Focusrite’s (LON:TUNE) FY24 results highlight the negative effects of the most challenging year the CEO has faced. While the company’s main operating market has been difficult, management has continued to invest in the development and release new products, which have enabled TUNE to outperform and gain share across all markets in FY24, and should enable it to thrive when conditions improve. With signs of stabilization in its most important segment, TUNE’s valuation looks attractive.

FY24 results: Headlines Flagged in Trading Update

Group revenue declined 11% y-o-y (10% organically) to £158.5m and adjusted EBITDA declined by c 35% to £25.2m. The results reflect that TUNE’s two key divisions were pulled in opposite directions. The Audio Reproduction division provided strong growth (+14% organic) as it continued to enjoy the post-pandemic recovery of attendance at live events etc. The overall group decline in revenue is attributed to weakness in TUNE’s largest division, Content Creation (c 70% of group revenue, -17% organic), due to macroeconomic weakness and de-stocking in the supply chain post the COVID-19 pandemic.

Growth Expectations

Over the medium term, management targets mid/high-single-digit organic revenue growth, with the assumption that TUNE will grow in new products and take market share in its newer brands. For the current year, there are welcome signs of stabilization in Content Creation, while management expects to outperform a slowing (ie post-pandemic recovery normalizing) Audio Reproduction market. Current trading for the first three months of FY25 is in line with expectations, against a tough comparative. Consensus is forecasting modest revenue growth of c 2–3% in FY25 and FY26.

Valuation: Well Below Long-Term Average Multiples

Having proven to be a beneficiary of the pandemic, the subsequent retracement of the share price and profitability as trading normalized and cost pressures increased has led to TUNE trading at a significant discount to historical multiples. For FY25 and FY26, its prospective EV/sales multiples of 1.1x and 1.0x, respectively, are well below its long-term (since FY15) average multiple of 2.2x, when we exclude FY21 and FY22. They are comparable with its all-time low multiple. Similarly, its FY25 and FY26 EV/EBITDA multiples of 6.8x and 6.6x compare with its average multiple of 11.0x, when FY21 and FY22 are excluded. A return to more positive trading should be helpful for its valuation. TUNE’s attractive relative valuation is featured in our recent sector report.

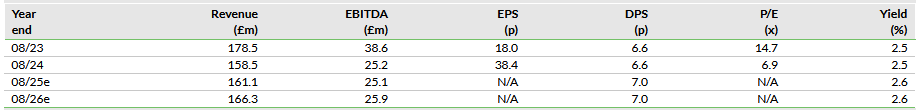

Consensus Estimates

Source: LSEG Data & Analytics, 27 November 2024