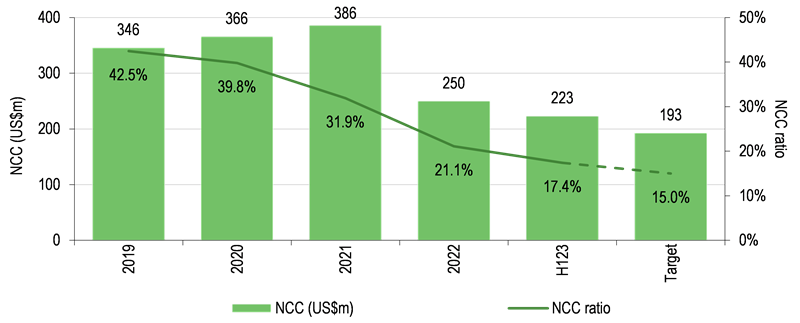

Georgia Capital (GCAP) delivered positive newsflow during August, including the successful pricing of its new sustainability-linked bond (with proceeds used to redeem the 2024 Eurobond), as well as its Q223 results release, with a robust 8.2% NAV total return (TR) in GEL terms posted during the quarter. We believe that the successful bond refinancing, coupled with continued deleveraging at holding level (net capital commitment ratio of 17.4% at end-June 2023) further reduces GCAP’s risk profile. Despite the above, GCAP’s shares are still trading at a relatively wide c 58% discount to its ‘live’ NAV estimate.

GCAP made further progress on its deleveraging agenda in H123

Georgian economy remains strong

GCAP provides diversified exposure to Georgia, mostly through resilient, marketleading businesses in sectors such as healthcare, pharmacy, financials, renewable energy and education. The Georgian economy has proved its resilience throughout the COVID-19 pandemic and the war in Ukraine and maintains its solid momentum, with H123 GDP growth of 7.6% y-o-y (after 10.1% in 2022), assisted by a healthy combination of external demand, FX flows and local credit expansion. At the same time, inflation remains contained, standing below the 3% central bank target since April 2023. The International Monetary Fund forecasts 4.0% GDP growth in 2023 and 5.0% growth pa in 2024–28. Galt & Taggart and TBC Capital (local brokers) expect 2023 GDP growth of 6.8% and more than 7.2%, respectively.

A quality play on the local economy

We believe that GCAP’s value proposition is underpinned by the following drivers: 1) 26% of its end-June 2023 NAV is attributable to the listed Bank of Georgia, a highly profitable bank (H123 ROE at 31.3%) and one of the local leaders, now trading at a moderate 1.0x book; 2) 92% of its portfolio is valued externally, with most of its private holdings valued by a third-party specialist; and 3) GCAP receives a steady income stream from dividends and buybacks from its holdings, with management expecting GEL150–160m of regular distributions in 2023 (GEL205–215m including one-off distributions), implying a 4.5–4.8% yield on its end-June 2023 portfolio value (6.1–6.4% including one-off distributions).

NOT INTENDED FOR PERSONS IN THE EEA

Successful refinancing of the 2024 Eurobonds

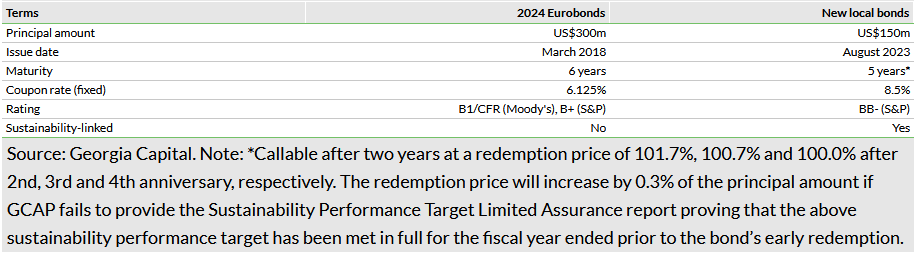

On 1 August 2023, GCAP announced that it has successfully priced a US$150m, five-year sustainability-linked bond in the Georgian market. GCAP highlighted that it was the largest ever corporate bond offering in the local market, and attracted significant interest from local investors. While high-profile international financial institutions (European Bank for Reconstruction and Development, Asian Infrastructure Investment Bank, Asian Development Bank and International Finance Corporation) committed to a US$110m investment in GCAP’s bonds, their tranche was scaled back to US$67m to allow local investors to acquire the remaining US$83m. It is also worth noting that holders of US$23m of the existing Eurobond transitioned their holdings to the new bond.

The bond bears a fixed coupon of 8.50% and was issued at par, which compares to a 6.125% fixed coupon for the previous bond (issued in March 2018). GCAP secured a quite attractive rate when compared to the local interest rates in Georgia (the current central bank refinancing rate is 10.25%), and the rate on GCAP’s bonds is also close to the US corporate high yield bonds (the effective yield of the ICE (NYSE:ICE) BofA High Yield Index at 1 August 2023 was 8.23%). Importantly, given the lower volume of the new bonds versus the US$300m Eurobonds, GCAP will reduce its overall interest expenses. The new bonds were rated ‘BB-’ by S&P, which represents a one-notch upgrade compared to the previous Eurobonds.

Key financial covenants embedded in the bond include: 1) net debt to total equity must be less than 45%; 2) payments such as dividends or capital stock redemptions will be restricted to 50% of end-2022 retained earnings and 50% of consolidated net profit thereafter; 3) interest coverage should be at least 100%; and 4) dividend payments and other distributions from material subsidiaries can be restricted only up to 50% of net profit of the material subsidiary. The sustainability-linked target embedded in the bond terms involves a 20% reduction in scope 1, 2 and 3 emissions versus the 2022 baseline of 22,829 tonnes of carbon dioxide equivalent by 2027 (scope 3 emissions represent aggregate scope 1 and 2 emissions of GCAP’s portfolio). This reduction will be an important milestone on GCAP’s agenda to become net zero in terms of carbon emissions by 2050.

New bond placement, dividend income and portfolio value growth support GCAP’s deleveraging agenda

The issue proceeds, together with GCAP’s liquidity already available before the bond placement, will allow the company to fully redeem its existing US$300m Eurobond (which was due to mature in March 2024). Following the pricing of the new bond, GCAP bought back Eurobonds with a principal amount of US$176.5m through a tender offer, which expired on 8 August 2023. The company intends to cancel these together with the US$106.9m bonds already held in treasury, leaving just US$16.6m outstanding (to be redeemed through a ‘Make Whole Call’ option in Q323).

At end-June 2023, GCAP’s NCC ratio reached 17.4% (see front-page chart), slightly down from 19.7% at end-March 2023 and lower than the 27.0% at end-June 2022. The Q223 improvement was driven by a solid dividend income and an increase in portfolio value. This means that GCAP is gradually approaching its NCC target (through the cycle) of below 15%. Once this is achieved, GCAP is likely to expand its buyback programme (in line with its capital management policy).

Following the full redemption of the previous Eurobonds, GCAP estimates its net debt balance will be c US$110m (or c 8.6% of GCAP’s total portfolio value at end-June 2023) versus US$124.1m at end-June 2023. We believe that the bond refinancing meaningfully reduces GCAP’s risk profile, warranting a narrowing of the discount to NAV (currently 58% of its ‘live’ NAV estimate). Importantly, the bond is callable after two years, providing GCAP with the flexibility to pursue its recently reiterated target of reducing the holdinglevel balance of net debt and guarantees issued close to zero over the short-to-medium term. In this context, we note that GCAP’s put option on the remaining 20% stake in its water utility business granted by FCC Aqualia (see our January 2022 note for details) will be exercisable in 2025 or 2026 (the stake was valued at GEL159m at end-June 2023 using an option valuation method). GCAP plans to continue pursuing on-market buybacks as part of its deleveraging strategy, which will also enhance liquidity in the local bonds.

GCAP’s management expects GEL150–160m of recurring distributions in 2023

GCAP’s holding-level net debt reduction is also being assisted by continued solid income streams from GCAP’s portfolio holdings. It received GEL148m in H123, with Bank of Georgia’s (BoG’s) cash dividend and buyback ‘dividend’ being the major contributor (GEL114.4m), followed by the one-off dividend from the retail (pharmacy) business of GEL20.1m, as well as regular dividends from the P&C insurance (GEL8.4m) and renewable energy (GEL5.2m) businesses. Management expects FY23 recurring income to reach GEL150–160m, which together with additional one-off inflows should bring the full-year income to c GEL205–215m (or c US$62–65m). GCAP’s management remains confident in the dividend outlook beyond 2023, which across its private holdings should be particularly driven by the insurance, renewable energy and retail (pharmacy) businesses.

Further scope for deleveraging of some portfolio holdings

In terms of the deleveraging of its portfolio holdings, we note that the retail (pharmacy) and renewable energy businesses had adjusted net debt to EBITDA ratios of 1.7x and 7.1x at end-June 2023 (slightly above their over-the-cycle targets of up to 1.5x and up to 6.0x, respectively). The education business had a ratio of 1.0x (within its target of up to 2.5x), while hospitals had leverage of 4.1x, with clinics and diagnostics at 7.1x (above their targets of up to 2.5x). In terms of the maturity profile, we note that 12% and 35% of total gross debt across GCAP’s private portfolio companies matures in 2023 and 2024, respectively. The debt maturing in 2024 includes in particular GEL112m for the hospitals business (c 53% of total gross debt of the hospital business) and a US$35m bond issued by the housing development business. We note that the hospitals and clinics and diagnostics businesses have been affected by the return to normal, post-COVID-19 operations since Q122, but GCAP’s management highlighted that the revenues and earnings of these businesses started rebounding in Q223 (hospitals up 8.3% and 9.2% y-o-y, respectively, clinics and diagnostics up 18.7% and 38.1% y-o-y, respectively), suggesting a possible inflection point in performance.

Q223 NAV TR assisted primarily by Bank of Georgia

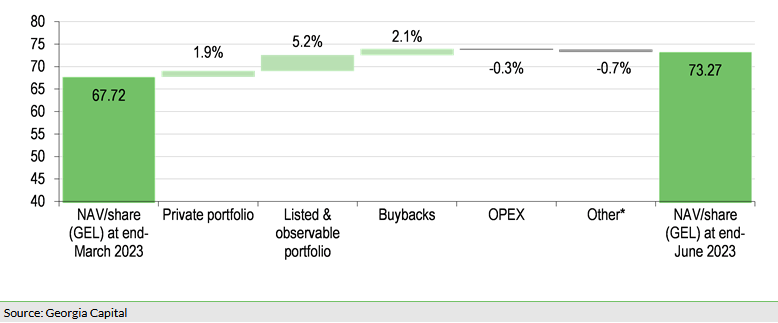

GCAP posted an 8.2% NAV TR in Q223 in Georgian lari terms (3.3% in sterling terms), mostly on the back of the continued share price appreciation of BoG, which, together with a minor revaluation of the minority stake in the water utility business, resulted in a 5.2% increase in GCAP’s NAV during the quarter (see Exhibit 2).

BoG’s share price was up c 6.4% in Q223 and appreciated further by c 17% since end-June 2023 on the back of its strong Q223 results published on 17 August. The company achieved a healthy annualised return on equity (ROE) of 34.6% during the quarter (bringing the H123 ROE to 31.3%), with a net interest margin of 6.6% (vs 5.3% in Q222) and an adjusted cost-income ratio of 26.9% (vs 32.5% in Q222). BoG also saw a solid increase in loan book of 7.6% during Q223 (or 6.4% on a constant currency basis) and in deposits of 7.3% (5.9% on a constant currency basis). The company booked cost of risk at 80bp (slightly up from 60bp in Q222), and its non-performing loan ratio stood at a moderate 2.4% at end-June 2023 (vs 2.6% at end-June 2022). Its CET-1 ratio and total capital ratio were 18.7% and 22.6% at end-June 2023, respectively (well above the regulatory requirements of 14.6% and 19.8%, respectively).

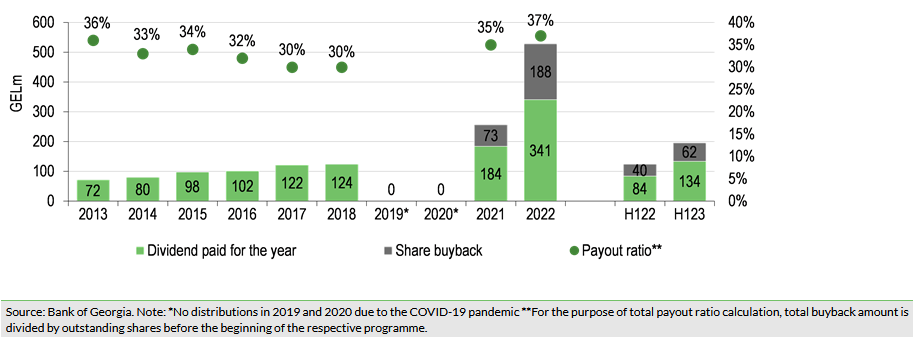

BoG continues to pursue its policy of distributions to shareholders, targeting a 30–50% dividend and share buyback payout ratio in the medium term. It paid a final dividend for 2022 of GEL5.80 and declared an interim dividend for H123 of GEL3.06 per share (or GEL134m), which on a last 12-month basis represents a c 8% dividend yield. On top of this, BoG spent GEL62m on share buybacks in H123, with a further GEL62m programme approved by the board (to be commenced later this year).

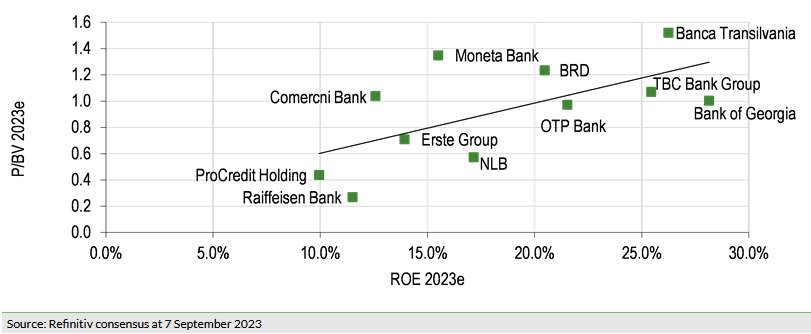

We note that, despite the recent share price rally, BoG’s market valuation does not look very demanding based on the Refinitiv FY23 consensus ROE (c 28% currently) and book value per share (now implying a P/BV of 1.0x) compared to local peers (see below).

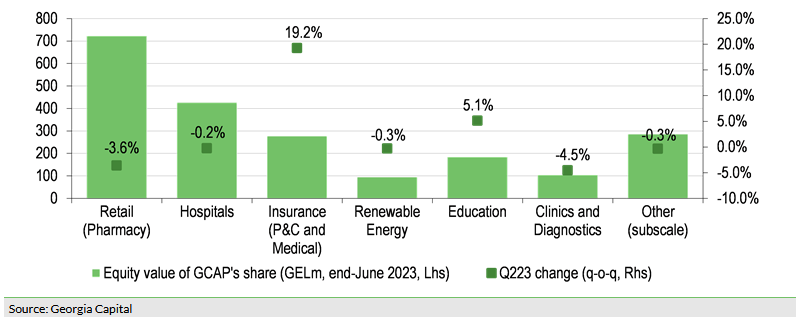

Within GCAP’s private holdings (whose revaluation raised GCAP’s NAV by 1.9% in Q223), the major positive contributor was the insurance business, consisting of P&C and medical insurance businesses and making up c 9% of GCAP’s end-June 2023 total portfolio value. The business was revalued by 19.2% in Q223, with revenue growth of 22.6% y-o-y assisted by a wide range of business lines, including motor, credit life, agricultural and border motor third-party liability. Despite a higher combined ratio in the P&C business (84.3% in Q223 versus 79.8% in Q222), the net income of the entire insurance business rose strongly by 28.0% y-o-y. The higher fair value also reflects a c GEL40m one-time positive effect from the introduction of the Estonian Taxation Model from January 2024, following which GCAP’s insurance businesses will no longer be subject to the corporate income tax payment (given that GCAP is a domestic legal entity).

GCAP’s education business also contributed positively, as it was revalued by 5.1% versus endMarch 2023 on the back of a continued strong operating performance, with revenues up by 27.5% yo-y in Q223 fuelled by a strong intake and utilisation ramp-up. EBITDA was up just 1.5% yoy due to the negative impact of the shift in academic days in the midscale schools, as well as a 44% yoy rise in operating expenses due to business expansion and cost inflation. Its valuation was assisted by a net debt decline to GEL13.4m at end-June 2023 from GEL17.9m at end-March 2023.

The above positive valuation effects were partly offset by a 3.6% reduction in the fair value of the retail (pharmacy) business based on higher net debt. The latter was due to a one-off dividend distribution to GCAP, as well as the buyout of the 20.6% minority stake concluded during the quarter (bringing GCAP’s total stake to 97.6%). The retail (pharmacy) business posted Q223 revenue and EBITDA growth of 5.3% and 11.7% y-o-y, respectively amid the expansion of pharmacy chain and franchise stores, but with the top line somewhat dampened by lower product prices (due to Georgian lari appreciation) and the implementation of the External Reference Pricing model (still, same store sales were up 2.8% y-o-y in Q223). GCAP’s NAV TR was further supported by its ongoing share buyback programme (translating into 2.1pp NAV accretion in Q223).

General disclaimer and copyright

This report has been commissioned by Georgia Capital and prepared and issued by Edison, in consideration of a fee payable by Georgia Capital. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2023 Edison Investment Research Limited (Edison).

Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS

United Kingdom