- Patience and consistency are key qualities for investors seeking 100-bagger stocks

- Potential 100-bagger stocks have two main characteristics: earnings growth and a small market cap

- In this piece, I will teach investors to use the InvestingPro stock screener to identify such stocks

- Franklin Resources (NYSE:BEN) (the fastest ever to 100x): 4.2 years

- Great Plains Energy (slowest in the sample): 52.5 years

Every investor dreams of buying a share for $1 and selling it for $100. And history shows that there are several stocks that have managed to do so.

But how do you go about finding a 100-bagger stock, and what do these stocks have in common?

Based on historical data, an investor needs to have these two qualities to pick 100 baggers:

1. Patience

We took a look at the list of American 100-baggers from 1962 to 2014 (we have almost 400). Here are the fastest and the slowest stocks to 100x, along with their time frames:

2. Consistency

Another key element is consistency. All these stocks should be bought despite the ups and downs of the market and never touched again until they 100x. This is something really simple, but it goes against our impatient nature, where the average holding period of a stock today is 6 months.

So, these are the two main characteristics of a potential 100-bagger stock:

1. Growth (especially earnings)

Low starting valuations (such as the P/E ratio) are key. If a stock trades at a P/E of 5 with an EPS of $1, the stock is worth $5.

But if after 10 years, say, earnings have grown 20% per anum to an EPS of $5.16, and the multiple changes from 5 to, say, 15, the final price will be $77.4 (this is not a 100-bagger, but a 15-bagger. This serves to illustrate the example of how valuations and earnings growth work together).

2. Company Market Cap

Statistically, the majority of 100-bagger companies started out small. (It would be difficult for an Apple (NASDAQ:AAPL) to grow 100 times from its current size.)

Historically, companies with a market capitalization of less than $500 million are actually more likely to achieve such results. As always, we need to consider risk and diversify.

If, on the other hand, you only bet on one stock, you will not only have a high specific risk (the individual firm may fail), but you will also have a low probability of finding a 100-bagger (the needle in the haystack).

Conversely, we might not only reduce risk but also increase the likelihood of finding a potential 100-bagger stock by building a portfolio of, for example, 10 different stocks.

And even if we did not find the 100-bagger, and there was a 10-bagger among those stocks, it would probably still help the portfolio perform well.

With this in mind, I will show you how to use our InvestingPro tool to set up filters to look for the next 100-bagger.

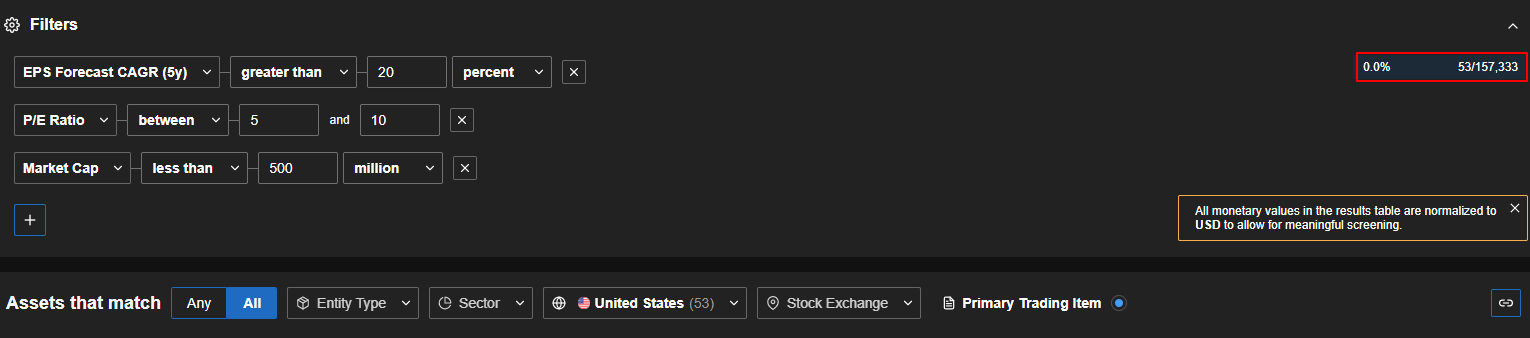

Source: InvestingPro

In the "screener" section, I set the 2 characteristics mentioned above: at least 20% average annual earnings growth over the last 5 years, a P/E ratio between 5 and 10, and a market capitalization below $500 million.

Note that I could also have included an EPS growth rate over the last 10 years, but in that case, we would probably have already missed out on some of the growth.

As you can see from the red box on the right, we only have 53 stocks (from a global database of 157,000+) with these characteristics.

Will there be 100 baggers among them? We will find out in the near future!

In the meantime, here is the link for those of you who would like to subscribe to InvestingPro and start analyzing stocks yourself.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.