- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

FTSE100 Underperforms Again, But Record Highs Remain In Sight

It’s been a perennial question for UK investors over the last 20 or so years. Is the FTSE100 fit for purpose, when you consider it is one of the few global indices that hasn’t made a new record high in the last two years.

There was progress of sorts back in 2015 when it finally cracked its previous record high of 6,950 set at the end of the 1990’s. Since then, it’s been a tale of incremental new highs, with the most recent record set back in May 2018 at 7,903.50.

Since then, we’ve tried several times to move back to those peaks, with the most recent peak set back in January 2020 at 7,689, before in March 2020 we collapsed down to the 4,899 level on 16th March 2020, as it became apparent that governments were going to have to hit the stop button on the global economy, as the coronavirus pandemic swept across the globe.

The FTSE100 quickly recovered back to 6,500, before slipping back towards 5,500 in October 2020, and has spent the last 12 months slowly clawing back its way back to its current levels, still well short of the record highs set back in 2018.

Contrast that to the performance of other global benchmarks, and even the FTSE250, which has managed to set new record highs on a regular basis, and it’s a dismal performance.

So why the underperformance?

Well, there are several mitigating factors, but it still begs the question as to why the UK persists in having an index that diverges so much from every other global index.

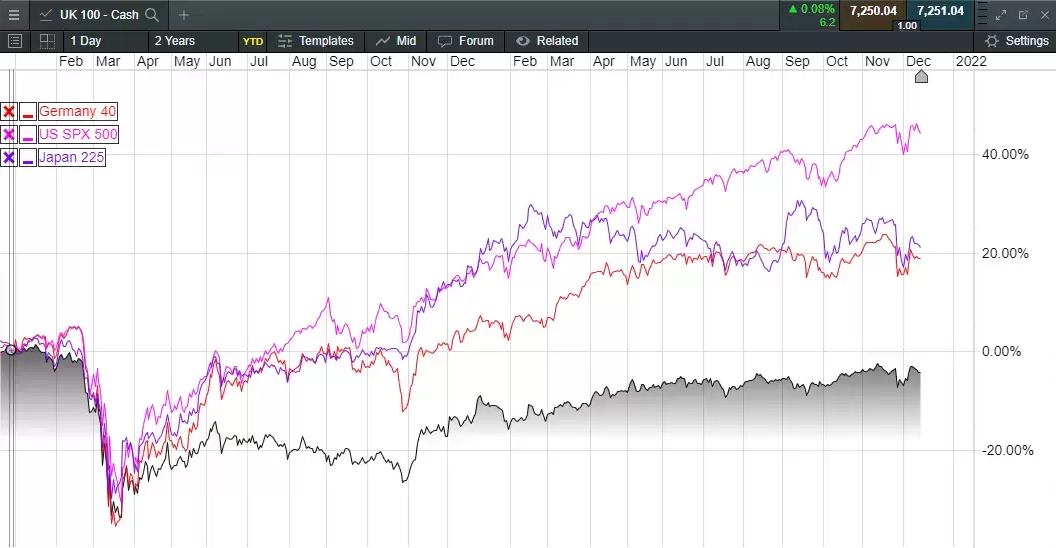

FTSE100 underperformance since 2019

Source: CMC Markets

As can be seen from the chart above the FTSE100 has only just about recovered to levels last seen at the beginning of 2019, in contrast to its peers of the DAX, S&P500, and Japanese Nikkei 225, with the S&P500 almost going parabolic.

There are several reasons for this underperformance and while some commentators would pin the blame on the 2016 Brexit vote and subsequent departure of the European Union for the lacklustre performance, they omit to explain why the FTSE250 hasn’t been affected in a similar way.

The reality is the FTSE100 has underperformed for years and while the pandemic hasn’t helped it, its composition hasn’t necessarily helped it.

When looking at different markets it’s important to understand that we aren’t always comparing like with like.

Starting with the S&P 500, we’ve seen a huge number of US companies buy back their own shares in response to various tax changes brought about by the Trump administration, which in turn boosted their valuations. This has been a consistent theme among US companies since 2016, while the German DAX is a total return index, which includes dividend reinvestment.

If we looked at the FTSE100 as a total return index like the DAX we would also be at record highs, moving above the peaks that we saw at the end of 2019.

To finish off the comparison, the Japanese Nikkei 225 has continued to be helped by large-scale ETF buying by the Bank of Japan, which has helped boost this index to its highest levels in over 30 years, and with a new Japanese government set to implement a new fiscal stimulus plan we could see the Nikkei 225 move and hold above the 30,000 level for the first time since 1990.

When the FTSE 100 is looked at through this prism, it is then less surprising that the index has underperformed and that theme has continued through this year, as we’ve move back above the 7,200 level as we look to close back in on the pre-pandemic peaks from 2020.

With vaccines and booster shots keeping the global economy ticking over, we’re now starting to see some of the side effects of the global shutdown from 2020.

It turns out that when you switch everything off all at once it’s not as easy to switch it all back on again, especially when governments around the world opened their wallets with large scale fiscal support for consumers to encourage them to observe the various Covid-19 restrictions.

We now have a situation where demand for goods is outstripping supply, at the same time as trying to transition to a different economic model, more attuned to renewables and cleaner energy This is not as easy as perhaps some in the green lobby would have you believe and is not without costs.

You can’t just transition to renewables at the flick of a switch, especially given the complexity of global supply chains, which rely heavily on fossil fuels for “just in time” delivery.

The big question now is what happens next, and that’s a harder question to answer, given the complexities outlined above, however the trend remains positive for broader markets even though there are huge areas of frothiness in some parts of the market, particularly in the US.

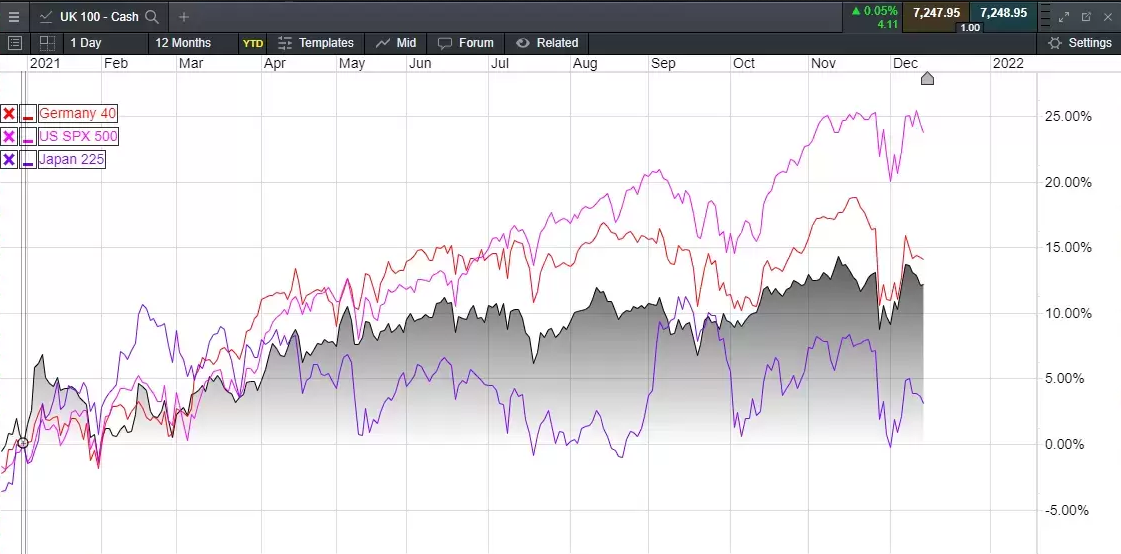

2021 Market performance year to date

Source: CMC Markets

It’s notable that once again the S&P 500 has managed to outperform, hitting new record highs almost every month this year, while the Nikkei has underperformed, despite hitting 30-year highs back in September.

The response of the US Federal Reserve has continued to aid the rally in US markets, with the slow removal of various monetary policy interventions. In the aftermath of the economic lockdowns the central bank rolled out various lending programmes, along with the purchase of so-called “fallen angels” corporate debt which acted as a type of put against the bankruptcy of several large US companies, which it is now slowly beginning to unwind.

It is also interesting to note how different the pace of the respective bounce backs has been, and how much harder the FTSE 100 continues to be held back by a few significant underperformers.

The sectors hit the hardest by the pandemic: travel, leisure, general retail, energy, and banks, all of which make up a significant proportion of the FTSE100, serve to highlight why the FTSE 100 has continued to lag.

In 2020 we saw the likes of IAG (LON:ICAG), finish the year down over 60%, Rolls Royce (LON:RR), BP (LON:BP), Royal Dutch Shell (LON:RDSa), and Lloyds Banking Group (LON:LLOY) close over 40% lower, and NatWest (LON:NWG) Group finish down over 30%.

While we’ve seen a rebound in the banks this year, along with the oil companies, the likes of IAG and IHG have lagged, along with some in other big cap names like Rio Tinto (LON:RIO), Tesco (LON:TSCO), Unilever (LON:ULVR), and Reckitt Benckiser all struggling, due to concern over rising costs.

UK housing shares have also underperformed despite enjoying a very strong year, and remain below their pre-pandemic peaks, despite solid results and strong order books. The predominantly London based Berkeley Group is the worst performer, with Taylor Wimpey (LON:TW) not too far behind, perhaps over concern over what a Bank of England interest rate rise might do to demand for housing.

British Airways owner IAG has made no progress this year at all, although Holiday Inn owner IHG has seen some modest gains as overseas and domestic travel gets going again. The US/UK transatlantic routes reopening at the beginning of November could offer some hope for IAG as we head into 2022.

On the basis, that the current inflation storm may well pass, there is no reason why we can’t see the FTSE100 move beyond the highs this year at 7,400 and revisit the record highs of 7,900, and above the 8,000 level by the end of next year.

The rebound in European markets has been impressive this year, despite concerns over the lack of fiscal interventions, with concerns over the sustainability of the European growth, as it has been for the last two years.

While the pandemic has hit the likes of Spain and Italy the hardest, we have seen some semblance of a decent recovery there, albeit it’s not been as strong as it could have been due to their large travel sectors which are running well below their pre-pandemic capacity due to continued lockdown and travel restrictions.

Dissatisfaction with the EU remains a danger for politicians across Europe, as highlighted by the shambolic events over the vaccine rollout program. For now, the European Central Bank has seen President Christine Lagarde be able to take the rest of the governing council with her when it comes to filling the vacuum created by the lack of a bazooka type of fiscal response from EU leaders, however the resignation of Jens Weidmann as Bundesbank President still speaks to simmering tensions within German monetary circles when it comes to current policy. The current PEPP program is also due to expire in March 2022, although the APP program is still expected to continue.

The US economy also benefitted from a third fiscal stimulus programme which was rolled out at the beginning of the year, and which consisted of $1,400 in stimulus payments to most Americans, along with a $300 a week unemployment insurance boost, until 6th September, while also putting $350bn into state, local and tribal relief.

This set of measures has no doubt gone a long way to support the resilience of the US economy, as well as US company earnings, which have benefitted from the extra spending power that has been afforded by these payments.

With another infrastructure bill only signed off in November this year, we could well see a further uplift for markets, if the inflation genie doesn’t start to run riot in 2022.

Other concerns for the UK are further increases in energy prices in early next year, along with the various tax hikes that are due to take place because of the recent UK budget, which could introduce quite a lot of fiscal drag. Given the uncertain outlook it wouldn’t be a surprise if these measures were deferred.

"DISCLAIMER: CMC Markets is an execution only provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed.

No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. "

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

WisdomTree has launched the WisdomTree Global Quality Growth UCITS ETF (WGRO), which seeks to provide investors with a unique exposure to Growth in global developed markets...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.