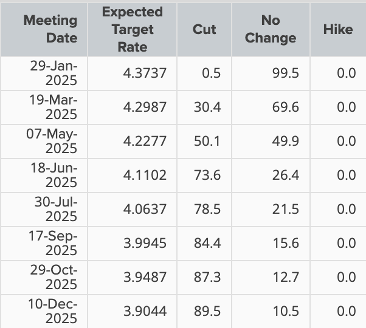

The Federal Reserve is widely expected to keep interest rates unchanged at its meeting on Wednesday, January 29. Chairman Jerome Powell has consistently signalled that the current rate range of 4.25%–4.5% will likely remain in place for an extended period. Current market pricing reflects near-certainty of no changes, with a 99.5% probability of maintaining rates versus a marginal 0.5% chance of a 25-basis-point cut.

Source: CME FedWatch tool

Assessing the Fed’s Position

Powell and his team are exercising caution, opting to hold rates steady as they monitor economic developments. Recent data continues to showcase a resilient US economy, characterized by sustained growth and a robust labour market. While core inflation saw an unexpected dip in December, the headline inflation rate remains elevated at 2.9%, well above the Fed’s 2% target, limiting room for immediate rate cuts.

Adding to the uncertainty is Donald Trump’s return to the White House, which has sparked speculation about potential pressures on the Fed’s independence. Trump’s recent calls for lower interest rates contrast sharply with Powell’s emphasis on maintaining a steady course. While Powell is unlikely to entertain politically motivated rate cuts, Trump’s tax and tariff policies could influence inflation trends in the months ahead, ultimately impacting monetary policy decisions. For now, the FOMC appears committed to a “wait and see” approach.

Powell has consistently emphasized the need for clear evidence of economic weakness and subdued inflation before resuming rate cuts. With no updated projections due at this meeting, Powell is expected to focus on a data-driven, patient stance to minimize market disruptions.

Market Expectations Beyond This Week

The Fed’s outlook, combined with forthcoming inflation and growth data, will shape market expectations in the months ahead. Current market pricing indicates a 30% probability of a 25-basis-point cut at the March meeting, with a rate cut fully priced in by June 18. However, barring significant surprises, this week’s meeting is unlikely to produce dramatic market reactions.

Source: Refinitv

DeepSeek Shakes Up the Market

While the FOMC meeting would normally dominate headlines, another major development is stealing the spotlight: the emergence of DeepSeek, a Chinese AI firm backed by a moderately sized hedge fund. The company’s R-1 product has sparked market turbulence, particularly in U.S. equities. Offering comparable or superior performance to U.S. competitors at a fraction of the cost, DeepSeek has raised concerns about overinvestment in the AI sector, potentially eroding returns for existing players.

The news triggered sharp declines in U.S. equity indices on Monday, with the tech-heavy Nasdaq taking the brunt of the sell-off. Although markets partially recovered later in the day, the episode has highlighted the fragility of investor confidence in the continued bullish trajectory of U.S. stocks, which relies mostly on tech superiority.

Earnings Season Takes Centre Stage

Against this backdrop, the ongoing U.S. earnings season is drawing significant attention. Key tech companies are set to report earnings this week and next, which could further influence market sentiment. With investor focus shifting toward corporate performance and macroeconomic factors, the FOMC meeting may end up having a relatively muted impact.

S&P 500 and its Volatility Index (Daily chart)

Past performance is not a reliable indicator of future results.

Volatility on the Rise

The recent spike in the S&P 500 Volatility Index (VIX) reflects rising investor anxiety. The VIX, a popular measure of market volatility, often acts as a hedge against potential price declines in the S&P 500. Monday’s rapid rise in the VIX suggests growing concerns about the sustainability of the index’s upward momentum, particularly after encountering resistance near the 6,100 level.

Capital Com is an execution-only service provider. The material provided in this article is for information purposes only and should not be understood as investment advice. Any opinion that may be provided on this page does not constitute a recommendation by Capital Com or its agents. We do not make any representations or warranty on the accuracy or completeness of the information that is provided on this page. If you rely on the information on this page, then you do so entirely at your own risk.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI