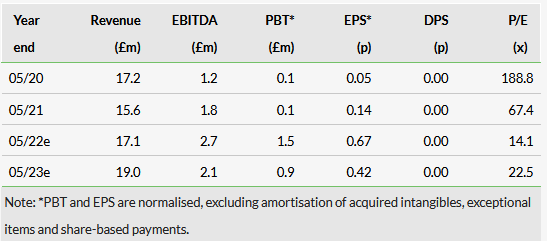

Filtronic's (LON:FTC) post-close trading update notes that FY22 revenues will be broadly in line with market expectations, rising by 10% y-o-y to £17.1m. In addition, adjusted EBITDA will be materially ahead of market expectations at over £2.7m, mainly reflecting a higher-than-expected proportion of defence revenues. We adjust our FY22 estimates accordingly and leave our FY23 estimates unchanged.

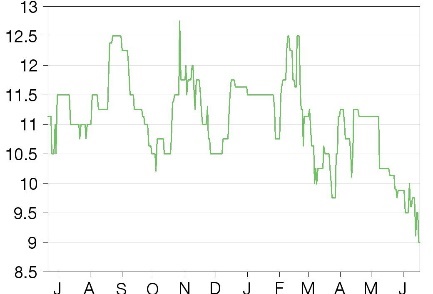

Share price performance

Business description

Filtronic is a designer and manufacturer of advanced radio frequency communications products supplying a number of market sectors including mobile telecommunications infrastructure, public safety, defence and aerospace.

Recovery in customer demand sustained

Filtronic’s 5G XHaul transceiver sales picked up in Q222 when the supply chain issue was resolved, and remained at a higher level throughout H222. Demand from the aerospace and defence market was resilient, with Filtronic benefitting from follow-on orders for development programme wins secured during FY21. However, while end-user demand for critical communications equipment remained strong, Filtronic’s customer was adversely affected by supply chain issues, which restricted its ability to build complete solutions, resulting in some order book rescheduling.

Investing for further growth in FY24 and FY25

Our FY23 estimates are underpinned by a growing order book for 5G XHaul transceivers, and we leave them unchanged. Since gross margins are likely to be lower year-on-year in FY23 because of the lower proportion of defence orders and overheads are likely to be higher reflecting the investment in radio frequency (RF) engineering and direct sales during FY22, we model a year-on-year drop in EBITDA (but an increase versus FY21), although revenue growth is modelled at 11%. Management intends that this investment will result in stronger revenue and profit growth during FY24 and FY25 as the group diversifies into adjacent markets such as 5G test equipment, private low-latency links and broadband communications networks based on networks of multiple high-altitude platform stations and low earth orbit satellites.

Valuation: Premium for stronger growth

Comparing Filtronic’s multiples with those of its specialist RF peers, we note it is trading broadly in line with the sample mean for prospective EV/sales and EV/EBITDA and at a premium for P/E multiples. However, our estimates show Filtronic’s revenues growing more quickly than those for most of the companies in this sample during FY22 and FY23. This gives it a growth trajectory closer to the companies in our sample offering a highly differentiated technology which trades on higher multiples, suggesting a premium may be justified.

Click on the PDF below to read the full report: