- U.S. unemployment hits a two-year high at 3.9%

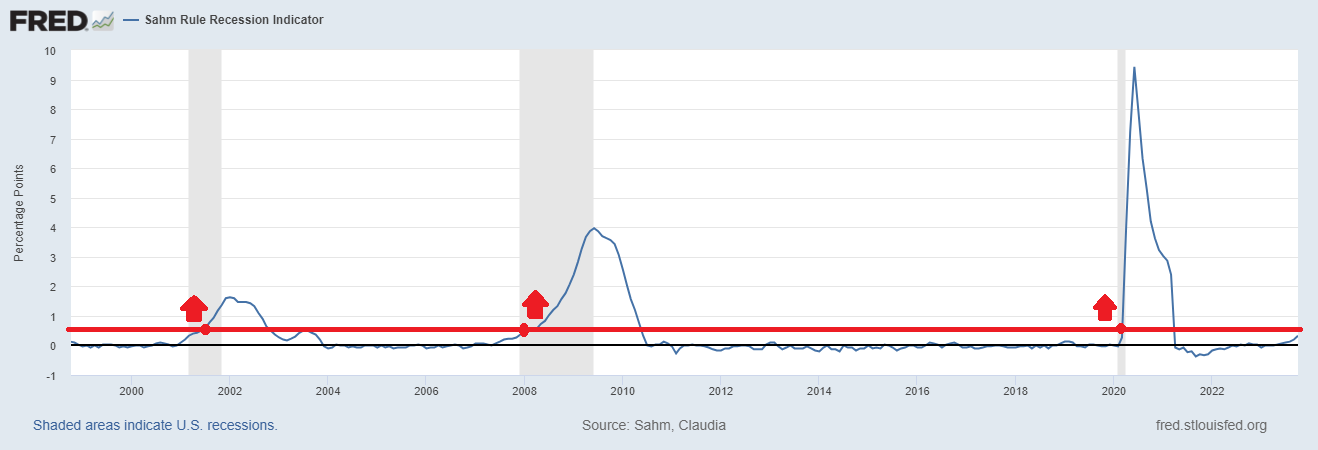

- Sahm's rule suggests potential recession, as the quarterly moving average of the unemployment rate nears the 0.5% threshold

- Meanwhile, cryptocurrencies surge as economic indicators fluctuate, prompting speculation on their role as safe-haven investments

- Unlock the potential of InvestingPro for up to 55% off this Black Friday and never miss out on a market winner again

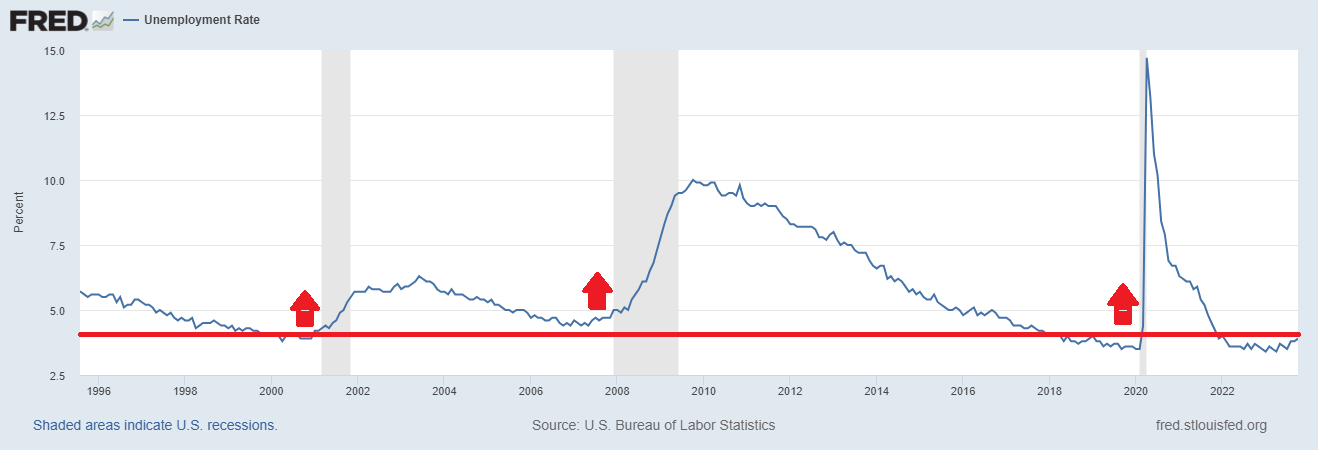

Last week's U.S. employment data revealed the unemployment rate for October at 3.9 percent, marking the highest in two years. Although this figure is historically low, it has surpassed the earlier low of 3.4 percent recorded earlier this year.

This brings Sahm's rule to mind, as it closely monitors the potential onset of a recession. Created in 2019 based on research by Federal Reserve economist Claudia Sahm, this highly accurate indicator states that when the quarterly moving average (as the monthly rate often fluctuates too much) of the unemployment rate rises by 0.5 percent from the previous 12-month low, it signals that the economy will very likely enter a recession in the next 12 months.

Currently the quarterly moving average of the unemployment rate has increased to 0.33 percent from the one-year low, still far from the 0.5 percent threshold that indicates a recession, thus still insufficient but remains worrisome.

Confirming the indicator, historically, any activation of the Sahm rule will prompt unemployment to continue rising.

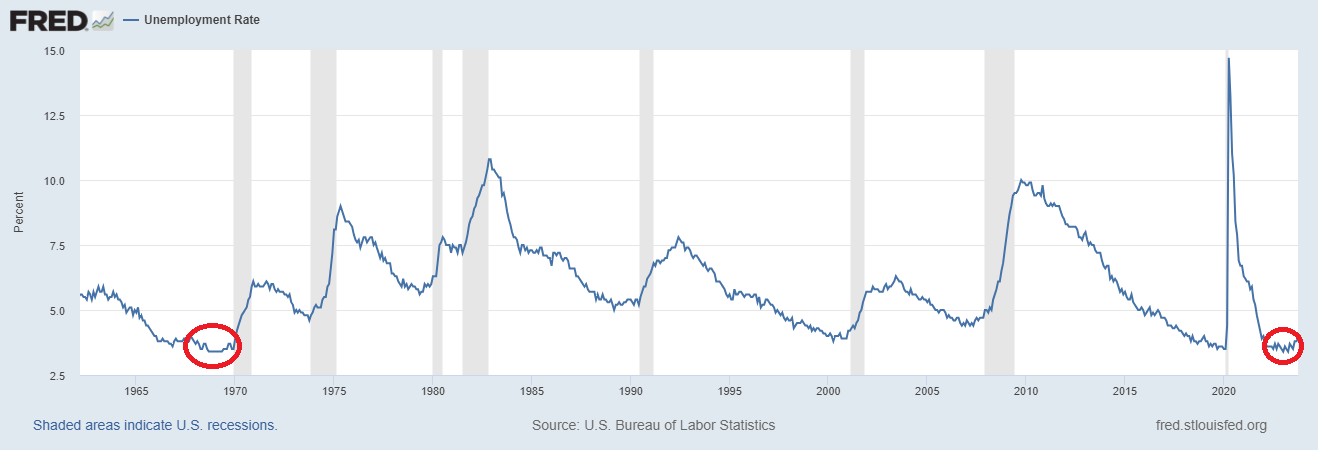

From the graph we can see how unemployment often reaches a cyclical low, before a recession, and then explodes upward above 4 percent, as seems to be happening over the past year. Today it is at 3.9 percent, after having been at levels similar to the lows of the past 50 years.

Could this signal a recession in the coming months?

Currently, the indicators present a mixed picture—consider the hiring rate, which has dipped below pre-Covid levels, juxtaposed with a consistently low layoff rate. Amidst this, consumer spending growth maintains its robust trajectory.

Could Crypto Be the Solution?

Turning attention to the cryptocurrency landscape, these weeks have proven quite eventful for Bitcoin. It showcased a positive performance of approximately 8 percent last week, surging to 52-week highs and surpassing the $37,000 mark.

Ethereum also experienced a rally of more than 14.5 percent. While the cryptocurrency has seen an overall rise of over 120% since the beginning of the year, noteworthy peaks occurred in January, March, June, and the present, as illustrated in the chart below.

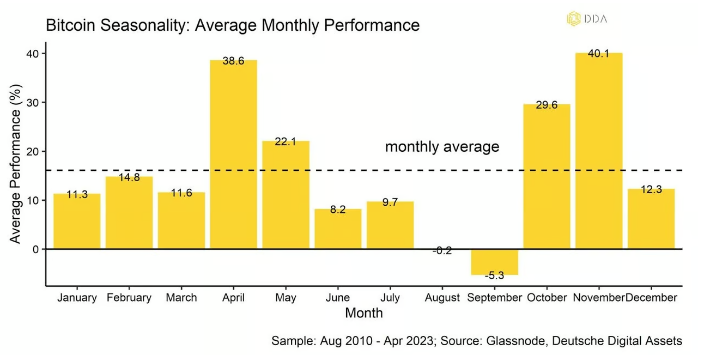

The fact that Bitcoin is now above 52-week highs (now on the highs of the past 18 months), confirms that November is one of the best performing months

In fact, historically speaking, Bitcoin has consistently delivered remarkably high average returns (+40%). However, it's crucial to note that its all-time high, just below $69,000, occurred precisely two years ago. Despite a surge of over 100% in 2023, the current downturn is substantial, standing at 45%—exceeding the average decline of 40.4% since 2016. Given the current price levels, a retesting of these highs doesn't appear imminent.

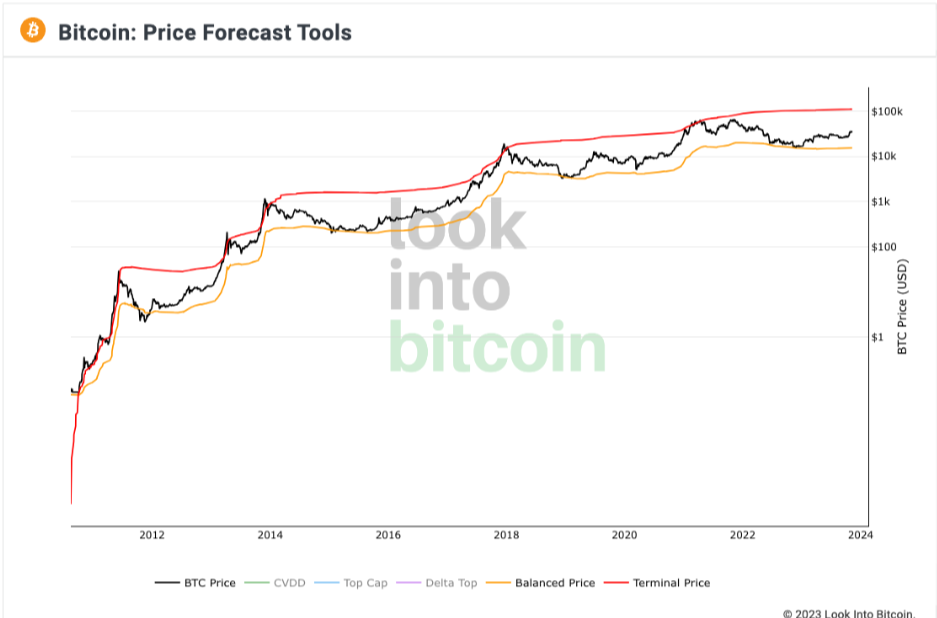

Looking ahead, analysts point to the upcoming block halving (Halving) scheduled for April 2024, with a target of $130,000. This projection is derived from Bitcoin's "Transferred Price" analyzed through Look Into Bitcoin's Terminal Price, a metric based on hodler activity indicated by the division of Coin Days Destroyed by the existing supply.

The Terminal Price manifests at the "peak" of each BTC price cycle, notably touching the trendline (red) during the all-time high in 2017 and the initial peak in April 2021. Notably, the $69,000 mark has not been registered as a "high" yet, suggesting the possibility of an even higher peak in the future.

Is Bitcoin the best investment at this point? What do you think?

***

Buy or Sell? Get the answer with InvestingPro for Half of the Price This Black Friday!

Timely insights and informed decisions are the keys for maximizing profit potential. This Black Friday, make the smartest investment decision in the market and save up to 55% on InvestingPro subscription plans.

Whether you're a seasoned trader or just starting your investment journey, this offer is designed to equip you with the wisdom needed for more intelligent and profitable trading.

**Disclosure: The author holds no positions in any of the securities mentioned in this report.