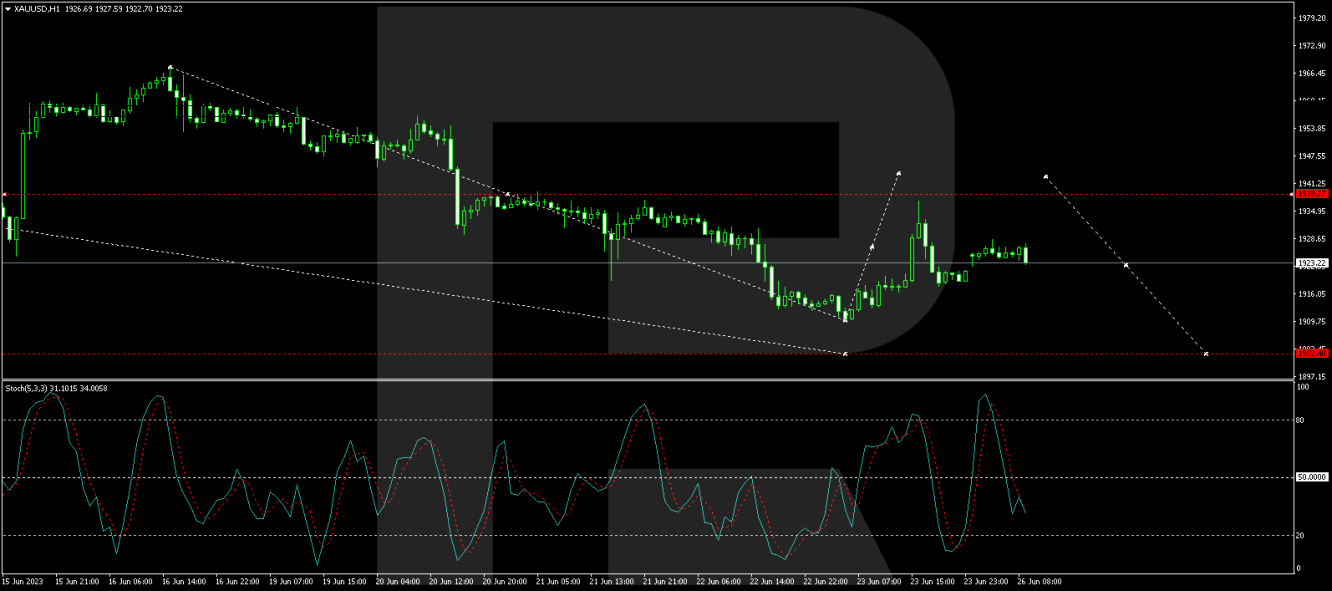

On the H1 timeframe, XAU/USD has displayed a declining wave structure, reaching 1910.00. A correction to 1943.00 could develop today, with the price currently rising to 1937.00 and completing a link of decline to 1918.00. A rise to 1943.00 (a test from below) is expected, potentially marking the end of the correction. Subsequently, a decline to 1902.00 might follow. The Stochastic oscillator lends support to this technical scenario, as its signal line is near 50 and steadily moving upwards, with a rise to 80 appearing possible.

In summary, gold's weakness persists as it hovers around the $1934.00 level, facing multiple challenges. The potential for interest rate hikes by the Federal Reserve System and limited physical demand for gold contribute to the uncertainty surrounding its future prices. From a technical perspective, various indicators and patterns suggest the possibility of both corrective rallies and further downward movements, emphasizing the importance of closely monitoring key levels and trend developments.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold's Fragile Outlook Interest Rates and Limited Demand Cast Shadows

Published 26/06/2023, 11:56

Gold's Fragile Outlook Interest Rates and Limited Demand Cast Shadows

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.