For the first time in history, the price of a fine ounce of gold broke through the 3,000-dollar barrier, reaching a new all-time high. On Friday, the precious metal continued to rise, and at the London Stock Exchange (LON:LSEG), a troy ounce (about 31.1 grams) traded at $3001.20 – higher than ever before. The yellow metal, however, saw a decline on Monday and was trading at slightly less than $3000 at the time of writing.

Reasons for this are geopolitical tensions and the escalating trade conflict, which are significantly increasing interest in gold as a safe haven investment. Experts see the rise as being due, among other things, to the uncertainties caused by US President Donald Trump’s tariff policy.

Is Gold a Good Investment Now?

Should you avoid the stock market now and invest in gold instead? If we compare the strongest and broadest index in the US, the S&P 500, with gold, it is noticeable that gold has outperformed the strong US stock market in recent years from 2022 to the present:

Can the Gold Price Hold Above $3000?

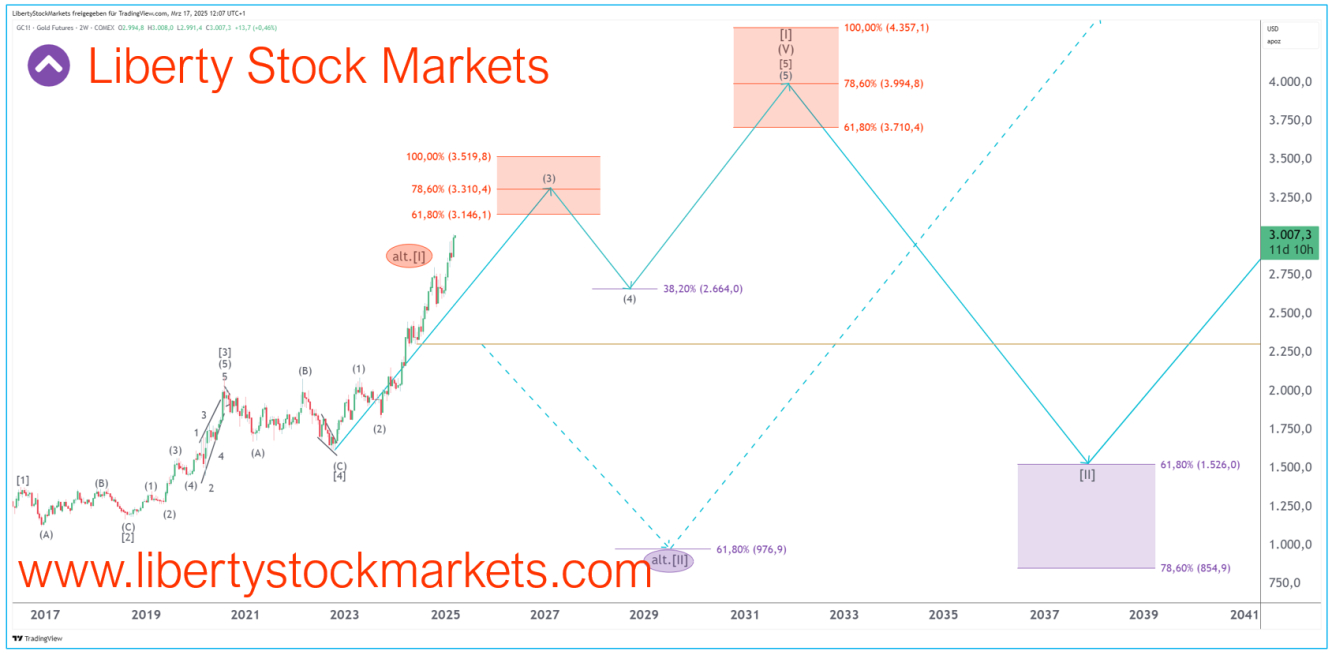

We believe that not only will the gold price hold above $3000 but that it will even rise to around $4000 or higher:

But that’s not to say that gold is a better investment. Gold, as we see on the chart above, will make a very prominent top and then go into a massive correction. At the end of that correction, we could be left with prices of $1500 or even less on the chart. In the short to medium term, gold can be a good alternative or a good addition to an equity portfolio, but in the long term, gold will lose a lot of its value.

We are seeing some distortions in the stock market, but we see this as a clear opportunity.

Factors Favouring Rising Gold Price

Over the course of the week, the gold price has gained significant momentum. Since Monday, the value of the precious metal has increased by more than $80 per ounce. Demand for safe havens remains high as there is still no visible progress in efforts to achieve a ceasefire in the war in Ukraine and new conflicts are looming on the horizon. And today, the price increase could continue in the same vein.

Another major factor behind the price increase is concern about the impact of the aggressive trade policy of the new US administration. Since Donald Trump took office in January, the price of gold has risen by more than ten per cent. Repeated announcements and withdrawals of tariffs by the US government have unsettled the markets. Most recently, Trump threatened the European Union with tariffs of 200 per cent on wine, champagne and other alcoholic beverages.

According to analysts at the investment bank IG Asia, reciprocal tariff measures could cause further unrest in the financial markets in the coming months. Gold therefore remains ‘an attractive safe haven investment option in an environment with limited alternatives’, provided one believes that gold will rise more sharply than the stock market.

Right now, it’s extremely important to know exactly which way the market is moving. Perhaps the sell-off is a great opportunity.

Disclaimer/Risk warning:

The information provided here is for informational purposes only and does not constitute a recommendation to buy or sell. It should not be understood as an explicit or implicit assurance of a particular price development of the financial instruments mentioned or as a call to action. The purchase of securities involves risks that may lead to the total loss of the capital invested. The information provided does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either explicitly or implicitly, for the timeliness, accuracy, appropriateness or completeness of the information provided, nor for any financial losses. These are expressly not financial analyses, but journalistic texts. Readers who make investment decisions or carry out transactions based on the information provided here do so entirely at their own risk. The authors may hold securities of the companies/securities/shares discussed at the time of publication and therefore a conflict of interest may exist.