GBP/USD is showing limited movement on Tuesday, as the pair trades at the 1.5340 in the European session. Taking a look at economic releases, British Preliminary GDP posted a gain of 0.5%, compared to a forecast of 0.6%. In the US, we’ll get a look at two key releases later on Tuesday – Core Durable Goods Orders and CB Consumer Confidence.

British releases started off the news trading week on the wrong foot, as housing and manufacturing data slipped. BBA Mortgage Approvals dipped to 44.5 thousand, short of the forecast of 46.2 thousand. CBI Industrial Order Expectations slumped badly, with a reading of -18 points, its lowest level since July 2013. This points to weaker manufacturing growth due to less demand for British products both domestically and abroad. On Tuesday, Preliminary GDP in the third quarter posted a gain of 0.5%, shy of the estimate of 0.6%. This is certainly a cause for concern, as Final GDP in the second quarter posted a gain of 0.7%. Still, the British pound has not reacted negatively, as it has remains lethargic in Tuesday trading.

The US housing sector is sending mixed messages to the markets. Existing Housing Sales looked sharp last week, improving to 5.55 million, which was well above the estimate of 5.38 million. The news was much worse from New Home Sales on Monday, as the indicator slid to just 468 thousand, its lowest level in 10 months. The markets had expected a strong reading of 546 thousand. It promises to be a busy week, as the Federal Reserve issues a policy statement on Wednesday. Any hints about a rate hike could spark a dollar buying spree. Will the Fed finally provide some clarity about its monetary plans? Such transparency and lack of communication from the Fed has been lacking and has been a source of frustration for the markets, which continue to receive conflicting signals from Fed policymakers regarding the timing of a rate hike. On Thursday, the US releases a market-mover, Advance GDP for the fourth quarter. The markets are expecting a gain of 1.6%, compared to Final GDP in the third quarter of 3.9%,

GBP/USD Fundamentals

Tuesday (Oct. 27)

- 9:30 British Preliminary GDP. Estimate 0.6% . Actual 0.5%

- 9:30 British Index of Services. Estimate 1.0%. Actual 0.9%.

- 10:36 British 10-year Bond Auction. Actual 1.82%

- 12:30 US Core Durable Goods Orders. Estimate 0.0%

- 12:30 US Durable Goods Orders. Estimate -1.1%

- 13:00 US S&P/CS Composite-20 HPI. Estimate 5.1%

- 13:45 US Flash Services PMI. Estimate 55.3 points

- 14:00 US CB Consumer Confidence. Estimate 102.5 points

- 14:00 US Richmond Manufacturing Index. Estimate -3 points

Upcoming Events

Wednesday (Oct. 28)

- 18:00 FOMC Statement

- 18:00 Federal Funds Rate. Estimate

*Key releases are highlighted in bold

*All release times are GMT

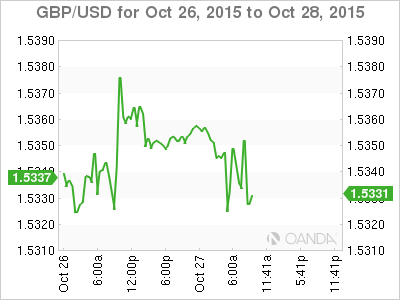

GBP/USD for Tuesday, October 27, 2015

GBP/USD October 27 at 11:15 GMT

GBP/USD 1.5344 H: 1.5358 L: 1.5304

GBP/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.5163 | 1.5269 | 1.5341 | 1.5485 | 1.5590 | 1.5660 |

- GBP/USD has shown limited movement in the Asian and European sessions, continuing the lack of movement we’ve seen since the start of the week.

- 1.5485 is strong resistance line.

- On the downside, 1.5341 was tested earlier in the day and remains under strong pressure.

- Current range: 1.5341 to 1.5485

Further levels in both directions:

- Below: 1.5341, 1.5269, 1.5163 and 1.5026

- Above: 1.5485, 1.5590 and 1.5660

OANDA’s Open Positions Ratio

GBP/USD ratio has shown gains in short positions since the European session on Monday. The ratio has a majority of short positions (55%) on Tuesday, pointing to trader bias towards GBP/USD moving lower.