GB Group (LON:GBGP) reported a strong performance in H122, with organic constant currency revenue growth of 12.6% y-o-y and an adjusted operating margin of 25.5%. The Acuant acquisition completed on 29 November and the group’s immediate focus is on combining the two companies and pushing forward with growth plans. Our forecasts are substantially unchanged.

Strong underlying organic growth in H122

In H122, GBG reported revenue growth of 5.4% y-o-y or 12.6% on an organic constant currency basis, with all divisions growing at a double-digit rate. Adjusting for exceptional revenue benefits from cryptocurrency trading and the US stimulus programme, GBG generated underlying revenue growth of 17.6%. The adjusted operating margin of 25.5% was ahead of the pre-Acuant target of 22–23% but is expected to decline to more normal levels in H222 as hiring accelerates and one-off revenues do not repeat. The company closed H122 with net cash of £39.5m. Our forecasts are substantially unchanged.

Focus shifts to integration of Acuant

The outlook for H222 is in line with board expectations and the focus now shifts to integrating the recently completed Acuant acquisition. The deal strengthens the group’s presence in the US, the largest identity verification market globally, and broadens GBG’s product range. The combined group is now in a better position to meet customer requirements for end-to-end solutions, providing a point of differentiation from high-profile, privately owned point solution providers.

Valuation: Not fully capturing growth potential

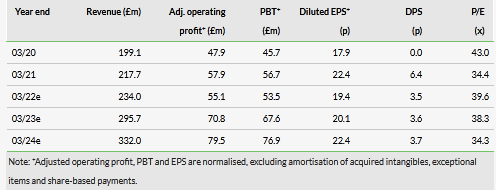

The stock has regained some ground since the 19 November placing at 725p. On our revised estimates, including Acuant from 1 December, GBG is trading at a premium to identity management (IDM) peers but at a discount to higher-growth, lower-profitability identity access management (IAM) and cybersecurity (CS) peers. However, our reverse DCF calculates that the share price is factoring in revenue growth of only 8.5% from FY25, well below the double-digit growth rate previously factored in by the market. Considering that Acuant is expected to grow faster than the original GBG, this appears overly conservative. Using a 12% growth rate (the lower end of new management guidance) from FY25 would imply a per share value of 950p.

Share price performance

Click on the PDF below to read the full report: