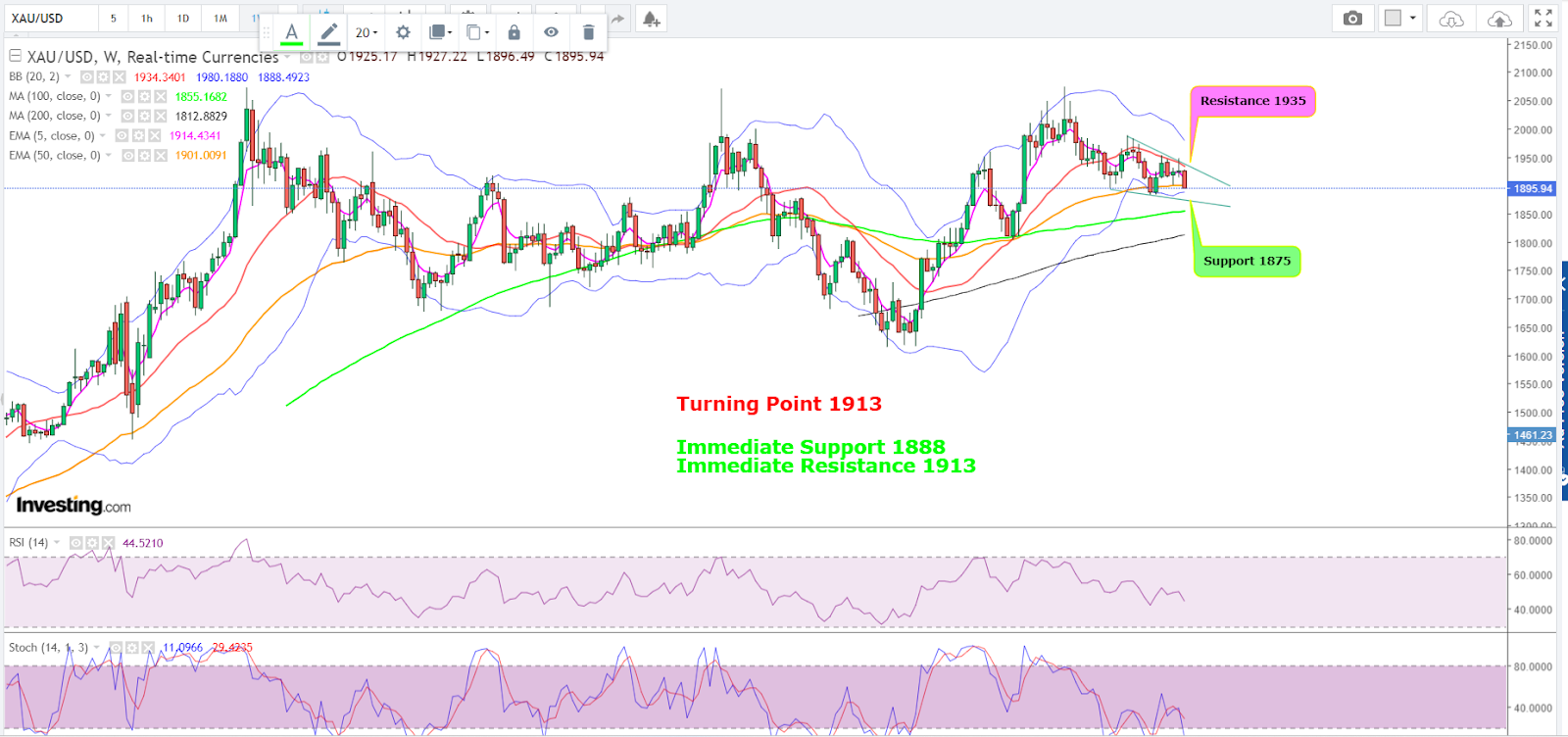

- Spot gold’s immediate support seen at $1,888 on dollar, yields weight

- Bullion could fall to $1,875 or $1,858 without recovery in near term

- Dollar Index could hit hard wall at 107.18, providing some relief to gold

A partial U.S. government shutdown seems to be looming and global economic ructions are being heard again, but gold isn’t catching the usual safe-haven bid because ‘King Dollar’ isn’t allowing it.

Since returning to $1,900 an ounce on Aug 21, the spot price of gold, which is more closely followed than futures by some traders, reached a one-month high of $1,953 on Sept 1, clinging to that support.

At the time of writing, though, that adventure may be over, with bullion, or XAU, hovering at just below $1,900 after dipping beneath that support on the previous occasion.

Whether gold gets to go back to where it was — or sink further to the lows of mid $1,800 or below — will depend largely on what the dollar does.

Context

Spot gold hit a session low of $1,896.61 at the time of writing, as the resurgent dollar and Treasury yields brought their full weight to bear on bullion.

“A move below $1,900 could be a very bearish move, at which point the August lows would be very interesting not too far away,” said Craig Erlam, analyst at online trading platform OANDA. “Of course, we could simply see further consolidation and we have seen some support today around $1,900 but it's certainly looking vulnerable.”

Spot gold fell to as low as $1,884.35 in August.

Yields, benchmarked to the U.S. 10-year note, shot to fresh 16-year highs on Tuesday, reaching peaks not seen since July 2007. Meanwhile, the Dollar Index got to highs not visited since November 2022.

The two alternatives to gold surged since the Federal Reserve last week projected another quarter-percentage point rate increase by the year-end, despite leaving rates unchanged for September at a policy meeting on Wednesday.

Fed Chair Powell told a news conference last week that energy-driven inflation was one of the central bank’s bigger concerns.

“We are prepared to raise rates further, if appropriate," Powell said. "The fact that we decided to maintain the policy rate at this meeting doesn't mean we have decided that we have or have not at this time reached that stance of monetary policy that we are seeking."

The Fed had raised interest rates 11 times between February 2022 and July 2023, adding a total of 5.25 percentage points to a prior base rate of just 0.25%.

Economists fear that the Fed’s renewed hawkish stance will dampen global growth though many also agree that a lid has to be put on oil prices if the Fed is to achieve its annual inflation target of 2%.

Where Is the Dollar Going?

Charts by SKCharting.com with data powered by Investing.com

Futures of the Dollar Index, or DXY, have maintained their robust uptrend to cross above the May high of 104.70 without any significant resistance. In fact, it has continued to advance, crossing smoothly well above 38.2% Fibonacci level of 105.39 to reach 106.10 That has propelled it to highs last seen in November 2022.

But charts suggest the 107 level could be the first real hard wall for the dollar.

“As long as the Dollar Index maintains strength and stability above the Fibonacci level of 105.39, the path remains open for it to reach its next overhead resistance 107.18, which is a 50% Fibonacci level,” said Dixit of SKCharting. “This is expected to be the most formidable resistance for DXY in a while.”

But he also says there could be some volatile swings as the uptrend had left the rally substantially vertical and open for heightened fluctuations.

“The 50% Fibonacci level is the first and important gateway to resumption of yet another bull run in DXY as this zone is strongly established by consistency in price action.

This zone is often seen to act as a coordinate which has potential to either strengthen the continuation of trend or flip the trend altogether.”

Gold: Lower Lows and Lower Highs From Here?

Spot gold’s correctional wave, extended to below the 50-week Exponential Moving Average, or EMA, of $1,901 and reaching $1,896, places next immediate support at $1,888, said Dixit.

He added:

“A break below $1,888 can extend the decline to the descending wedge support line of $1,875. Major downside target remains the Monthly Middle Bollinger Band $1,858.”

In the event of a flip, gold could go no higher than $1,940 in the near term, Dixit said.

“Immediate resistance is seen at the $1,909-$1913 which can act as a turning point.

Strength above the zone can extend recovery towards the $1,929-$1,935 resistance zone.”

***

Disclaimer: The aim of this article is purely to inform and does not in any way represent an inducement or recommendation to buy or sell any commodity or its related securities. The author Barani Krishnan does not hold a position in the commodities and securities he writes about. He typically uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables.