Entain (LON:ENT), a global leader in sports betting and gaming, has had a dynamic year in 2024. The company, which operates well-known brands such as Ladbrokes, Coral, and BetMGM, has been at the forefront of the online gambling industry.

Throughout the year, Entain has continued to expand its digital presence while navigating the challenges of a highly regulated environment.

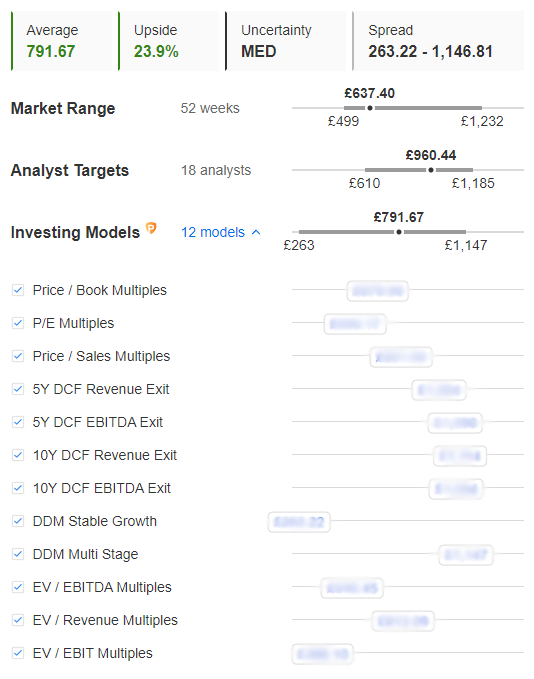

In 2024, Entain's stock (ENT) has shown resilience despite market volatility. The company has benefited from a strong performance in its core online gaming division. This success is largely attributed to the continued growth of its digital platforms and a strategic focus on emerging markets. As of July 2024, Entain’s stock has demonstrated steady gains, reflecting investor confidence in its long-term strategy.

One of the key developments for Entain in 2024 has been its ongoing expansion into the North American market, particularly through its joint venture with MGM Resorts, BetMGM. The success of BetMGM has been a significant growth driver for Entain, with the platform expanding its market share in key states.

According to a report by The Financial Times on 15th June 2024, "Entain's partnership with MGM continues to yield positive results, with BetMGM now a leading player in the US online sports betting market."

According to ProTips, Entain has impressive gross profit margins.

However, Entain has also faced challenges, particularly in navigating the increasingly complex regulatory landscape in Europe. The UK’s Gambling Commission has imposed stricter regulations, which have impacted the company’s operations. In May 2024, The Guardian reported that "Entain is adapting to tighter regulations in the UK, which could pose short-term challenges but ultimately strengthen the company’s compliance framework."

Despite these challenges, Entain remains committed to its strategy of innovation and expansion. The company has invested heavily in technology to enhance its product offerings and customer experience. In particular, Entain’s focus on responsible gambling and the development of its proprietary technology platform, ARC (Advanced Responsibility & Care), has been well received by regulators and customers alike.

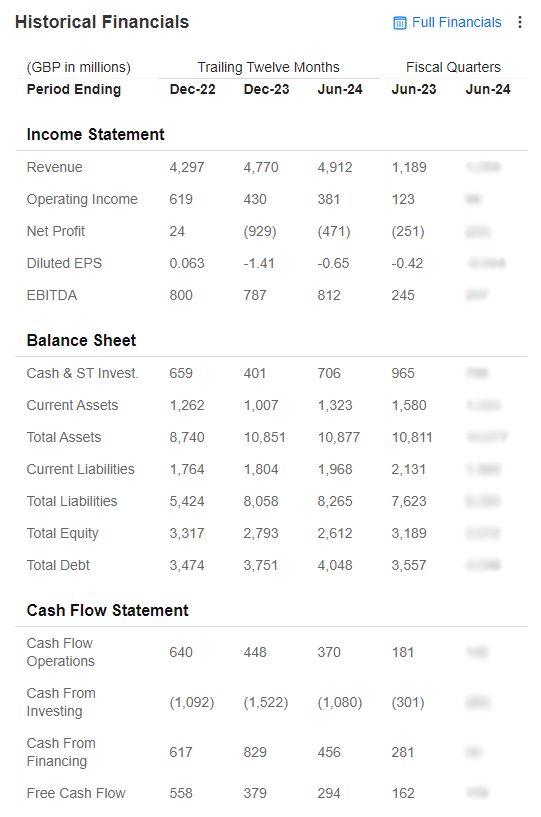

Looking ahead, Entain’s future appears promising. While it hasn't been profitable the last twelve months, the analysts predict that the company will be profitable this year. The company is expected to continue its expansion into new markets, particularly in Latin America and Europe. Additionally, the potential for further mergers and acquisitions could provide additional growth opportunities. As Entain continues to innovate and adapt to the evolving regulatory environment, it is well-positioned to maintain its leadership in the global online gambling industry.

With valuation volatility careening in 2024, are you unsure where to invest next? Visit our proven portfolios and discover high-potential opportunities.

In 2024 alone, our ProPicks' AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

Explore various wealth-building strategies and use our comprehensive stock screener to see the top FTSE 100 companies to add to your watchlist today.