Today the data on the third quarter GDP and on the Index of Services for August are due in the UK. The latest data on labour productivity and retail sales from the UK suggests that the GDP figure for the third quarter may come out higher than forecasted by the Bank of England 0.6%.

At the same time, the US Fed starts its meeting today and publishes the Interest Rate Decision tomorrow. If the rate is not changed, the GBP/USD pair could continue its correctional growth until the end of the week.

Furthermore, the pair could receive additional support from preliminary third quarter GDP and Personal Consumption Expenditures data from the US that are due to come out lower than their previous figures.

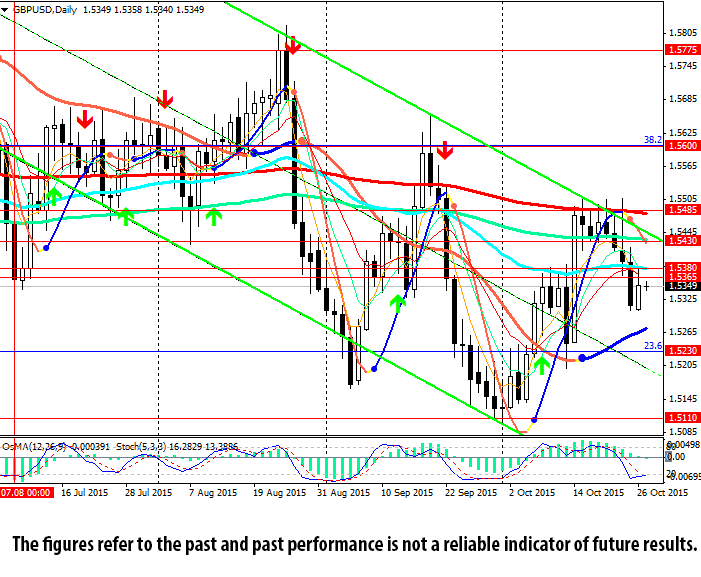

From the technical point of view, short positions are preferable.

On the daily chart, the pair is moving along a descending channel and is currently in its upper part. On all charts, the price remains below its ЕМА200 and ЕМА144.

The nearest resistance levels are at 1.5365 (ЕМА200, ЕМА144 on the 4-hour chart), 1.5380 (ЕМА50 on the daily chart), a breakout of which would send the pair towards 1.5430 (ЕМА144 on the daily chart, upper border the descending channel), 1.5485 (ЕМА200).

If the fall continues, the pair would head towards 1.5230 (23.6% Fibonacci correction), 1.5110 (month lows), 1.5000 (lower border of the channel).

OsMA and Stochastic on all charts from the hourly to monthly recommend short positions.

Support levels: 1.5300, 1.5230, 1.5110.

Resistance levels: 1.5365, 1.5380, 1.5430, 1.5485.