- The Fed held its policy meeting, leaving rates unchanged but slowing down quantitative tightening.

- Today's focus shifts to US labor data: strong figures could justify the Fed's hawkish stance of maintaining high rates.

- A weak jobs report might push back expectations for rate cuts, potentially weakening the dollar and reviving the EUR/USD correction.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

The Federal Reserve held its policy meeting on Wednesday, delivering no major surprises. As anticipated, the central bank left interest rates unchanged.

It did, however, announce a reduction in the pace of quantitative tightening. This change is unlikely to significantly alter the overall neutral perception of the meeting.

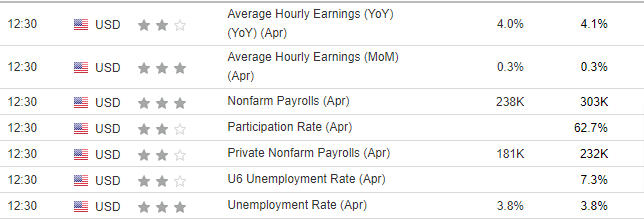

Today, the market's focus shifts to the upcoming U.S. labor market data. If the forecasts hold true, the data will confirm the labor market's strength, potentially justifying the Fed's hawkish stance of maintaining higher interest rates for longer.

Alongside inflation and GDP figures, U.S. labor market data remains a crucial indicator guiding the Fed's monetary policy decisions. Current projections suggest minimal disruption, potentially granting the Fed additional time to delay a potential policy pivot until at least the third quarter of 2024.

With a light data calendar from the US, today's economic releases and the Fed's stance hold the potential to significantly impact the US dollar and major indexes in the short term.

Negative signals from the labor market could push back market expectations for the first interest rate cut, potentially weakening the US dollar and extending the correction on the EUR/USD currency pair.

It's also important to consider potential revisions to previous months' data, which can significantly alter the market's interpretation of the current readings.

Is a US Rate Hike on the Horizon?

The recent halt in disinflation and the rebound in the CPI have sparked some speculation about a potential interest rate hike by the Fed.

While the market currently doesn't anticipate this scenario, recent months have shown that the probability of rate changes can shift swiftly over time.

If inflation remains persistently high above 4-5% in the coming months, a rate hike could become a possibility, but it's unlikely at this point.

EUR/USD: Inverted Head-and-Shoulders Hints at Correction

The EUR/USD pair is currently stuck in a local consolidation that has formed an inverted head-and-shoulders pattern. This technical formation suggests a high probability of a corrective move, signaled by a break below the neckline around 1.0750.

If the demand side continues its upward movement, the bulls will likely target the strong supply zone near 1.0850, which translates to roughly 100 points of upside potential.

Conversely, a break below the right shoulder's neckline could lead to a retest of the recent lows near $1.06 per euro.

***

Want to try the tools that maximize your portfolio? Take advantage HERE AND NOW of the opportunity to get the InvestingPro annual plan for less than $10 per month.

For readers of this article, now with the code: INWESTUJPRO1 as much as a 10% discount on annual and two-year InvestingPro subscriptions.ProPicks: AI-managed portfolios of stocks with proven performance.

Act fast and join the investment revolution - get your OFFER HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.