By Mobeen Tahir, Director, Research, WisdomTree

Last week, we introduced The 4 fundamental investment shifts triggered by the current geopolitical conflict. One of the shifts we highlighted was the need to recognise that geopolitical risks are always around the corner.

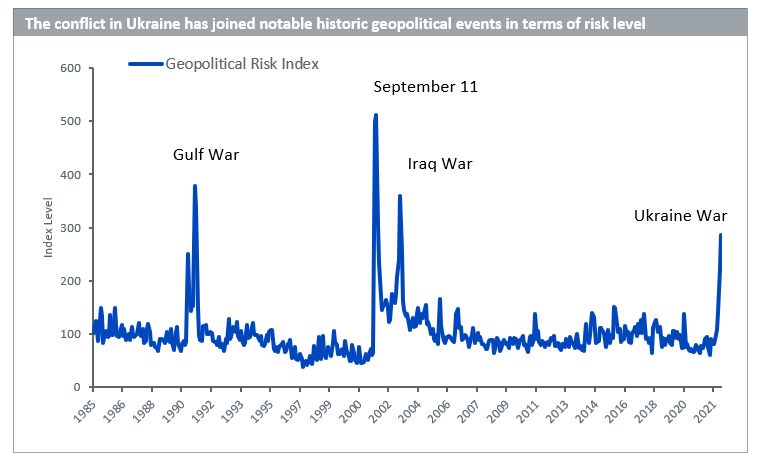

The chart below shows how the war in Ukraine has elevated geopolitical risks in the same vein as major crises in the recent past. It has even dwarfed the level of perceived geopolitical risk emanating from US-China trade wars.

Source: WisdomTree, policyuncertainty.com. Data as of 07 April 2022. Historical performance is not an indication of future performance and any investments may go down in value.

There are three things for investors to bear in mind when it comes to conceptualising geopolitical risks. First, the risks themselves are very hard to predict. You just don’t know what impending crisis might be brewing where. Second, it is even harder to know if and when apparent risks will manifest as full-blown geopolitical incidents. And third, it is impossible to foresee what the impact might be on markets.

Investors make their own assumptions with the information available to them, assign probabilities to certain outcomes, and make investment decisions accordingly. Market pricing, especially when it comes to geopolitical risks, is anything but efficient.

The conflict in Ukraine has resulted in inexplicable human suffering, without a doubt. But it has also created profound implications for the economy and markets. It has exposed fault lines in already fragile supply chains, created stagflationary risks for the global economy, and raised questions about energy and food security.

How are investors positioning themselves to defend against the adverse implications?

Focus is on gold once again

Geopolitical risks often catalyse demand for gold. There have been times in the past when gold has been subdued but then brought back to life following a geopolitical event. This is true for the run-up to the Gulf War and after the September 11 attacks.

Since the start of the Ukraine war, gold has benefited from strong demand both through speculative positioning on futures and physical demand through exchange-traded products. Gold has, in recent weeks held its ground well despite rising US Treasury yields and a strong dollar – both of which normally serve as headwinds for the yellow metal. It appears that gold’s haven demand is more than offsetting those headwinds.

In equities, investors are seeking quality

Like gold could sit in a portfolio ready to deliver downside protection when it is most needed, equity exposures can also be made more robust to withstand uncertainty. If a geopolitical risk blows up, it is perhaps already too late for investors to add protection. What investors need is an ‘all-weather’ exposure that can offer defensiveness in periods of turmoil without foregoing the upside potential when markets are booming.

Investors increasingly recognise quality as the factor that offers this desired balance. We define quality as companies with healthy financials, generating cash through strong business models. Profitable companies tend to be able to better withstand market volatility. Quality companies also tend to have high pricing power, i.e., market pullbacks don’t create as severe an impact on margins as you might expect. Moreover, these companies generally have lower debt levels, making them better prepared for environments where interest rates are on the rise – another dynamic we are seeing playing out right now.

The landscape shift

The shift in the investment landscape lies in the recognition that defensive exposures are not supposed to be added after something bad has already happened. Instead, they are meant to feature at all times to make portfolios more resilient and better prepared for adversity. You just don’t know when it might strike.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.