EQS Group's (DE:EQSn) Q3 figures show the boost given to its whistleblowing offering by the June acquisition of Business Keeper, lifting the total number of whistleblowing customers to around 1,500. Implementation of the EU Directive into national legislations is delayed in a number of territories, but the direction of travel is set and the timetable slippage should only be one or two quarters. The additional sales and marketing costs were already factored into our estimates (in line with management guidance for FY21), which are unchanged. We regard the scale of the opportunity as worth the short-term impact on EBITDA.

Whistleblowing coming round the mountain

Compliance revenues were up 45% in the first nine months of 2021 versus the prior year, with the strongest growth from the cloud-based products (+60%), with cloud-based services up 26%. The sales effort is squarely targeted at whistleblowing solutions, given the EU Directive requiring companies with over 250 employees to have effective solutions in place for reporting of breaches of EU law. Denmark and Sweden have already incorporated into the national legal frameworks, but there are delays of varying severity elsewhere. The German market is obviously key for EQS and looks likely to be an early priority for the new administration. The group has put several commercial partnerships in place on a profit-share basis to accelerate the sales effort, including with Bundesanzeiger Verlag. Investor relations revenues were up 10%, despite the comparative period having benefited from COVID-19-restrictions on company meetings, helped by an increase in IPOs.

EBITDA already in the targeted FY21 range

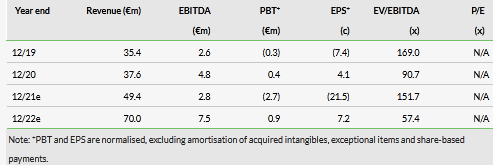

As intended, the EBITDA margin in the period reflected the investment in sales and marketing at 6.4%, versus 15.5% for Q1 to Q320. Management also provides a ‘clean’ EBITDA figure, which strips out the identifiable additional cost; on this basis, the margin would have been 13.3%. Reported EBITDA was €2.3m, in the range of €2–3m previously indicated. Our full-year estimate is €2.8m, which allows for a continuing quarter of additional overhead. Given the phasing, we would expect FY22 EBITDA to be weighted to H2.

Valuation: Good performance in the year to date

The share price started the year at €23.4 and peaked at €47.0 in September. Given the EBITDA containment, peer comparison on earnings multiples is not a helpful measure of value. A DCF using a WACC of 8.0% and terminal growth of 2% indicates a price of €47.2, 13% ahead of the current level.

Share price performance

Business description

EQS Group is a leading international provider of regulatory technology in the fields of corporate compliance and investor relations. Its products enable corporate clients to fulfil complex national and international disclosure obligations, minimise risks and communicate transparently with stakeholders.

Click on the PDF below to read the full report: