- Nobody knows what future corporate profits will be, but signs show parts of the global stock market have turned attractive on valuation

- WisdomTree has a handy dashboard to view P/Es across the market-cap spectrum and the globe

- I spot a few funds that look particularly cheap using both trailing and forward earnings estimates

I continue to assert that investors must have their shopping lists ready to go in advance of the holiday season. No, we are not talking about your favorite items on Amazon. I’m looking at enticing price-to-earnings (P/E) ratios around the world that might be worth putting in your portfolio cart.

As a blanket disclaimer, nobody knows what the “E” will be when using forecast earnings. Nobody ever does. Good analysts and investors use a mosaic of data points and weigh all pieces of evidence when coming to a conclusion to buy or sell securities.

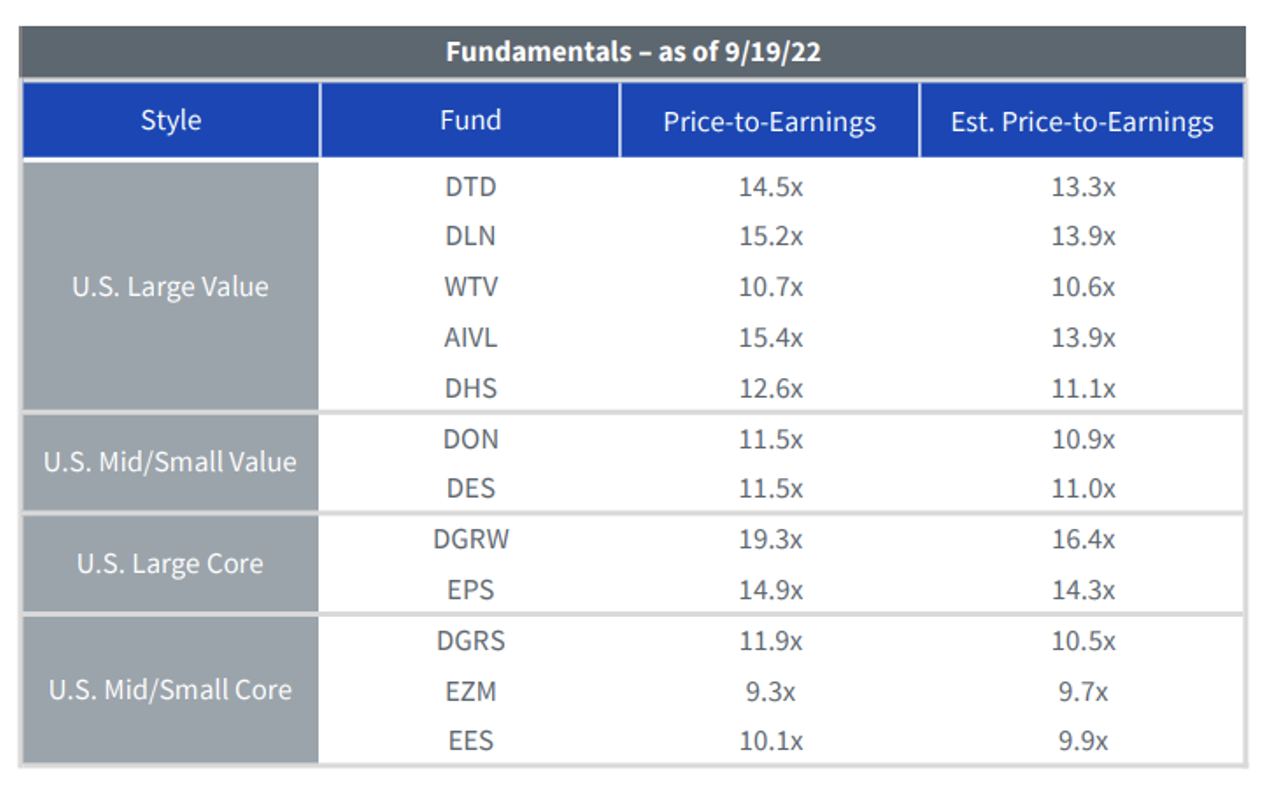

Jeremy Schwartz, Global Chief Investment Officer at WisdomTree, shared with me a fantastic resource for investors searching for low-multiple parts of the equity universe. When parsing through WisdomTree’s Daily Dashboard, you’ll see that certain niches are downright cheap even if you slash the forecast “E” by, say, 20%.

For example, the WisdomTree U.S. MidCap Earnings Fund (NYSE:EZM) holds only earnings-generating mid-cap companies within the domestic stock market. Its trailing P/E is just 9.3, while its forward P/E is also in the single digits at 9.7. The chart below illustrates that valuations are compelling in virtually all the SMID-cap ETFs WisdomTree offers (which often only include earnings-generating companies).

Domestic ETF Valuations

Source: WisdomTree

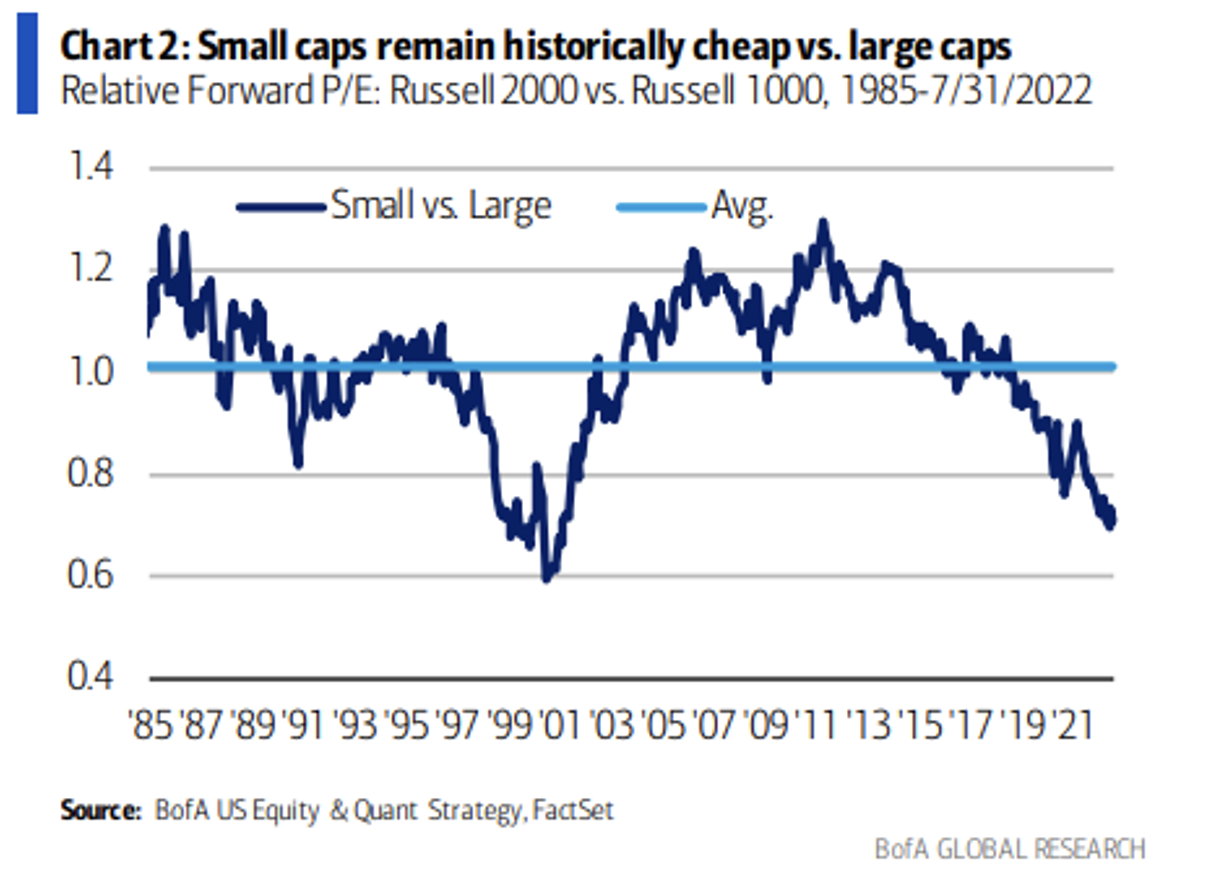

Speaking of small-cap stocks, research from Bank of America Global Research, using FactSet data, shows that domestic “smalls” are historically a bargain versus their large-cap counterparts. The relative forward P/E of the Russell 2000 small-cap index versus the Russell 1000 large-cap index is approaching the lowest level since the dot-com bubble when large-cap growth left small caps in the dust.

U.S. Small Caps: Intriguing Relative Value

Source: BofA Global Research

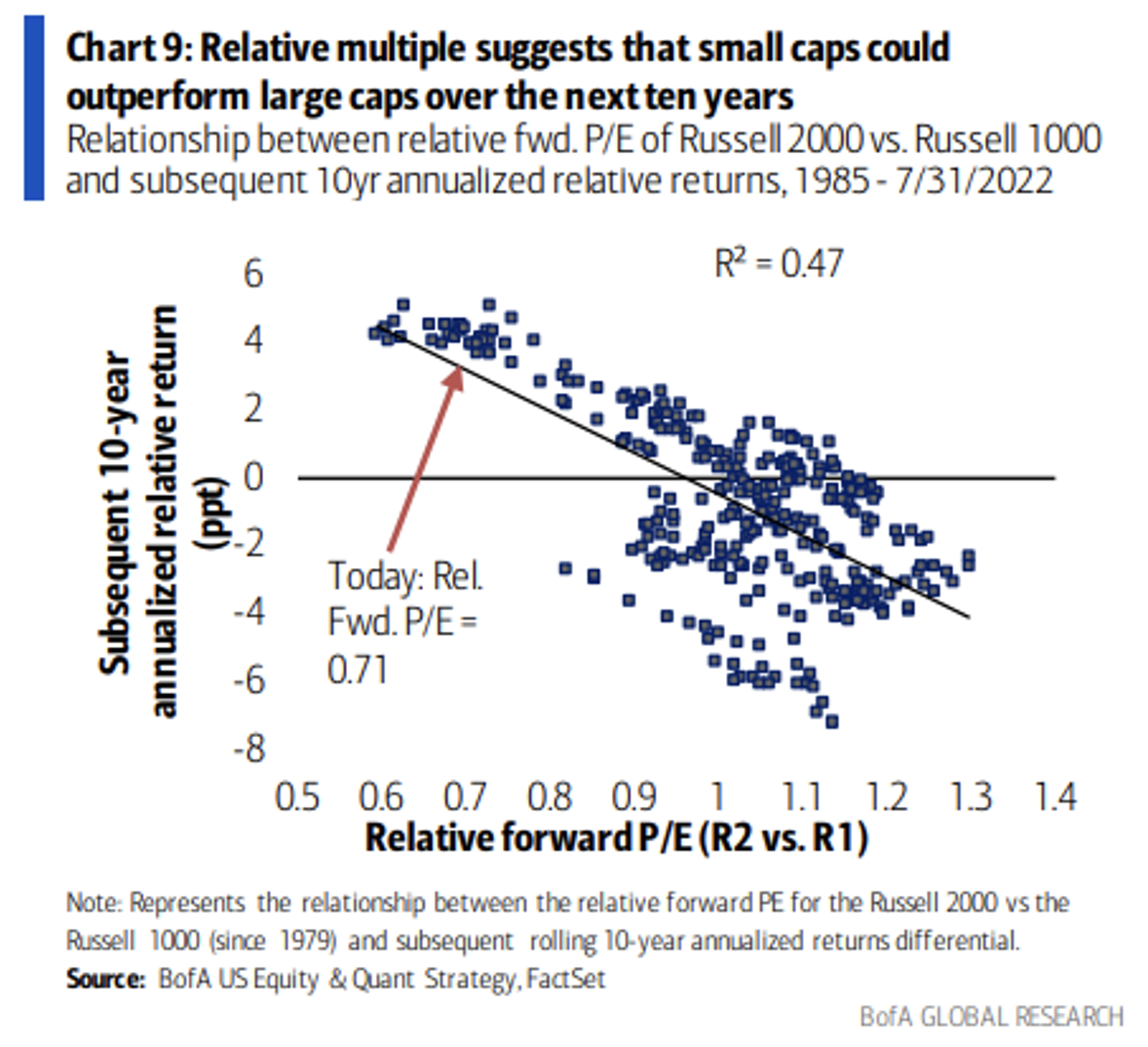

Using that forward multiple, BofA projects that U.S. small-cap equities will sharply outperform large caps to the tune of about four percentage points annually over the next 10 years. Keep in mind that small-cap equities have underperformed large caps since 2006.

Is There Alpha Available Away From Mega Caps?

Source: BofA Global Research

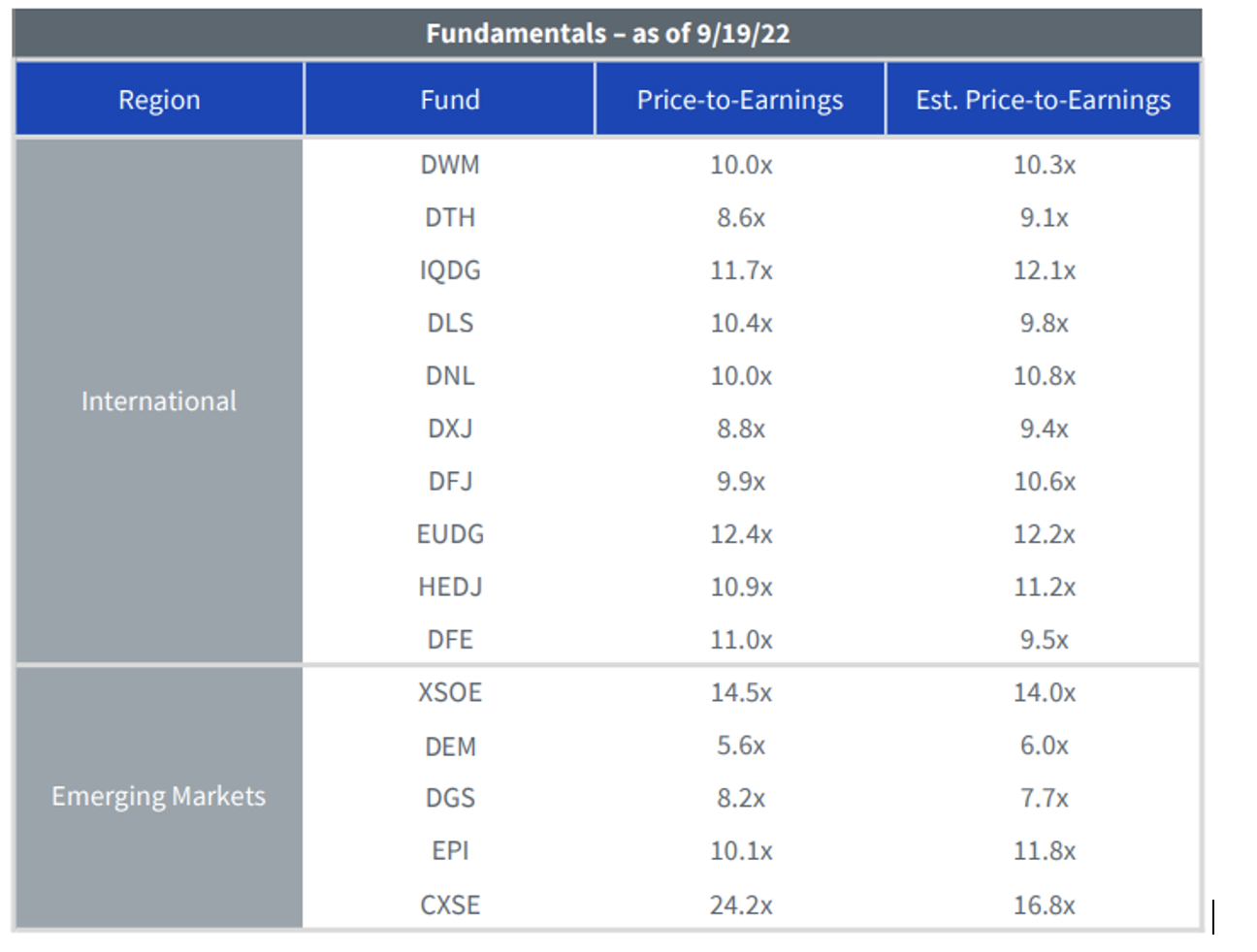

But it’s not just domestic SMID caps that look cheap. Let’s refer to the WIsdomTree dashboard once again, and venture into the international ETF space.

Are you a dividend investor? If so, the WisdomTree International High Dividend Fund (NYSE:DTH), which owns high-dividend-yielding stocks in the developed world except U.S. and Canada, could be something worth owning. Consider that it trades just 8.6 times last year’s profits per share while the ETF’s forward P/E is a paltry 9.1.

Single-Digit P/Es Are Commonplace Outside Of The States

Source: WisdomTree

How about one of the most beleaguered groups of all – Emerging Markets? The WisdomTree Emerging Markets High Dividend Fund (NYSE:DEM) is heavy in the financials sector as well as materials and energy companies. It has a combined exposure to the growth sectors of Information Technology, Communications Services and Consumer Discretionary of just 18%. This fund, which trades at a stunning 5.6 times last year’s earnings and a 6.0 forward P/E, would surely benefit from a shift toward value.

The Bottom Line

A lot of ink has been spilled about valuations. And just as much has been used up with the rebuttal that “we don’t know what the 'E' will be.” The reality is that, away from U.S. large-cap growth companies, there are plenty of cheap parts of the global equity arena. With single-digit P/E ratios, I assert now is a good time to at least dip your toe into some of these inexpensive niches.

Disclaimer: Mike Zaccardi does not own any of the securities mentioned in this article.