EMIS Group (LON:EMISG) reported H121 results ahead of board expectations and is on track to meet the company’s FY21 expectations. After a period of investment to develop the EMIS-X platform, and at least a year of diverting resource to support customers’ COVID-19 efforts, EMIS is now in a position to execute its growth strategy. Our revenue and adjusted operating profit forecasts are unchanged, with revenue growth accelerating to the lower end of the targeted medium-term 5–9% range from FY22.

Share price performance

H121: Solid performance

While continuing to support customers with COVID-19 related requirements, EMIS saw operations start to return to normal. H121 revenue increased 7% y-o-y and adjusted operating profit grew 13% y-o-y. EMIS Health revenue was marginally higher, with higher-margin revenue driving adjusted operating profit up 5% y-o-y. EMIS Enterprise revenue increased 21% y-o-y and adjusted operating profit was up 28% y-o-y. The group closed H121 with net cash of £48m and announced an interim dividend of 17.6p, up 10% y-o-y and ahead of our 17p forecast. Our revenue and adjusted operating profit forecasts are unchanged although we have revised our capex, depreciation and amortisation forecasts to reflect company guidance.

Well-positioned for post-COVID-19 healthcare market

The pandemic has accelerated digital adoption within healthcare and even once the worst of the pandemic is over, and the vaccination programme substantially complete, we believe this is a permanent structural shift. The importance of data to assess performance and improve preventative medicine has become more evident and at the same time, there is increased focus on combining health and social care. EMIS’s expertise in connected care puts it at the heart of this, with critical mass in primary, acute, pharmacy and community care, and EMIS-X analytics tools that are designed to work safely and securely with clinical data.

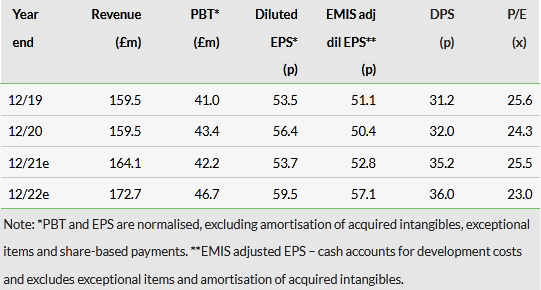

Valuation: At a discount to peers

Compared to a global group of healthcare software peers, EMIS trades at a discount on all valuation metrics. EMIS generates significantly higher operating profit margins but with slightly slower revenue growth, generates lower earnings growth. Its dividend yield is significantly ahead of the group. Key to closing the discount will be evidence that revenue growth is returning to the company’s medium-term goal of mid- to high-single digits, in turn driving stronger earnings growth. We note that EMIS has good visibility (recurring revenue was 79% in H121) and a strong balance sheet with no debt.

Click on the PDF below to read the full report: