The EUR/USD pair moved upward to 1.0844 on Thursday, marking an unexpected shift following a period of strong US dollar performance. This change in dynamics can be attributed to investors' positive response to comments made by US Federal Reserve Chair Jerome Powell regarding the future of interest rates. Powell's remarks led to a surge in risk appetite, resulting in the dollar's decline.

Powell indicated that economic indicators would heavily influence the Federal Reserve's decisions on interest rate adjustments. Traders interpreted his comments as suggesting that, given the recent modest nature of US economic data, the anticipated forecast of three rate cuts in 2024, starting in June, remains on the table. The expectation is for the Federal Reserve to reduce interest rates by 75 basis points by the year's end, which aligns with earlier statements from the Fed. These hinted at a majority consensus among monetary policy committee members to commence rate cuts within the year, contingent on economic data.

Powell's reaffirming the Fed's trajectory towards lower interest rates, with specific timing depending on upcoming data, sets the stage for March's closely watched US employment market reports. The focus will be on whether the unemployment rate has remained steady and whether there has been any deceleration in the growth of average wages.

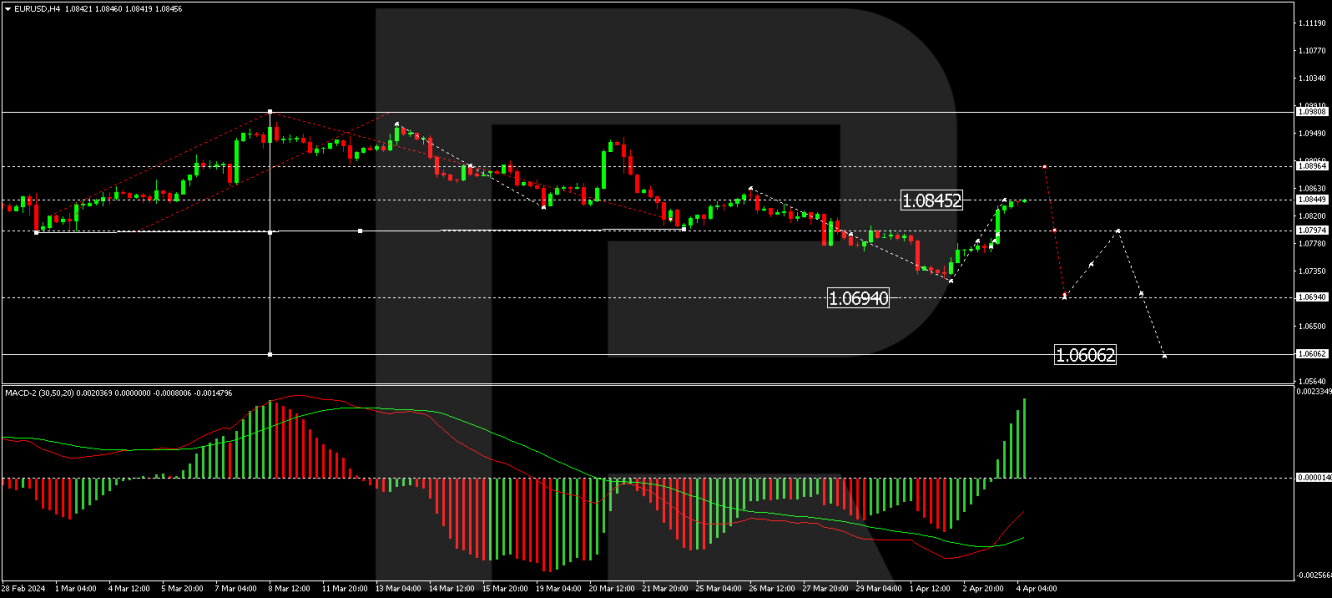

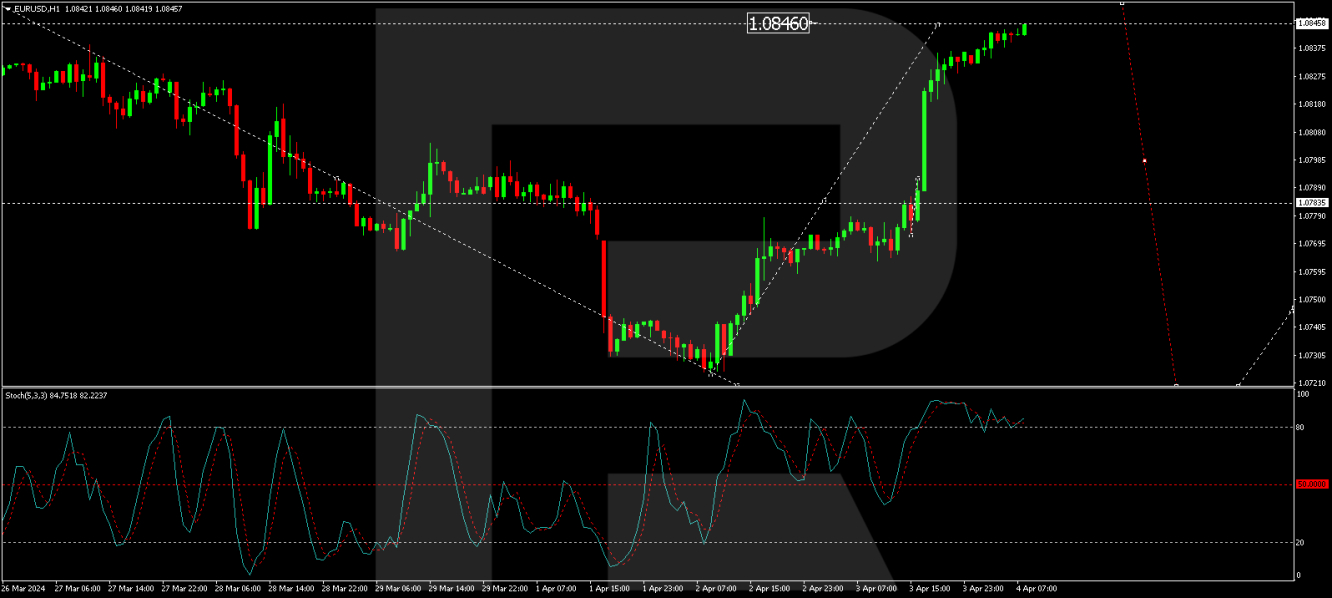

Technical analysis of EUR/USD

On the H4 chart, the EUR/USD pair has completed a correction to 1.0783, with a narrow consolidation range now established around this level. An upward breakout from this range could lead to a continuation of the correction to 1.0847, potentially followed by a new downward wave to 1.0694. This scenario is supported by the MACD indicator, where the signal line is below zero and the histogram peaks, suggesting a potential sharp decline.

The H1 chart reveals a corrective pattern towards 1.0847, with an expected shift towards 1.0783 to commence a decline phase. A new consolidation range at these levels could lead to further correction to 1.0888 or a downward wave to 1.0694 upon a breakout. The Stochastic oscillator, positioned above 80, anticipates a significant drop to the 50 mark, potentially leading to further declines.

By RoboForex Analytical Department

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EUR/USD surges following Powell's remarks on interest rates

Published 04/04/2024, 13:37

EUR/USD surges following Powell's remarks on interest rates

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.