GB Group (LON:GBGP) (GBG) confirmed that its Identity business continued to benefit from a number of exceptional volume drivers in H122, resulting in 12.4% y-o-y organic constant currency revenue growth and a 25.2% operating margin for the group. With management expectations for H222 unchanged, we upgrade our forecasts to incorporate these windfall revenues and slightly better growth in the Fraud and Location divisions.

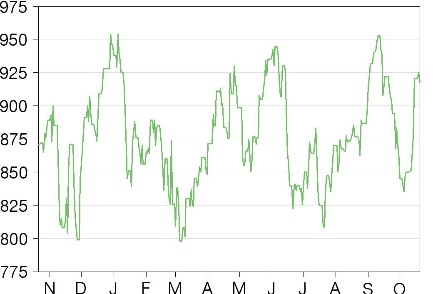

Share Price Performance

12% organic revenue growth in H122

GBG expects to report H122 revenue of £109m, up 5.3% y-o-y and up 12.4% on an organic constant currency basis after adjusting for the two businesses sold in H221. GBG confirmed that in H122 each of its three business units grew on a reported and organic constant currency basis. The Identity business saw the one-off project supporting the US financial stimulus continue for longer than expected, generating incremental revenue of £3m compared to £11m in H121. In addition, high volumes of cryptocurrency trading in April/May generated £4m in revenue over and above the normal run rate. The Location business continued to see good demand as consumers do more online. After a weak H121, the Fraud business saw a good recovery in demand from renewals, new contracts and the resumption of on-premise deployments. GBG expects to report adjusted operating profit of c £27.5m, equating to a margin of 25.2%, which is ahead of the more usual 22–23% range.

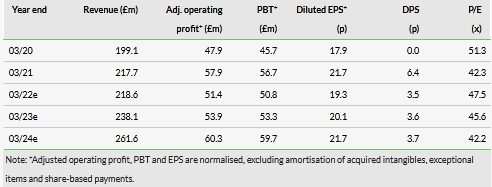

Upgrading estimates on better-than-expected H1

The board confirmed that the outlook for H222 is in line with its expectations. We have revised our forecasts to take account of the one-off boosts to Identity revenue in H1 and our expectation of slightly higher growth rates in Fraud and Location. We expect the operating margin to normalise from H222, through a combination of previously flagged new hires and the lack of one-off revenues in H222. We lift our normalised EPS forecasts by 9.3% in FY22, 2.3% in FY23 and 1.2% in FY24.

Valuation: Premium rating reflects growth potential

GBG trades at a premium to the UK software and IT services sectors and its global ID management peer group on a P/E basis, reflecting its strong growth outlook, high recurring revenues and strong balance sheet. Our reverse DCF analysis estimates that the share price is factoring in operating margins of 23.5% and revenue growth of c 11% pa from FY25, slightly ahead of our FY23/24 forecasts. Outside of faster than expected COVID-19 recovery, triggers for upside could include successful cross-selling, adoption of combined solutions and accretive acquisitions.

Click on the PDF below to read the full report: