EUR/USD has posted a new yearly high as the pair continues to attract buying interest. The bullish momentum seen earlier this month has re-emerged this week pushing the euro past the 1.10 mark against the dollar, a level not seen since the beginning of 2024. The weakness in the US dollar has been an important contributor to the momentum but the euro has been picking up strength across the board over the past few weeks.

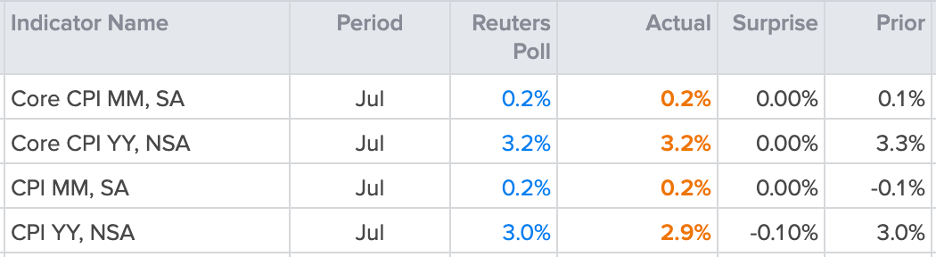

Wednesday US CPI report showed inflation falling mostly in line with expectations in July, with just a minor deviation in the headline YoY growth figure, coming in slightly below forecasts at 2.9% vs 3%. Nonetheless, the reaction in markets was quite subdued as there were no major surprises. This was a stark contrast to the momentum seen over the past few weeks, where softer data had induced heightened market volatility. For now, markets remain convinced that a rate cut will happen in September, what’s yet undecided is how big the cut will be.

Source: refintiv

With not much on the economic calendar in the coming days EUR/USD traders will have to focus on the chart. The bullish rally is starting to show signs of exhaustion above 1.10 and the RSI is flattening out just below the 70 marks, suggesting a mild correction may be on the cards.

However, there is likely to be support from buyers if the momentum turns with 1.0915 a possible area to focus on. Fundamentally, the European Central Bank (ECB) is slightly better positioned than the Federal Reserve at the start of this cutting cycle, having decided to cut for the first time in June in an attempt to take things slowly and gradually. This has been seen as a better strategy as it allows for more wiggle room to react to the upcoming data, which supports the euro against the dollar.

EUR/USD daily chart

Past performance is not a reliable indicator of future results.

Elsewhere, EUR/GBP has been covering significant ground having undone three months of pullback in just a matter of days. The pair shot above 0.86 last week but then corrected, settling below 0.8550. Wednesday saw another significant session for buyers, demonstrating the appetite for the pair to move higher, even if resistance is becoming more prominent. The RSI has turned lower but continues to show upside potential so we could see a retest of bullish appetite above 0.86 over the coming days.

EUR/GBP daily chart

Past performance is not a reliable indicator of future results.

Disclaimer: This is for information and learning purposes only. The information provided does not constitute investment advice nor take into account the individual financial circumstances or objectives of any investor. Any information that may be provided relating to past performance is not a reliable indicator of future results or performance. Social media channels are not relevant for UK residents.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84.01% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

The information provided is not to be considered investment advice or investment research. Capital.com will not be liable for any losses from the use of the information provided.'

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Euro fights back: EUR/USD, EUR/GBP Latest

Published 15/08/2024, 11:42

Euro fights back: EUR/USD, EUR/GBP Latest

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.