- Eli Lilly's ascent in late January, driven by the success of its weight-loss drug Zepbound, ousted Tesla from Wall Street's Magnificent 7.

- Analysts are predicting the company's value to exceed $900 billion while anticipating that the company will face tough competition in the global weight-loss market.

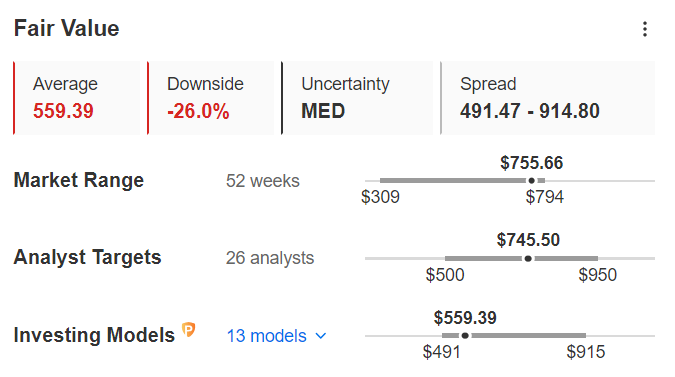

- Meanwhile, InvestingPro's Fair Value suggests that the company could be overvalued at current price levels.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

- ProPicks: stock portfolios managed by a combination of artificial intelligence and human expertise, with proven performance.

- ProTips: digestible information to simplify complex financial data in a few words.

- Fair Value and Health Score: 2 synthetic indicators based on financial data providing immediate insight into the potential and risk of each stock.

- Advanced stock screener: Find the best stocks based on your expectations, considering hundreds of metrics and financial indicators. Historical financial data for thousands of stocks: So fundamental analysis professionals can delve into all the details.

In late January, Eli Lilly (NYSE:LLY) weight-loss drugs helped the Indianapolis-based drugmaker replace Tesla (NASDAQ:TSLA) from the Magnificent 7.

By the closing bell on Feb. 20, Eli Lilly's stock, despite a -3.38% dip, stood at $755.66 per share, boasting a market capitalization of nearly $680 billion.

Eli Lilly's surge was fueled by the success of its weight-loss drug Zepbound, which gained approval in November 2023.

This medication, known for its effectiveness in weight loss treatment, posed a direct challenge to Novo Nordisk (NYSE:NVO), Eli Lilly's primary competitor.

Eli Lilly Faces Tough Competition

Novo Nordisk's weight-loss drug Wegovy catapulted the company to become Europe's top market cap leader at 505 billion euros, surpassing luxury giant LVMH (EPA:LVMH).

Now, Eli Lilly and Novo Nordisk's respective weight-loss products are fiercely competing to gain market share worldwide.

Market experts at Morgan Stanley (NYSE:MS) recently projected that Eli Lilly could be valued at over $900 billion, elevating the target price from $727 to $763 per share.

However, some analysts argue that Eli Lilly's potential is already factored into its current value.

To gauge the pharmaceutical company's target share price, one can turn to InvestingPro's tools.

InvestingPro's Fair Value, which consolidates 13 recognized financial models tailored to Eli Lilly's specific characteristics, stands at $559.39.

This value represents a 26 percent decrease from the stock's closing price on Feb. 20.

Source: InvestingPro

In recent weeks, InvestingPro subscribers have been tracking analysts' forecasts for Eli Lilly.

The average of 26 analysts surveyed by InvestingPro indicates a bearish forecast, setting the target price at $745.50 per share.

In essence, analysts' opinions and valuation models' average suggests that Eli Lilly's stock is currently overvalued.

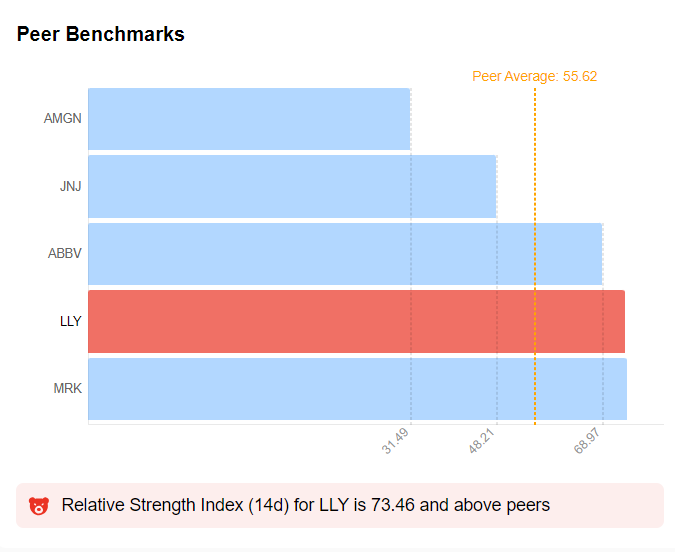

Utilizing InvestingPro's Protips, we observe that the relative strength index (RSI), measuring the speed and variation of price movements, indicates heavy buying activity in the recent period.

This phenomenon could potentially have driven the stock price above its true intrinsic value.

Source: InvestingPro

However, it's crucial to note that some individual analysts expressed more optimism about Eli Lilly, setting a target price as ambitious as $950.

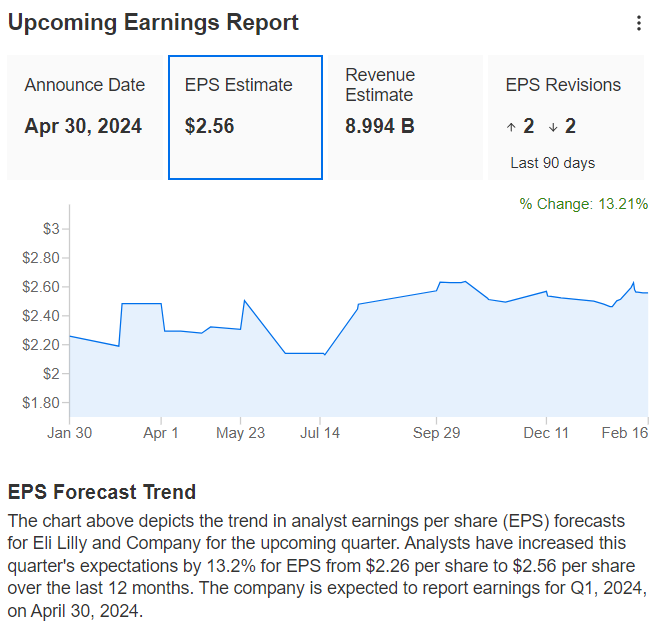

This optimism stems from the company's impressive performance in the last quarter, where it reported earnings per share of $2.49, marking a 13% increase and surpassing market expectations by 5.1%.

Additionally, Eli Lilly reported revenues of $9.35 billion, reflecting a substantial 28% growth, exceeding the consensus estimate by 4.3%.

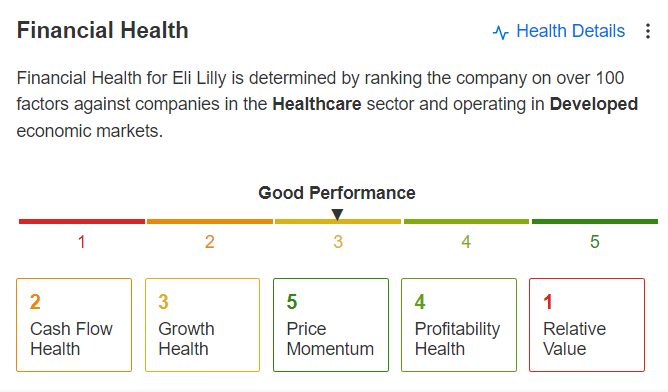

Turning our attention to the risk profile, Eli Lilly demonstrates robust financial health, earning a score of 3 out of 5.

Source: InvestingPro

Eli Lilly Forecasts: Can the Company Keep Growing?

In addition, experts expect the company's earnings per share to rise further this quarter, with EPS estimates rising 13.2%.

Source: InvestingPro

Bottom Line

In conclusion, investors have found great satisfaction in Eli Lilly's performance, with the stock gaining approximately 130% over the past year.

Some analysts argue that this surge has led to the stock being currently overvalued and overbought due to outstanding returns.

However, InvestingPro's analysis indicates that the pharmaceutical company is in good health, and the positive forecast for the next quarter supports the belief that Eli Lilly still has room for further growth.

***

As readers of our articles, you can take advantage of our stock strategy and fundamental analysis platform InvestingPro at a reduced price, with a 10% discount on the annual plan.

You can discover which stocks to buy and sell to outperform the market and increase your investments, thanks to a range of exclusive tools:

And many more services, not to mention those we plan to add soon! Don't face the market alone: join the thousands of InvestingPro users to make the right decisions in the stock market and boost your portfolio, whatever your profile or expectations.

Click here to subscribe with a Super discount valid for annual Pro+ subscriptions!

Don't forget your free gift! Use coupon code pro2it2024 at checkout to claim an extra 10% off on the Pro yearly and bi-yearly plans.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.